“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“The first presidential debate of this election cycle is over, and what a depressing spectacle it was. I can’t remember feeling guilty watching a campaign event before, but seeing the exchanges between Joe Biden and Donald Trump felt like participating in elder abuse. There’s nothing winsome about pestering old men with incessant questions as if to deny them the dignity of their dotage. Biden was particularly ill-served by the proceedings. From the moment he shuffled onstage and muttered his first answer in a hushed and wheezing monotone, it was clear that he is too old for the job he has right now, and certainly too old for another four-year term. The president is in the wintertime of his life. He ought to rest.” Story at...

They’re Both Totally Unfit (msn.com)

“The Personal Consumption Expenditures price index — a closely watched inflation gauge that the Federal Reserve uses for its 2% target — was unchanged from April and slowed to 2.6% for the 12 months ended in May from 2.7% the month before, according to Commerce Department data released Friday. It’s the first time since November that prices didn’t increase on a monthly basis.” Story at...

https://www.cnn.com/2024/06/28/economy/us-pce-inflation-fed-consumer-spending-may/index.html

My cmt: Futures were well up before the open, but declined after the PCE report came out at 8:30. After an early peak, the S&P 500 fell for most of the day.

“The latest Chicago Purchasing Manager's Index (Chicago Business Barometer) jumped to 47.4 in June from 35.4 in May. This is the first monthly increase since November of last year and largest monthly increase since July 2020. The latest reading is better than the 39.7 forecast but keeps the index in contraction territory for a seventh consecutive month.” Story at...

https://www.advisorperspectives.com/dshort/updates/2024/06/28/chicago-pmi-jumps-to-7-month-high

-Friday the S&P 500 declined about 0.4% to 5460.

-VIX rose about 2% to 12.44.

-The yield on the 10-year Treasury rose to 4.392% (compared to this time yesterday).

XLK – Holding since the October 2022 lows.

“The Dow Jones U.S. Completion Total Stock Market Index, also known as the DWCPF, is a widely used financial index that provides a comprehensive measure of the US equity market. The DWCPF includes all US stocks that are not included in the Dow Jones US Total Stock Market Index, which comprises large-cap and mid-cap companies. As a result, the DWCPF provides a complete picture of the US stock market, including small-cap and micro-cap companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

The Bull/Bear Spread (Bull Indicators minus Bear Indicators) was 7 Bear-signs and 16-Bull. (The rest are neutral. It is normal to have a lot of neutral indicators since many of those are top or bottom indicators that will signal only at extremes.) The 10-dMA of spread (purple line in the chart below turned up, a bullish sign, although it has bounced back and forth so much that it is hard to tell.

TODAY’S COMMENT:

-Friday there was another Bearish outside reversal day. There was one just 4 sessions ago and today’s is the fourth one in 3-weeks.

According to Investopedia: “This demonstrates that the bulls had control over the market before the bears took the reins in a meaningful way, signaling a shift in the overall trend... For instance, a stock may have a small move higher on the first day, climb even higher the second day, but then sharply decline by the second day’s end... This formation is considered a strong indicator that the prior upward momentum is waning and a reversal is on the horizon.”

https://www.investopedia.com/terms/o/outsidereversal.asp#:~:text=A%20bearish%20outside%20reversal%2C%20also,by%20the%20second%20day's%20end

-There was a bearish crossover in the MACD (Moving Average Convergence Divergence) indicator.

-The S&P 500 is 12.2% above the 200-dMA and that remains stretched. The bear sign is greater than 12%.

-Breadth vs. the S&P 500 remains bearish.

-Friday was a statistically significant down-day. That just means that the price-volume move exceeded my statistical parameters. Statistics show that a statistically-significant, down-day is followed by an up-day about 60% of the time.

-Breadth improved.

-New-Hi/New-Low data improved on a short-term and long-term basis. (Nearly 5% of issues on the NYSE made new-highs today. That’s impressive on a down day.

(The Long-Term Indicator is not a good top-indicator. It can signal BUY at a top.)

No change: I am Neutral on the market. Perhaps next week we’ll see some signs that will allow me to get more bullish.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

For more details, see NTSM Page at…

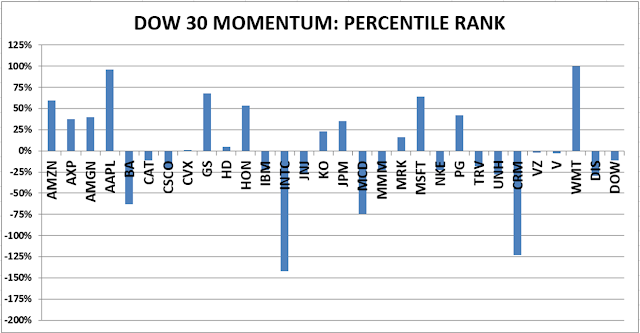

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals improved to BUY. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)