“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

https://www.wsj.com/articles/robert-de-niro-tries-to-out-crazy-mtg-0fc7f7e6

Trump was convicted of a felony in last week’s jury decision for falsifying business records. But that crime is only a misdemeanor unless it was done to conceal another crime. In this case, the other crime was a campaign finance violation because Trump paid a porn star to keep her silence so he could be re-elected. Interestingly, paying hush money is not a crime. The nexus is that Trump’s electability would have been diminished had the news been available. The hush money was therefore, according to prosecutors, a campaign donation and thus a campaign violation. There were also claims that he defrauded the electorate. The whole thing is a stretch to me and that is why Republican never-Trumpers such as Mitt Romney criticized the prosecution.

The Georgia “...grand jury accused him [Trump] and more than a dozen of his allies of orchestrating a massive criminal enterprise to overturn the results of the 2020 presidential election in Georgia... Trump attorneys Jenna Ellis, Sidney Powell and Kenneth Chesebro and Atlanta-based bail bondsman Scott Hall have pleaded guilty in the case and were given reduced sentences in exchange for their cooperation with prosecutors... Trump faced 13 charges, including a violation of the state racketeering law, or RICO, solicitation of violation of oath by public officer, conspiracy to commit impersonating a public officer, conspiracy to commit forgery, conspiracy to commit false statements and writings, committing false statements and writings, conspiracy to commit filing false documents and filing false documents.” Story on Trump charges at...

https://www.usnews.com/news/national-news/articles/2023-08-15/explainer-trumps-four-indictments

Trump faces a similar prosecution from the Federal Government, but if he is elected he can order the DOJ to kill the prosecution. In a normal world, he would be impeached if he tampered with DOJ, but the Republicans have lost all credibility with their support of Trump.

"The Manufacturing PMI® registered 48.7 percent in May, down 0.5 percentage point from the 49.2 percent recorded in April. The overall economy continued in expansion for the 49th month after one month of contraction in April 2020. (A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy.) ..."Demand remains elusive as companies demonstrate an unwillingness to invest due to current monetary policy and other conditions. These investments include supplier order commitments, inventory building and capital expenditures.” Press release at...

https://www.prnewswire.com/news-releases/manufacturing-pmi-at-48-7-may-2024-manufacturing-ism-report-on-business-302161049.html

“U.S. construction spending fell unexpectedly for a second consecutive month in April on declines in non-residential activity, though outlays for single-family home building climbed to the highest since August 2022.

The Commerce Department's Census Bureau on Monday said construction spending fell 0.1%... Construction spending increased 10% on a year-on-year basis in April.” Story at...

https://money.usnews.com/investing/news/articles/2024-06-03/us-construction-spending-slips-again-in-april

-Monday the S&P 500 rose about 0.1% to 5283.

-VIX rose about 1% to 13.11.

-The yield on the 10-year Treasury declined to 4.392%.

UWM – Added 5/2/2024

QLD – Added 4/29/2024

SSO – Added 4/29/2024.

XLE – Added 4/24/2024

XLK – Technology ETF (holding since the October 2022 lows). I don’t want to pay taxes on this gain, so I am holding this position.

“The Dow Jones U.S. Completion Total Stock Market Index, also known as the DWCPF, is a widely used financial index that provides a comprehensive measure of the US equity market. The DWCPF includes all US stocks that are not included in the Dow Jones US Total Stock Market Index, which comprises large-cap and mid-cap companies. As a result, the DWCPF provides a complete picture of the US stock market, including small-cap and micro-cap companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

The Bull/Bear Spread (Bull Indicators minus Bear Indicators) improved to Neutral Monday. Today there were 13 Bear-signs and 11-Bull. (The rest are neutral. It is normal to have a lot of neutral indicators since many of those are top or bottom indicators that will signal only at extremes.) The 10-dMA of spread (purple line in the chart below) continued down, but the rate of decline has been improving. A 10-dMA is going to lag the daily numbers. Daily numbers have improved the last 2 days.

Daily Indicators improved again. It’s too early to give the all-clear, but so far, the numbers look good.

(The Long-Term Indicator is not a good top-indicator. It can signal BUY at a top.)

I am neutral at this point watching the markets, but leaning bullish.

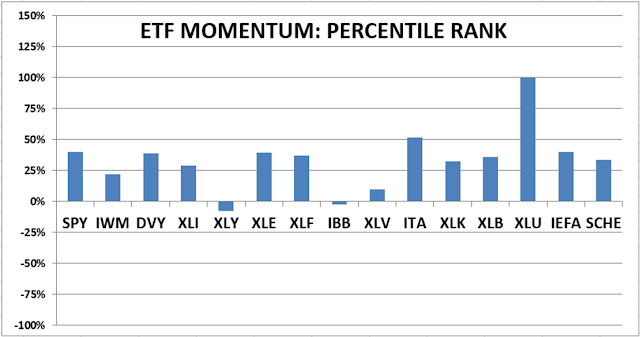

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals improved to Neutral. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)