“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

If you don’t like the conservative leaning Supreme Court,

just pack the court with Liberal judges:

“Dubbed the Judiciary Act of 2023, the measure would expand the high court by adding four seats to create a 13-justice [liberal] bench. First introduced in 2021, the measure has added sponsors since it was initially conceived. Rep. Hank Johnson (D-Ga.), one of the original co-sponsors, said the initial House bill had only two co-sponsors when it was first introduced. Now, the measure is being reintroduced with 56.” From Politico at...

https://www.politico.com/minutes/congress/05-16-2023/supreme-court-expansion-bill/

“For decades we disagreed with [Supreme] Court rulings when progressives held sway, but we never called the Court illegitimate. But now that the left has lost the Court as a backup legislature for its policy goals, the institution is supposedly broken. Tell us again who is the threat to democratic institutions?” – WSJ Editorial Board.

The Democrats want to pack the Supreme Court, in part,

because some of the Justices are “originalists.” Here’s a short comment from former

Justice Scalia:

“Originalists believe that the provisions of the Constitution have a fixed meaning, which does not change (except by Constitutional amendment): they mean today what they meant when they were adopted, nothing more nothing less. This is not to say of course that there are not new applications of old constitutional rules. The Court must determine, for example, how the first Amendment guarantee of “the freedom of speech” applies to new technologies that did not exist when the guarantee was created...But acknowledging the need for projection of old constitutional principles upon new physical realities is a far cry from saying what non-originalists say: that the Constitution changes; that the very act that it once prohibited, it now permits, and which it once permitted it now forbids...

...As a practical matter, there is no alternative to originalism but standardless judicial constitution-making. And that of course is the very appeal of non-originalism for the judges: once they are liberated from the original meaning, they are liberated from any other governing principle as well. Nothing constrains their action except perhaps the estimation of how much judicial social engineering the society will tolerate.” – Antonin Scalia (1936-2016), Justice of the Supreme Court 1986 – 2016. Excerpt from “The Essential Scalia,” Edited by Sutton and Whelan, Pub., Crown Forum.

MARKET REPORT / ANALYSIS

-Monday the S&P 500 rose about a point to 4193.

-VIX rose about 2% to 17.21.

-The yield on the 10-year Treasury rose to 3.715%.

PULLBACK DATA:

-Drop from Top: 12.6%. 25.4% max (on a closing basis).

-Trading Days since Top: 347-days.

The S&P 500 is 5.5% ABOVE its 200-dMA and 2.8% ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area and we called a buy on 4 October 2022.

MY TRADING POSITIONS:

I am not trading as much as in the past. You may wish to use the momentum charts and/or the Monday 40-day gain charts for trading the Dow stocks and ETFs.

MSFT – Microsoft.

XLK – Technology ETF.

XLE – Energy Sector ETF. XLE has been testing its March lows and recent 4 May low on lower volume so I continue to hold it.

XLY - Consumer Discretionary ETF.

KRE – Regional Banking ETF. This is a very small position

for me. KRE tested the May 4 low of 36.08 on much lower volume 11 & 12

May. That’s a bullish sign for KRE and it was up over 7%, 17 May.

SHY – Short term bonds. 30-day yield is 4%. (Trailing

1-year yield is 1.6%.) I’ll hold this, but if the market retests the lows, I’ll

sell it and buy stocks.)

TODAY’S COMMENT:

Issues advancing on the NYSE (Breadth) vs. the S&P 500 remains bearish. Currently, the S&P 500 is advancing too far ahead of other issues on the NYSE. That’s a concern. Overall, though, the Friday rundown of indicators turned bullish. There were only 6 bear-signs and 18-Bull. That’s a pretty decent bullish count.

The daily spread of 20 Indicators (Bulls minus Bears) declined

from +6 to +1 (a positive number is bullish; negatives are bearish); the 10-day

smoothed sum that smooths the daily fluctuations declined from +26 to +21.

(The trend direction is more important than the actual number for the 10-day

value.) These numbers sometimes change after I post the blog based on data that

comes in late. Most of these 20 indicators are short-term so they tend to

bounce around a lot.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained BUY: PRICE & VIX are positive; SENTIMENT & VOLUME are neutral.

(The important BUY in this indicator was on 21 October,

7-days after the bottom. For my NTSM overall signal, I suggested that a

short-term buying opportunity occurred on 27 September (based on improved

market internals on the retest), although without market follow-thru, I was

unwilling to call a buy; however, I did close shorts and increased stock

holdings. I issued a Buy-Signal on 4 October, 6-days before the final bottom,

based on stronger market action that confirmed the market internals signal. The

NTSM sell-signal was issued 20 December, 8 sessions before the high of this

recent bear market, based on the bearish “Friday Rundown” of indicators.)

Bottom line: I remain a Bull. I would add to stock

holdings, except I am still concerned about the Debt Ceiling negotiations. The negotiations haven’t bothered the markets yet. That may change as the deadline approaches.

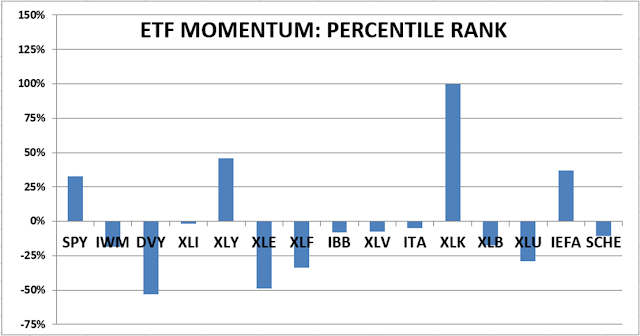

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

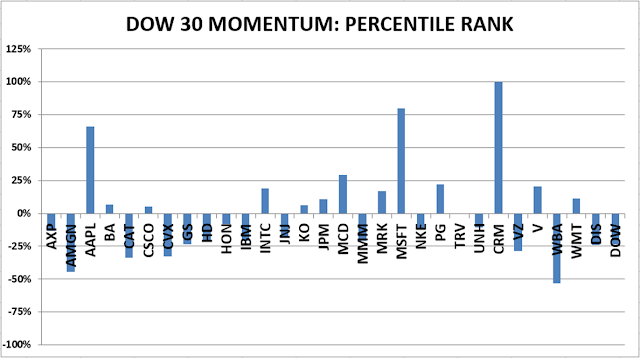

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals remained HOLD. (Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)

“Dubbed the Judiciary Act of 2023, the measure would expand the high court by adding four seats to create a 13-justice [liberal] bench. First introduced in 2021, the measure has added sponsors since it was initially conceived. Rep. Hank Johnson (D-Ga.), one of the original co-sponsors, said the initial House bill had only two co-sponsors when it was first introduced. Now, the measure is being reintroduced with 56.” From Politico at...

https://www.politico.com/minutes/congress/05-16-2023/supreme-court-expansion-bill/

“For decades we disagreed with [Supreme] Court rulings when progressives held sway, but we never called the Court illegitimate. But now that the left has lost the Court as a backup legislature for its policy goals, the institution is supposedly broken. Tell us again who is the threat to democratic institutions?” – WSJ Editorial Board.

“Originalists believe that the provisions of the Constitution have a fixed meaning, which does not change (except by Constitutional amendment): they mean today what they meant when they were adopted, nothing more nothing less. This is not to say of course that there are not new applications of old constitutional rules. The Court must determine, for example, how the first Amendment guarantee of “the freedom of speech” applies to new technologies that did not exist when the guarantee was created...But acknowledging the need for projection of old constitutional principles upon new physical realities is a far cry from saying what non-originalists say: that the Constitution changes; that the very act that it once prohibited, it now permits, and which it once permitted it now forbids...

...As a practical matter, there is no alternative to originalism but standardless judicial constitution-making. And that of course is the very appeal of non-originalism for the judges: once they are liberated from the original meaning, they are liberated from any other governing principle as well. Nothing constrains their action except perhaps the estimation of how much judicial social engineering the society will tolerate.” – Antonin Scalia (1936-2016), Justice of the Supreme Court 1986 – 2016. Excerpt from “The Essential Scalia,” Edited by Sutton and Whelan, Pub., Crown Forum.

-Monday the S&P 500 rose about a point to 4193.

-VIX rose about 2% to 17.21.

-The yield on the 10-year Treasury rose to 3.715%.

-Drop from Top: 12.6%. 25.4% max (on a closing basis).

-Trading Days since Top: 347-days.

The S&P 500 is 5.5% ABOVE its 200-dMA and 2.8% ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area and we called a buy on 4 October 2022.

I am not trading as much as in the past. You may wish to use the momentum charts and/or the Monday 40-day gain charts for trading the Dow stocks and ETFs.

XLK – Technology ETF.

XLE – Energy Sector ETF. XLE has been testing its March lows and recent 4 May low on lower volume so I continue to hold it.

XLY - Consumer Discretionary ETF.

Issues advancing on the NYSE (Breadth) vs. the S&P 500 remains bearish. Currently, the S&P 500 is advancing too far ahead of other issues on the NYSE. That’s a concern. Overall, though, the Friday rundown of indicators turned bullish. There were only 6 bear-signs and 18-Bull. That’s a pretty decent bullish count.

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals remained HOLD. (Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)