“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Faced with a combination of record speculative extremes

and deteriorating speculative conditions, investors may want to remember that

the best time to panic is before everyone else does.” – John Hussman, Phd.

From...

https://michaelpramirez.com/index.html

NFIB SMALL BUSINESS OPTIMISM (NFIB)

“The NFIB Small Business Optimism Index was

unchanged in April, remaining at 93.2 and the fourth consecutive month below

the 48-year average of 98. Small business owners expecting better business

conditions over the next six months decreased one point to a net negative 50%,

the lowest level recorded in the 48-year-old survey.” Press release at...

HOUSE DEMOCRATS TAX PLAN DISASTER FOR SMALL BUSINESSES

(NFIB)

“As usual, the White House offered platitudes this month at

the start of Small Business Week. Small businesses are the ‘engines of our

economic progress.’ The ‘pillars of their neighborhoods.’ And so on. But a few

days later, the House of Representatives, with the White House’s backing,

announced one of the most dramatic assaults on small business in decades.

Lawmakers unveiled a massive tax-hike package that would jam those ‘engines of

our economic progress’ and topple many of those ‘pillars of their

neighborhoods.’” - NFIB President Brad Close. Press release at...

THE BAD THINGS QT3 WILL BRING (McClellan Financial

Publications)

“The Federal

Reserve announced on May 4, 2022 that it would start to reduce

its holdings of Treasury securities and mortgage-backed securities (MBS)

beginning on June 1, 2022. Their plan is to sell off $30 billion of

Treasuries and $17.5 billion of MBS every month from June through August.

Then in September they plan to ramp up to double those amounts every

month. This will not be bullish at all for the stock market, based on our

collective past experience with instances when the Fed has tried to do this

before...In an ideal scenario, we would just get rid of the FOMC, and outsource

interest rate policy to the 2-year T-Note yield. That would save a lot on

travel costs for the FOMC members, and it would arguably get us a much better

result.” Commentary at...

https://www.mcoscillator.com/learning_center/weekly_chart/the_bad_things_that_qt3_will_bring/

INVESTOR SENTIMENT IS SO BEARISH – IT’S BULLISH (RIA)

“’If everybody’s optimistic, who is left to buy? If

everybody’s pessimistic, who’s left to sell?’ - Sam Stovall, the investment

strategist for Standard & Poor’s...

...The takeaway from this commentary is not to let media

headlines, financial narratives, or concerns over long-term issues like

valuations, economics, or geopolitical events impact the decision-making

process in your portfolio strategy...The next few weeks, and even the next

couple of months, will likely be frustrating. Markets are likely to remain

rangebound with little progress made for either the bulls or the bears. We are

maintaining our exposures to higher-than-normal levels of cash and underweight

both equities and bonds.” Commentary at...

https://realinvestmentadvice.com/investor-sentiment-is-so-bearish-its-bullish/

My sentiment 5-day numbers are 88%-bulls

(Bulls/{bulls+bears}) based on the amounts invested in selected

Rydex/Guggenheim mutual funds. While that seems very bullish, currently, below 85%

is my “Buy” signal and I am much closer to a “Buy” than a “Sell.”

ANOTHER DEAD RUSSIAN OLIGARCH (msn.com)

“Subbotin, the former top manager of Russian energy company

Lukoil, is the latest of several Russian oligarchs to die in a suspicious manner amid Russia's invasion of

Ukraine...His death comes just months after Lukoil called for a quick end to

the war between Russia and Ukraine. ” Story at...

Russian

Oligarch Found Dead Under Mysterious Circumstances (msn.com)

Highly likely that Putin is killing them off. I heard an interview

with a Russian woman at the May-Day Parade in Moscow. She praised Putin for keeping Russia out of a

war. Apparently, none of her neighbors told her that their children in the

military seem to have vanished.

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 rose about 0.2% to 4001.

-VIX dropped about 5% to 32.99.

-The yield on the 10-year Treasury was 3.082% at 5:50pm.

PULLBACK DATA:

-Drop from Top: 16.6% as of today. 16.8% max. (Avg.= 13%

for non-crash pullbacks)

-Days from Top to Bottom: 88-days. (Avg= 30 days top to

bottom for corrections <10%; 60 days top to bottom for larger, non-crash

pullbacks)

The S&P 500 is 10.8% BELOW its 200-dMA & 8.1%

BELOW its 50-dMA.

*We can’t be sure that the correction is over until the

S&P 500 makes a new-high; however, we hope to be able to call the bottom

when we see it.

TODAY’S COMMENT:

“50% of the NASDAQ is down 50%.” – Josh Brown, CNBC.

Today was very likely a “Buy.” Given all of the issues facing

the markets it may not be a long-term buy.

Historically, the third year of a Presidential term tends to bottom in

the fall, but there are bullish signs now.

These bullish signs remain: (1) RSI is oversold (2) The

Overbought/Oversold Index (advance decline ratio) is oversold (3) My analysis

of the late day action shows an oversold condition. Bollinger Bands flipped to

neutral.

Today, the daily sum of 20 Indicators improved from -3 to

+1 (a positive number is bullish; negatives are bearish); the 10-day smoothed

sum that smooths the daily fluctuations improved from -17 to -12. (The trend

direction is more important than the actual number for the 10-day value.) These

numbers sometimes change after I post the blog based on data that comes in

late. Most of these 20 indicators are short-term so they tend to bounce

around a lot.

LONG-TERM INDCATOR: The Long

Term NTSM indicator was HOLD: VOLUME & PRICE are bearish; VIX &

SENTIMENT are hold. 45 days out of the

last 100 have been up-days; that leans bullish.

Today was a wild one as the

S&P 500 bounced between positive and negative values. The final result

looked bullish, but once again, not slam-dunk bullish. For a retest, we want to

see a lower-low. Today’s low, was not quite

a lower-low, so some would argue that Tuesday’s close should be ignored. They may be right, but Tuesday’s close was

only 0.25% above yesterday’s low and the internals looked more like values at a

low than not. Comparing internals, we find that internals improved and the

volume was lower compared to the low yesterday. That’s what we need to see. Improving volume suggests reduced selling

pressure and improving internals suggest an improving underlying stock

market. The markets may have made a bottom

Tuesday, though it may not be a long-term bottom. If I am right, there should

be a nice bounce Wednesday. My confidence level is not high; futures are down

as I write this.

My plan is to take a trading

position tomorrow (assuming the markets are positive) until the markets either

confirm or reject my hypothesis. Confirmation would be a strong move up.

We’ll see...

I’m a BULL, but I have to admit that position will

not last long if the markets don’t make a strong move up tomorrow.

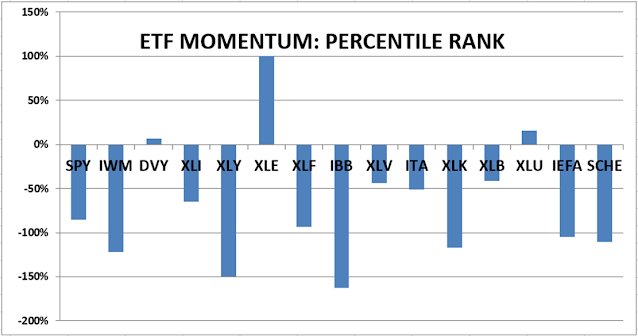

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

My only current trading

position is in the Energy XLE-ETF.

BEST DOW STOCKS - TODAY’S MOMENTUM

RANKING OF THE DOW 30 STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals improved to HOLD.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation in the

portfolio is now about 35% invested in stocks. This is below my “normal” fully

invested stock-allocation of 50%. I’ll up the stock holding Wednesday depending

on market action. I’ll probably move to

40-45% in stocks as a % of the total portfolio.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.