“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

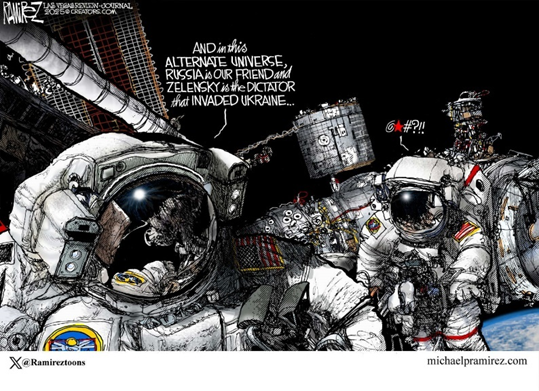

“The United States joined Russia to vote against a UN General Assembly resolution condemning Russia’s war against Ukraine Monday in a stunning shift from years of US policy. The vote against the Ukrainian and European-backed resolution saw the US at odds with its longtime European allies and instead aligned with the aggressor in the war on the three-year anniversary of Moscow’s full-scale invasion of Ukraine.” Story at...

https://www.cnn.com/2025/02/24/politics/us-joins-russia-ukraine-un-vote/index.html

My cmt: WHY????? Answer below:

TRUMP ASKED ZELENSKY TO INVESTIGATE BIDEN (NBC News - 2019)

“President Donald Trump, in a midsummer phone call with Ukrainian President Volodymyr Zelenskiy, asked him to look into why that country's top prosecutor apparently had ended an investigation of the business dealings of Joe Biden’s son, who served on the board of a Ukrainian gas company.

"(Then-Vice President Joe) Biden went around bragging that he stopped the prosecution, so if you can look into it. ... It sounds horrible to me," Trump told Zelenskiy during the 30-minute July 25 phone call.” Story at...

https://www.nbcnews.com/politics/trump-impeachment-inquiry/trump-asked-ukraine-leader-phone-call-look-why-investigation-biden-n1058551

My cmt: Is the Ukraine double-cross just Trump’s revenge?

“Texas factory activity fell in February after rising notably in January, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell 21 points to -9.1. Other measures of manufacturing activity also declined this month. The new orders index fell 11 points to -3.5, and the capacity utilization index slid 14 points to -8.7. The shipments index remained positive but edged down to 5.6.” Dallas Fed report at...

https://www.dallasfed.org/research/surveys/tmos/2025/2502

-Monday the S&P 500 declined about 0.5% to 5983.

-VIX rose about 6% to 19.24.

-The yield on the 10-year Treasury declined (compared to about this time, prior trading day) to 4.40%.

XLK – Holding since the October 2022 lows. Cut position in half – Monday, 2/24.

QLD – added 12/20/2024. (IRA acct.)

NVDA – added 1/6/2025.

Today, of the 50-Indicators I track, 15 gave Bear-signs and only 2 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

There was an ugly chart today. Late day action was poor to say the least.

https://www.youtube.com/watch?v=AuoFJ4jvqP8

I am cautiously bearish, but still fully invested - 50% in stocks. If indicators continue down, I’ll make further reductions in stock holdings.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals remained SELL. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.