Consumer Confidence ... Durable Orders ... Momentum Trading DOW Stocks & ETFs … Stock Market Analysis ...

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far more

money has been lost by investors in preparing for corrections, or anticipating

corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

“The reality is Donald Trump, everything he touches does

die. Everything he has tried to put in place does not work,” he said. “The RNC

is now going to be controlled by his daughter-in-law, basically... It’s how you

grind yourself down as a national party into the dust of nothing.” - Michael Steele, former Chair, Republican

National Committee.

"[Trump’s visit to the border] has nothing to offer

Eagle Pass, and Eagle Pass has nothing to gain from it. Not welcome here and

you know it. Not a leader but a loser. Not a president, but a contender. Not a

rebel but a threat. Not a friend but an enemy. Not a patriot but a traitor. Eagle

Pass deserves better. Maverick County deserves better. Texas deserves better. America

deserves better. We deserve better." - Eagle Pass Border Coalition, Eagle

Pass Texas, in recent Facebook post.

“The Border Patrol Union on Monday ridiculed President

Biden’s planned visit to the border this week as a cynical ploy to save his

presidency at the expense of Americans’ safety.” Story at...

Border

Patrol Union slams Biden border visit as ‘too little, too late’ just to 'try to

save himself' (msn.com)

“Seems like someone is starting 2024 hangry. You and your

lawyers have had the J6 cmttee materials plus the grand jury info & much

more for months. Lying about the evidence in all caps won’t change the facts. A

public trial will show it all.” –Liz Cheney, former Republican Representative

from Wyoming, denying Trump’s claim she destroyed evidence.

DURABLE ORDERS (YahooFinance)

"Orders for long-lasting U.S. manufactured goods fell by

the most in nearly four years in January, while business investment on

equipment appeared to have eased, signs that the economy lost momentum at the

start of the year... Orders for durable goods, items ranging from toasters to

aircraft meant to last three years or more, plunged 6.1% last month..." Story at...

https://finance.yahoo.com/news/us-durable-goods-orders-fall-135342448.html

CONSUMER CONFIDENCE (Conference Board)

“The Conference Board Consumer Confidence Index® fell in February to 106.7

(1985=100), down from a revised 110.9 in January. February’s decline in the

Index occurred after three consecutive months of gains... “The decline in

consumer confidence in February interrupted a three-month rise, reflecting

persistent uncertainty about the US economy,” said Dana Peterson, Chief Economist at The

Conference Board.” Press release at...

https://www.conference-board.org/topics/consumer-confidence

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 rose about 0.2% to 5078.

-VIX dipped about 2% to 13.43.

-The yield on the 10-year Treasury rose to 4.303%.

MY TRADING POSITIONS:

QLD- Added 2/20/2024

UWM – Added 1/22/2024.

XLK – Technology ETF (holding since the October 2022

lows).

INTC – Added 12/6/2023.

CRM – Added 1/22/2024

BA – Added 12/6/2023. I plan to hold Boeing for the time

being, although my patience is running out! Technically, there is a lot of

support around the 200 level. It closed

at 201.5 on 2/22/2024. If Boeing drops below 200 it will be time to bail out.

DWCPF - Dow Jones U.S. Completion Total Stock Market

Index. – Added 12/7/2023 when I sold the S&P 500. This is a large position

in my retirement account betting on Small Caps.

TODAY’S COMMENT:

More than half of issues on the NYSE have been up on all

time frames that I track (150, 100, 50, and 10-days). This shows that the rally

continues to be broad and makes me optimistic that the rally will continue.

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Now there are 8 bear-signs and 13-Bull. Monday

there were 8 bear-signs and 14-Bull signs.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: PRICE was positive; VOLUME, SENTIMENT & VIX are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

The Summary of Indicators was slightly less bullish

today. I remain cautiously bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

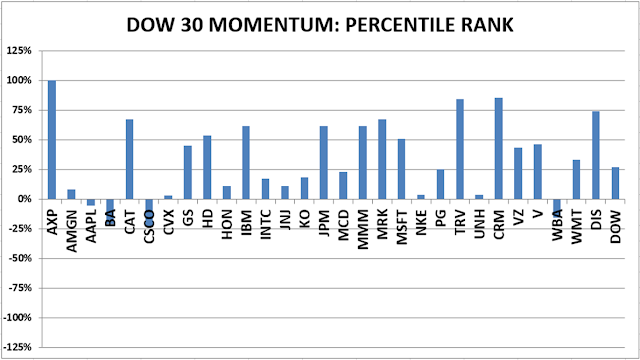

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The DOW added Amazon to the Dow 30. I’ll add it, but it’s a time consuming

effort and may take awhile. Walmart split 3 for 1 today and that took some

manipulation in the momentum ranking, too.

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained HOLD. (My basket of Market Internals

is a decent trend-following analysis of current market action, but should not

be used alone for short term trading. They are most useful when they diverge

from the Index.)

...My current invested

position is about 70% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting

continuation of bullish market action.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio using an S&P 500 ETF as I did back in

October.