“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

RETAIL SALES (CNBC)

“Consumers spent at a much faster pace than expected in

September, defying expectations for a pullback amid pervasive supply chain

problems, the Census Bureau reported Friday. Retail sales for the month

increased by 0.7%...” Story at...

EMPIRE STATE MANUFACTURING (Advisor Perspectives)

“Business activity grew at a solid pace in New York

State, according to firms responding to the October 2021 Empire State

Manufacturing Survey. The headline general business conditions index fell

fifteen points to 19.8, pointing to a slower pace of growth than last month.”

Story at...

Any number above

zero indicates expansion.

UNIV OF MICHIGAN SENTIMENT (Univ of Michigan)

“Consumer sentiment has remained for the past three

months at the lows first recorded in response to last year's shutdown of the

economy. The Delta variant, supply chain shortages, and reduced labor force

participation rates will continue to dim the pace of consumer spending into

2022. There is another, less tangible factor that has contributed to the slump

in optimism: confidence in government economic policies has significantly

declined during the past six months.” Story at...

CORONAVIRUS (NTSM)

Here’s the latest from the COVID19 Johns Hopkins website

as of 5:00 PM Friday. U.S. total case numbers are on the left axis; daily

numbers are on the right side of the graph in Red with the 10-dMA of daily

numbers in Green. I added the smoothed 10-dMA of new cases (in purple) to the

chart.

MARKET REPORT / ANALYSIS

-Friday the S&P 500 rose about 0.8% to 4471.

-VIX dropped about 3% to 16.30.

-The yield on the 10-year Treasury rose to 1.575%.

The Friday run-down of some important indicators is more

strongly to the bull side (2-bear and 16-bull). These indicators tend to be

both long-term and short-term, so they are different than the 20 that I report

on daily. Details follow:

BULL SIGNS

-Cyclical Industrials (XLI-ETF) are under-performing the

S&P 500, but the curve is sharply higher so this goes in the bull category.

-The 10-dMA % of issues advancing on the NYSE

(Breadth) is above 50%.

-The 50-dMA % of issues advancing on the NYSE (Breadth)

is above 50%.

-The 100-dMA % of issues advancing on the NYSE

(Breadth) is above 50%.

-MACD of the percentage of issues advancing on the NYSE

(breadth) made a bullish crossover 23 September.

-MACD of S&P 500 price made a bullish crossover, 8

October.

-McClellan Oscillator.

-My Money Trend indicator.

-The Smart Money (late-day action) indicates the Pros are

bullish. (This indicator is based on the Smart Money Indicator developed by Don

Hayes).

-Short-term new-high/new-low data is trending higher.

-Long-term new-high/new-lows are rising.

-VIX is falling sharply.

-The smoothed advancing volume on the NYSE is rising.

-Slope of the 40-dMA of New-highs is up. This is one of

my favorite trend indicators.

-59% of the 15-ETFs that I track have been up over the

last 10-days.

-The S&P 500 is out-performing the Utilities ETF (XLU).

NEUTRAL

-There was a Hindenburg Omen signal 28 September. The McClellan Oscillator turned positive

afterward, so the Omen has been cancelled.

-There have been 2 Statistically-Significant days in the

last 15-days – too low to send a signal. This can be a bull or bear.

-Bollinger Bands

-RSI.

-Breadth on the NYSE compared to the S&P 500 index is

neutral.

-The size of up-moves has been smaller than the size of

down-moves over the last month, but not quite enough to give a signal.

-The S&P 500 is 7.2% above its 200-dMA (Bear

indicator is 12%.). This value was 15.9% above the 200-dMA when the 10%

correction occurred in Sep 2020.

-Calm-before-the-Storm Indicator – expired.

-The Fosback High-Low Logic Index is neutral.

-There have been 10 up-days over the last 20 days.

Neutral

-There have been 5 up-days over the last 10-days. Neutral

-7.7% of all issues traded on the NYSE made new, 52-week

highs when the S&P 500 made a new all-time-high 2 September. (There is no

bullish signal for this indicator.) This is above the average for all-time

highs and suggests that if we do have a pullback, it is likely to be less than

10%.

-Statistically, the S&P 500 gave a panic-signal 17

Sept. Signal has expired.

-Non-crash Sentiment indicator remains neutral, but it is

very bullish and that means the signal is leaning bearish.

-14 October, the 52-week, New-high/new-low ratio improved

by 1.25 standard deviations, somewhat bullish, but neutral.

-The 5-10-20 Timer System is HOLD; the 5-dEMA and 10-dEMA

are not both below the 20-dEMA.

BEAR SIGNS

-Distribution Days.

There have been 7 in the last 25-days. The Index almost had a Follow-Through-Day

14 Oct, but volume was not quite high enough.

-Overbought/Oversold Index (Advance/Decline Ratio) is overbought.

On Friday, 21 February, 2 days after the top of the

Coronavirus pullback, there were 10 bear-signs and 1 bull-sign. Now there

are 2 bear-signs and 16 bull-signs. Last week, there were 6 bear-signs and 9

bull-signs.

This week’s reading has jumped very strongly to the bull side.

The daily sum of 20 Indicators slipped from +9 to +8 (a

positive number is bullish; negatives are bearish); the 10-day smoothed sum

that smooths the daily fluctuations improved from -7 to +9 (These numbers

sometimes change after I post the blog based on data that comes in late.) Most

of these indicators are short-term and many are trend following.

The Long Term NTSM indicator

ensemble slipped to HOLD but it is a whisker away from a BUY signal. VIX is bullish;

Volume, Price & Sentiment indicators are neutral.

I am bullish. It’s

hard not be be with the Friday rundown of indicators looking so bullish.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

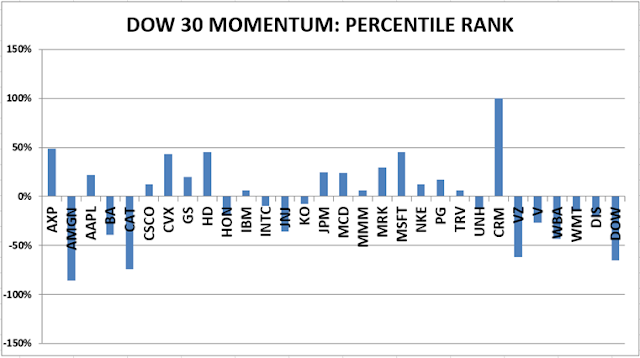

TODAY’S RANKING OF THE DOW 30

STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

Market Internals remained BULLISH on the market.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation in the

portfolio is now about 50% invested in stocks; this is my “normal” fully

invested stock-allocation.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a conservative

position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.