“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

HOUSING STARTS / BUILDING PERMITS (YahooFinance/Reuters))

“U.S. homebuilding unexpectedly fell in September and

permits dropped to a one-year low amid acute shortages of raw materials and

labor, strengthening expectations that economic growth slowed sharply in the

third quarter.” Story at...

https://finance.yahoo.com/news/u-housing-starts-permits-tumble-123711801.html

THE DISMAL TRUTH ABOUT THE CRUSADE AGAINST CLIMATE CHANGE

(ZeroHedge)

“Last week, Bank of America sparked a firestorm of

reaction amid both the pro and contra climate change camps...The bottom

line: no less than

a stunning $150 trillion in new capital investment would be required to reach a

"net zero" world over 30 years - equating to some $5 trillion in

annual investments - and amounting to twice current global GDP. Needless to

say, the private sector has nowhere near the capital required to complete this

investment which is why...the bill would have to be footed by central banks in

the form of tens of trillions in QE.” Story at...

My cmt: Spending such large sums by QE would lead to

massive inflation. In the climate change book, “Unsettled”, Steven Koonin, PhD,

concluded that a combination of strategies would be required: making smaller

reductions to CO2 outputs; adapting to the changed conditions; and, if

necessary, changing the reflectivity of the Earth. That last one seems like a

crazy idea, but it is technically the easiest. Putting additives in fuels would

reflect more sunlight and cool the planet. The problem is that some areas might

benefit, while others would be harmed. How would equity be achieved?

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website as

of 4:30 PM Tuesday. U.S. total case numbers are on the left axis; daily numbers

are on the right side of the graph in Red with the 10-dMA of daily numbers in

Green. I added the smoothed 10-dMA of new cases (in purple) to the chart.

Almost 15% of the entire US population has had Covid.

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 rose about 0.7% to 4520.

-VIX dropped about 4% to 15.68.

-The yield on the 10-year Treasury rose to 1.663%.

I noted yesterday that I didn’t see any bear indicators

and that wouldn’t last long. Well, it didn’t.

Bollinger Bands are “overbought,” but without confirmation from RSI I usually don’t

pay attention to this indicator. It is

not surprising considering the level of bullishness the markets are

showing.

Today was the fifth day in a row that the S&P 500

finished in positive territory. That’s

unusual and a lot of bears got burned today betting on a down-day in the Rydex

funds I track for sentiment. On longer terms, the numbers are not particularly

bearish – 12-days have been up over the last 20-days; and 6-days have been up

over the last 10-days. Still, I would expect a down-day tomorrow.

The daily sum of 20 Indicators slipped from +10 to +6 (a

positive number is bullish; negatives are bearish); the 10-day smoothed sum

that smooths the daily fluctuations improved from +19 to +23 (These numbers

sometimes change after I post the blog based on data that comes in late.) Most

of these indicators are short-term and many are trend following.

The Long Term NTSM indicator

ensemble slipped to HOLD (but it was almost a buy). Volume is bullish; Price, VIX

and & Sentiment indicators are neutral.

I remain bullish.

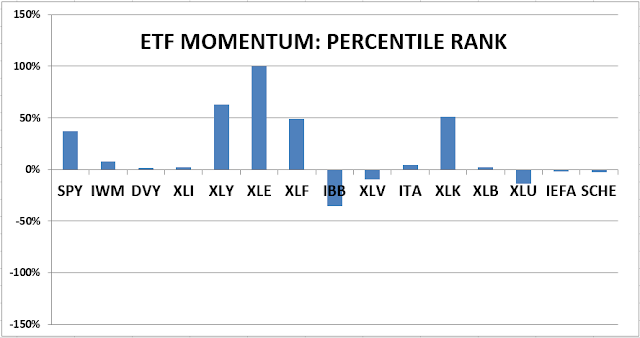

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

Market Internals remained BULLISH on the market.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation in the portfolio is now about 65% invested in stocks; this is above my “normal” fully invested stock-allocation of 50% stocks. Indicators are very bullish, so I am taking a short-term position in additional stocks to boost returns.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.