“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Faced with a combination of record speculative extremes

and deteriorating speculative conditions, investors may want to remember that

the best time to panic is before everyone else does.” – John Hussman, Phd.

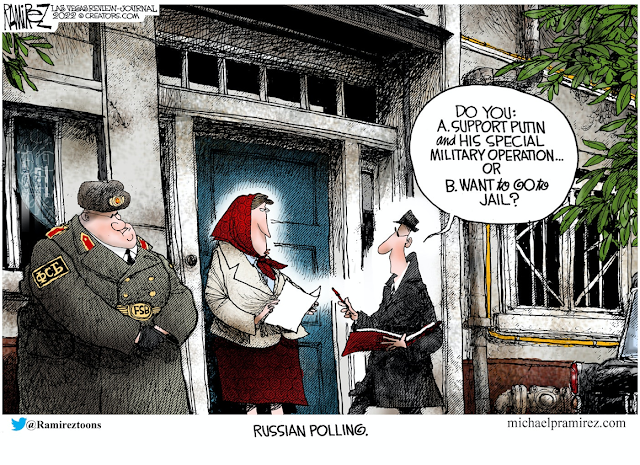

Political commentary at...

BIG TECH FOLLOWING CHINESE TECH? (The Felder Report)

“The lesson that might be gleaned from China’s experience

is that a reset in valuations for US tech stocks may not be complete until the

Fed’s monetary tightening has first been completed. What’s more, it’s not just

the “P” in the PE Ratio that must be considered but also the “E.” If valuations

continue to revert to more normal levels AND earnings estimates continue to

come down (as leading

indicators suggest), then the decline in prices may have only just

begun.” Commentary at...

Could be; but first the rally!

ADIOS MAY (Heritage Capital, 1 June)

“...to be crystal clear, I do not believe the rally is

over or even close to ending. At a minimum this should be the 7-15% rally I

have written about and it should last more than a few days or weeks.” - Paul

Schatz, President Heritage Capital. Commentary at...

https://investfortomorrow.com/blog/adios-may/

[More from Paul today] “...My thoughts in the short-term

are unchanged. May 20th was a low of significance. That’s a high conviction

statement. It may or may not be the ultimate bottom from which the launch to

40,000 begins, but I remain firm that a 7-15% rally is here. We’ll take the

rest as it comes.” Commentary at...

https://investfortomorrow.com/blog/bull-market-in-bearishness/

CHARTS SUGGEST A VERY NICE SUMMER FOR STOCKS (CNBC)

“CNBC’s Jim Cramer explained technical analysis from

veteran chartist Larry Williams that suggests the market’s recent rebound could

last for the next few months...’He thinks this is not just a short-term bounce,

it’s a move that could last through the end of August,’ the 'Mad Money’ host

said.” Story at...

https://www.cnbc.com/2022/05/31/jim-cramer-charts-suggest-a-very-nice-summer-for-stocks.html

I agree with both of these guys – the rally can last to

the 200-dMA, but how far it goes is really anyone’s guess.

MARKET REPORT / ANALYSIS

-Monday the S&P 500 rose about 0.3% to 4121.

-VIX rose about 1% to 25.07.

-The yield on the 10-year Treasury rose a bit to 3.049%.

PULLBACK DATA:

-Drop from Top: 14.1% as of today. 18.7% max. (Avg.= 13%

for non-crash pullbacks)

-Days from Top to Bottom: 106-days. (Avg= 30 days top to

bottom for corrections <10%; 60 days top to bottom for larger, non-crash

pullbacks)

The S&P 500 is 7.4% BELOW its 200-dMA & 2.8 %

BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500

makes a new-high; however, we hope to be able to call the bottom when we see

it...and...we did call the market a trading “Buy” one day after the recent

trading-bottom on 12 May (a little early).

MY TRADING POSITIONS:

XLK*

UWM*

I’ll sell quickly if the rally appears to be failing.

XLE

DOW

TODAY’S COMMENT:

More Bull-signs keep popping up. The analysis of the number

of advancing issues on the NYSE vs. the S&P 500 shows that advancing issues

are significantly ahead of the Index. That divergence suggests continued

improvement in the S&P 500.

The 5-10-20 Timer System switched to BUY today; the

5-dEMA and 10-dEMA are both ABOVE the 20-dEMA.

My Money Trend indicator remains bullish.

Today, the daily sum of 20 Indicators improved from +12

to +13 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations improved from +112 to +126.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long

Term NTSM indicator declined to HOLD:

VOLUME is bullish; SENTIMENT,

PRICE & VIX are hold.

I am cautiously Bullish in the short-term and Bearish

longer-term.

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

BEST DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals improved to BUY.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation in the

portfolio is now roughly 45% invested in stocks. This is slightly below my

“normal” fully invested stock-allocation of 50%.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.