FED PRESIDENT SUGGESTS RATE HIKES ARE AT AN END (CNBC)

“Philadelphia Federal Reserve President Patrick Harker on Tuesday indicated that the central bank could be at the end of its current rate-hiking cycle. A voter this year on the rate-setting Federal Open Market Committee, the central bank official noted progress in the fight against inflation and confidence in the economy.” Story at...

https://www.cnbc.com/2023/08/08/philadelphia-fed-president-patrick-harker-suggests-interest-rate-hikes-are-at-an-end.html

"The NFIB Small Business Optimism Index increased 0.9 of a point in July to 91.9, marking the 19th consecutive month below the 49-year average of 98. Twenty-one percent of owners reported that inflation was their single most important problem in operating their business, down three points from June... Of those hiring or trying to hire, 92% of owners reported few or no qualified applicants for the positions they were trying to fill.” Press release at...

https://www.nfib.com/surveys/small-business-economic-trends/

-Tuesday the S&P 500 dropped about 0.4% to 4499.

-VIX rose about 1% to 15.77.

-The yield on the 10-year Treasury slipped to 4.033

-Drop from Top: 6.2%. 25.4% max (on a closing basis).

-Trading Days since Top: 398-days.

The S&P 500 is 9.6% ABOVE its 200-dMA and 1.8% ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area and we called a buy on 4 October 2022.

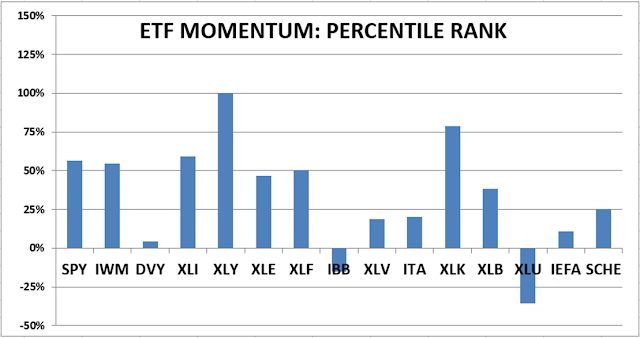

I am not trading as much as in the past. You may wish to use the momentum charts and/or the Monday, 40-day gain charts for trading the Dow stocks and ETFs.

XLK – Technology ETF.

XLY - Consumer Discretionary ETF.

In the article from CNBC above, Philadelphia Fed President, Patrick Harker, was quoted as saying, “Absent any alarming new data between now and mid-September, I believe we may be at the point where we can be patient and hold rates steady and let the monetary policy actions we have taken do their work.” While markets didn’t expect a rate hike at the next meeting, there was a reasonable expectation that another rate hike would be needed later. The article was published at 8:16 AM EDT, so the news was out before markets opened this morning. The S&P 500 bottomed around 11 AM. I’d like to say that the Fed news drove the market higher, but that does not seem to be the case.

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW 30 momentum ranking follows:

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained SELL. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)