“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“And when the courts ... stop you, stand before the country like Andrew Jackson did and say: ‘The chief justice has made his ruling. Now let him enforce it...’" – JD Vance, VP.

"I think you can dislike the court's opinion and think they're wrong on the substance, and criticize them for that, and you certainly can vigorously appeal...And you can also read a mandate—you know, when a court issues an opinion, they issue what's called a mandate that sort of sets the direction ... It's perfectly fine to read that very narrowly, to be like, 'All right, fine, you said to do this and we're going to do that, but we're going to do only that, we're not going to apply it broadly..."I think outright, sort of just, like, 'Oh, we're just going to completely ignore the decision?' That, I think you can't do. Andrew Jackson did that, infamously. He was wrong on that. That was the Trail of Tears. That was lawless. That was wrong." – Republican Senator Josh Hawley, Missouri.

My cmt: If enough Republicans agree, maybe the next impeachment will stick.

“Elon Musk said he might have uncovered “the biggest fraud in history” when he found millions of people over age 100 listed in a Social Security database, but that’s not what’s going on... Records with incomplete death info are a well-known, long-standing challenge for the Social Security Administration, but a 2023 agency inspector general report found “almost none” of the 18.9 million people listed as 100 or older were receiving benefits.” Story at...

https://www.newsnationnow.com/politics/elon-musk-social-security-fraud/

My cmt: DOGE credibility is suspect when items are flagged as fraud when they are not.

“The Department of Government Efficiency (DOGE), headed by Elon Musk, claims to have uncovered that the U.S. government processed nearly $40 billion in transactions using approximately 4.6 million active credit card accounts in the last fiscal year. The initiative, aimed at reducing government spending, announced its findings on social media platform X on Tuesday.”

DOGE Reveals Over 4 Million Government Credit Cards Linked to 90 Million Transactions

My cmt: So what? That’s about $1,000 per card in a year. My Federal agency used them for motor pool parts, heavy equipment parts, fuel, etc. Every Government employee used them when on travel, all for official purposes. It saved money by eliminating paperwork. Supervisors of employees with credit cards routinely checked to insure they were used only for official purposes. During my 35-year career I was appointed investigating officer on only one credit card case. The individual had purchased candy for the office (not an official use of the card) and a coffee maker and toaster for personal use, all violations of policy. The supervisor had flagged the illegal use, but not in the month that it took place so I was tasked to investigate. The employee was suspended without pay for a while, but was fired within a year for another transgression.

“Philadelphia-area manufacturing activity continued to expand in the month of February, according to a report released by the Federal Reserve Bank of Philadelphia on Thursday, although the index of activity in the sector pulled back sharply.” Story at...

https://www.rttnews.com/3514757/philly-fed-index-pulls-back-sharply-but-still-indicates-growth-in-february.aspx

“The Trump administration’s sweeping layoffs of federal employees already appear to be pushing up joblessness in Washington, D.C., and an economist projects they'll tip the city into a recession this year... Last week, a seasonally adjusted 219,000 Americans across the U.S. filed initial claims, up from 214,000 the week before and underscoring that, overall, layoffs remain low.” Story at...

https://www.usatoday.com/story/money/2025/02/20/trump-federal-layoffs-impact-on-washington-dc/79135624007/

“The US LEI declined in January, reversing most of the gains from the previous two months,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “Consumers’ assessments of future business conditions turned more pessimistic in January, which—alongside fewer weekly hours worked in manufacturing—drove the monthly decline... the LEI’s six-month and annual growth rates continued to trend upward, signaling milder obstacles to US economic activity ahead. We currently forecast that real GDP for the US will expand by 2.3% in 2025...” Report at...

https://www.conference-board.org/topics/us-leading-indicators

-Thursday the S&P 500 declined about 0.4% to 6118.

-VIX declined about 3% to 15.66.

-The yield on the 10-year Treasury declined (compared to about this time, prior trading day) to 4.507%.

XLK – Holding since the October 2022 lows. Added more 9/20/2024.

QLD – added 12/20/2024. (IRA acct.)

NVDA – added 1/6/2025.

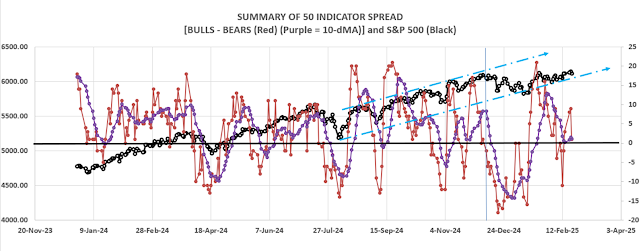

Today, of the 50-Indicators I track, 10 gave Bear-signs and 11 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

The daily, bull-bear spread of 50-indicators reversed back to a Neutral +1 (1 more Bull indicator than Bear indicators). The 10-dMA of the spread reversed down, a bearish sign.

I am cautiously bullish – 60% in stocks.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals declined to HOLD. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.