“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Faced with a combination of record speculative extremes

and deteriorating speculative conditions, investors may want to remember that

the best time to panic is before everyone else does.” – John Hussman, Phd.

FED BEIGE BOOK (Fox Business)

Supply chain bottlenecks, the highest inflation in

decades and a persisting labor shortage are weighing on businesses across the

country, according to a new Federal Reserve report. In its

region-by-region roundup of anecdotal information known as the Beige Book, the

Fed reported that while economic activity

increased at a "moderate pace" in most of its 12 districts during the

February through mid-April period that the report covers, firms continued to

struggle with rising prices and a lack of available workers.” Story at...

EXISTING HOME SALES (Yahoo Finance)

“Housing activity slowed for a second straight month in

March. Existing home sales fell 2.7% to a seasonally adjusted 5.77 million

units in March from a month earlier...” Story at...

https://finance.yahoo.com/news/existing-home-sales-march-2022-140010177.html

EIA CRUDE INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) decreased by 8.0 million barrels from the

previous week. At 413.7 million barrels, U.S. crude oil inventories are about

15% below the five-year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

My cmt: Falling inventories suggest increased demand and

higher prices and this data does not include the Strategic Oil Supply. It is

being reduced by 20% and sold to reduce gas prices.

MULTIYEAR RECORDS FOR AAII SURVEY (McClellan Financial

Publications)

“The American Association of Individual Investors (www.aaii.com) surveys its members every week to

see if they are bullish, bearish, or neutral. This week’s data, released

on Thursday, April 14, 2022, showed the most negative bull-bear spread since

April 2013... But these survey respondents, like in most other surveys, have an

excellent track record of being wrong when they all move together. That

should mean an opportunity for prices to rebound, even if only for a short

time, just to surprise the crowd to the greatest extent possible.” Commentary

at...

https://www.mcoscillator.com/learning_center/weekly_chart/multiyear_records_for_aaii_survey/

My cmt: The bounce is happening now and it may be, as Tom

McClellan warned, “only for a short time.”

EARNINGS GROWTH (FACTSET – Pub 12 Apr)

“...despite the negative impacts cited by these 20

companies [who had reported by 12 Apr], they have reported aggregate

(year-over-year) earnings growth of 18.5% and average (year-over-year) earnings

growth of 22.7%. It appears most of these companies are raising prices to

offset these negative impacts, as 18 of these 20 companies (90%) discussed

increasing prices or improving price realization on their earnings calls.”

Report at...

MARKET REPORT / ANALYSIS

-Wednesday the S&P 500 slipped about 0.1% to 4459.

-VIX dropped about 5% to 20.32.

-The yield on the 10-year Treasury was down to 2.845%.

PULLBACK DATA:

If the correction has ended:

-Drop from Top: 13% (Avg.= 13% for non-crash pullbacks)

-Days from Top to Bottom: 48-days. (Avg= 30 days top to

bottom for corrections <10%; 60 days top to bottom for larger, non-crash

pullbacks)

Currently:

If the correction has not ended:

Days since top: 74 (Avg= 60 days top to bottom for

>10% non-crash pullbacks)

Drop from Top: Now 6.9%. Max at close: 13%

The S&P 500 is 0.7% BELOW its 200-dMA & 1.2% ABOVE

its 50-dMA.

*We can’t call the end of the correction until the

S&P 500 makes a new high. If it makes a new low, then the correction has

obviously not ended.

TODAY’S COMMENT:

Markets faded after the FED Beige Book was released at

2PM. I don’t think there were any real surprises – it just reminded investors

that there are a lot of questions concerning the economy.

The McClellan Oscillator remained bullish, so the

currently bearish 10-day version of the Fosback Hi-Low Logic Index can be

ignored.

Today, the daily sum of 20 Indicators improved from zero

to +6 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations improved from -6 to -37 (The

trend direction is more important than the actual number for the 10-day value.)

These numbers sometimes change after I post the blog based on data that comes

in late. Most of these 20 indicators are short-term so they tend to bounce

around a lot.

The Long Term NTSM indicator switched

to BUY: VIX is Bullish and only 45-days have been up in the last 100, also

bullish; VOLUME, SENTIMENT & PRICE are hold. I am reserving judgement on

the LT NTSM indicator as noted below.

It’s frustrating to see the indicators switching to the

Bull side. I don’t like getting

whipsawed by back-and-forth trading signals. That is why I noted yesterday that

perhaps I should only follow the Long-Term Indicator. Now that the Long-Term Indicator has switched

to bullish, should I be bullish? Maybe, maybe not. The short-term indicator is still HOLD and

the Long-Term Indicator ensemble is not sending a very strong signal.

As I have noted before, the fact that only 45-days have

been up over the last 100 is bullish, but in a bear market, this number does not

guarantee that the bottom is in. When I

looked back to 2008 and 2009 bear market, only 47-days had been up (out of 100)

when the S&P 500 made its bottom in March 2009. The problem is that at the

end of Dec 2008, the data indicates that, again, only 47-days had been up (out

of 100). The Index fell another 25% from

Dec 2008 to the final low. That points out that in bear markets, the 100-day

number can remain low for extended times.

On the other hand, at the first bottom in Nov 2008, only

45-days had been up over the previous 100.

That’s today’s number, so this could still be a decent low signal for

current conditions, but I am not in a rush.

Bottom line: I’ll wait for the short-term indicator to

confirm the Long-term Buy and I’ll also look for a stronger Long-Term Buy

signal before I add to stock holdings. In the meantime, I’ll try to find the

time to check the 2000-2001 bear market for stats on the days-up out of 100.

I remain a Bear for the long-term, but this bounce may be

tradable for aggressive traders and it could be a buying opportunity. Let’s see

what happens tomorrow.

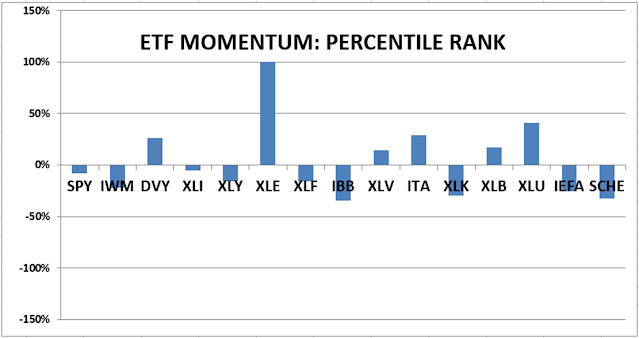

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

BEST DOW STOCKS - TODAY’S MOMENTUM

RANKING OF THE DOW 30 STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

WEDNESDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals improved to HOLD. I’d like to see this indicator in the green before I get back in the markets in a meaningful way.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation in the

portfolio is now about 35% invested in stocks. This is below my “normal” fully

invested stock-allocation of 50%.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.