Jobless Claims ... PCE Prices ... Personal Spending ... Momentum Trading DOW Stocks & ETFs … Stock Market Analysis ...

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

“It was Thomas Edison who brought us electricity, not the

Sierra Club. It was the Wright brothers who got us off the ground, not the

Federal Aviation Administration. It was Henry Ford who ended the isolation of

millions of Americans by making the automobile affordable, not Ralph Nader.

Those who have helped the poor the most have not been those who have gone

around loudly expressing 'compassion' for the poor, but those who found ways to

make industry more productive and distribution more efficient, so that the poor

of today can afford things that the affluent of yesterday could only dream about.”

― Thomas Sowell

JOBLESS CLAIMS (Fox Business)

“The number of Americans filing for unemployment

benefits rose more than expected last week as high-profile companies

continue to announce major job cuts. Figures

released Thursday by

the Labor Department show initial claims for the week ending Feb. 24 jumped by

13,000 to 215,000...” Story at...

https://www.foxbusiness.com/economy/jobless-claims-jumped-more-expected-last-week

PCE PRICES / PERSONAL INCOME / PERSONAL SPENDING (CNBC)

“Inflation rose in line with expectations in January,

according to an important gauge the Federal Reserve uses as it deliberates

cutting interest rates. The personal consumption expenditures price index

excluding food and energy costs increased 0.4% for the month and 2.8% from a

year ago... The moves came amid an unexpected jump in personal income, which

rose 1%, well above the forecast for 0.3%. Spending decreased 0.1% versus the

estimate for a 0.2% gain.” Story at...

https://www.cnbc.com/2024/02/29/pce-inflation-january-2023-.html

CHICAGO PMI (Advisor Perspectives)

“The latest Chicago Purchasing Manager's Index (Chicago Business

Barometer) fell to 44.0 in February from 46.0 in January, marking the third

straight monthly decline.. The latest reading is worse than the 48.1 forecast

and keeps the index in contraction territory for a third consecutive month.”

Commentary and charts at...

https://www.advisorperspectives.com/dshort/updates/2024/02/29/chicago-pmi-falls-for-3rd-straight-month-in-february

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 rose about 0.5% to 5096.

-VIX dipped about 3% to 13.40.

-The yield on the 10-year Treasury slipped to 4.262%.

MY TRADING POSITIONS:

QLD- Added 2/20/2024

UWM – Added 1/22/2024.

XLK – Technology ETF (holding since the October 2022

lows).

INTC – Added 12/6/2023.

CRM – Added 1/22/2024

Salesforce reported and beat on earnings and revenue, but

their guidance for 2024 was light so CRM dipped about 2% in afterhours trading

on Wednesday. Apparently yhe news wasn’t as bad as it first seemed – CRM was up

3% on Thursday.

BA – Added 12/6/2023. I plan to hold Boeing for the time

being, although my patience is running out! Technically, there is a lot of

support around the 200 level. It closed

at 201.5 on 2/22/2024. If Boeing drops below 200 it will be time to bail out.

DWCPF - Dow Jones U.S. Completion Total Stock Market

Index. – Added 12/7/2023 when I sold the S&P 500. This is a large position

in my retirement account betting on Small Caps.

TODAY’S COMMENT:

It is not unusual in my summary of 50 indicators to have

Bear-indicators even in strong bull-markets. Now, the most concerning of the

Bear-indicators are those that show the markets are stretched. For example, I

mentioned that the S&P 500 was 12.2% above its 200-dMA in yesterday’s blog

post. Today let’s review another worrisome indicator.

I track 15 ETFs in my momentum analysis that I chart

daily and they form an interesting indicator. Those 15 ETFs were chosen as a

cross-section of the markets. I don’t think the exact 15 are particularly

important, as long as one uses a representative sample of the market. Currently,

the 15 ETFs in my momentum analysis are all above their respective 120-dMAs.

That’s a bearish sign, and for evidence, we look at a chart of recent history.

Before we panic though, let’s look at another chart with

the same data, but going back to 2017-2018. It shows that when the % of ETFs

above their 120-dMA hit 100%, there was a significant lag time before a

correction occurred. In 2018, it took 4 months before there was a significant

decline – in that case about 10%.

What does this mean.

We need to be on our toes and accept that a 10% decline (or more) is

possible at any time. Hopefully, we’ll get some warning in the indicators

before we get a decline of that magnitude.

In the meantime, I’ll keep a close eye on indicators and market

action. Today, the news was good - The Summary of About 50-Indicators moved well

to the bullish side and breadth looks good.

8.4% of all issues traded on the NYSE made new, 52-week

highs when the S&P 500 made a new all-time-high, today, 29 February 2024. This

confirms, once again, that the rally is healthy with decent participation in

the advance.

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Now there are 3 bear-signs and 18-Bull. Wednesday

there were 6 bear-signs and 15-Bull signs.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: PRICE was positive; VOLUME, SENTIMENT & VIX are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I remain cautiously bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

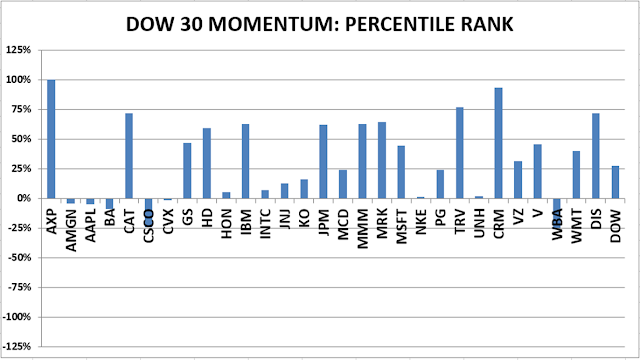

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking

follows:

The DOW added Amazon to the Dow 30. I’ll add it, but it’s a time consuming

effort and may take awhile. Walmart split 3 for 1 today and that took some

manipulation in the momentum ranking, too.

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained BUY. (My basket of Market Internals

is a decent trend-following analysis of current market action, but should not

be used alone for short term trading. They are most useful when they diverge

from the Index.)

...My current invested

position is about 70% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting

continuation of bullish market action.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio using an S&P 500 ETF as I did back in

October.