“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Faced with a combination of record speculative extremes

and deteriorating speculative conditions, investors may want to remember that

the best time to panic is before everyone else does.” – John Hussman, Phd.

PUTIN RECOGNIZES UKRAINE SEPARATISTS: ORDERS TROOPS TO

INVADE (CNBC)

“Russian President Vladimir Putin ordered troops into two

breakaway regions of eastern Ukraine after announcing Monday evening that he

would recognize their independence.” Story at...

https://www.cnbc.com/2022/02/21/putin-recognize-rebel-eastern-ukrainian-regions-as-independent.html

IHS MARKIT COMPOSITE PMI (Markit Economics)

“Growth of private sector output in the US gained

considerable momentum in February as companies reported a notable recovery in

demand from COVID-related disruptions at the start of the year. Services firms

led the rise, although manufacturers likewise registered a stronger increase in

output, buoyed by a slight easing of supply bottlenecks. However, February also

saw a survey record rise in average prices charged for goods and services.”

Report at...

https://www.markiteconomics.com/Public/Home/PressRelease/74fab5cff0d4400fb5776c46db6db6c0

CONSUMER CONFIDENCE (Conference Board)

“The Conference Board Consumer Confidence Index® fell

slightly in February, after a decrease in January...“Consumer confidence was

down slightly for a second consecutive month in February,” said Lynn Franco, Senior Director

of Economic Indicators at The Conference Board. “The Present

Situation Index improved a touch, suggesting the economy continued to expand in

Q1 but did not gain momentum. Expectations about short-term growth prospects

weakened further, pointing to a likely moderation in growth over the first half

of 2022.” Release at...

https://www.conference-board.org/topics/consumer-confidence

TRADERS MARKET CONTINUES - BEWARE JUNK (Heritage Capital)

“...Below is a crude outline of the most likely scenario

into mid-March where I think this whole decline wraps up.

...Finally, I have mentioned high yield bonds [junk] a

number of times and their unusual plunge...If you can only watch one single

thing now, this is the one to watch.” Paul Schatz, President heritage Capital.

Commentary at...

https://investfortomorrow.com/blog/traders-market-continues-beware-junk/

The bottom on this guess would be around 4166. That would

match the June 2021 low.

VALUATION

Chart from...https://www.youtube.com/watch?v=compEuvDmJc

Valuation is better, but that doesn’t mean that it isn’t

still at extreme levels.

UTILITIES ARE OUTPERFORMING THE S&P 500 (NTSM)

The red line on the chart is the spread between Utilities

and the S&P 500. Below zero means Utilities are outperforming the S&P

500; a falling line means the trend is getting worse. This is a bearish indication.

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 fell about 1% to 4305, dropping

below the prior correction low.

-VIX rose about 4% to 28.81.

-The yield on the 10-year Treasury rose to 1.944%.

Given that most corrections retest their prior lows, I’ll

keep the pullback stats.

Pullback Data:

Days since top: 34 (Avg= 30 days top to bottom for

corrections <10%; 60 days top to bottom for larger, non-crash pullbacks)

Drop from Top: Now 10.3%; Max closing: 9.8%; Max

intraday: 12% (Avg.= 13% for non-crash pullbacks)

The S&P 500 is 3.4% BELOW its 200-dMA & 6.0% BELOW

its 50-dMA.

Max Retracement from bottom: 56% 2 Feb.

The slope of the 200-dMA is up, but just barely.

Volume has been picking up over the last 4 or 5 days. I have

been wondering whether we’d see another huge-volume, down-day. Look for it; it

might signal a bottom, or be close to the bottom.

The daily sum of 20 Indicators dropped from -4 to -7 (a

positive number is bullish; negatives are bearish); the 10-day smoothed sum

that smooths the daily fluctuations dropped from -19 to -28 (The trend

direction is more important than the actual number for the 10-day value.) These

numbers sometimes change after I post the blog based on data that comes in

late. Most of these indicators are short-term so they tend to bounce around a

lot.

The Long Term NTSM indicator

ensemble remained to SELL. Volume & VIX are bearish; Price & Sentiment

are Neutral.

Tuesday, we got the lower low on the S&P 500, but the

numbers weren’t encouraging. Volume was higher and internals were weak too. No

bottom yet. As I noted above, it may take a high volume down day to put an end

the correction. The market needs to

scare out the remaining investors before it can move on.

I did notice one bullish sign: at Today’s test of the 27

Jan low, 27% of the ETFs I track in the momentum analysis were above their

120-dMAs. At the 27 Jan low, 13% of those ETFs were above their 120-dMAs. So,

there is some improvement in the markets even though the S&P 500 has traded

back to its prior low. Overall though, there is not much to cheer in today’s

data.

The Russian Commies have invaded Ukraine; the cold-war détente

is over. The market may take a while to digest that news, but I'll keep

watching the indicators and bottom signs. Hopefully, I’ll be able to call a

bottom when it arrives. The S&P 500 has dropped to its 4 Oct 2021 low

around 4300. There are a number of small support levels below this level and

major support in the 4100 area, about 5% lower than today’s close. It’s

possible the markets may not fall much further...

...but until we see some more bullish signs, I am

bearish.

TRADING POSITIONS:

XLE; Purchased Wednesday, 26 January. I may sell the

position soon since I don’t want to take a loss. Energy had been holding up pretty

well, but not over the last week or so.

MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

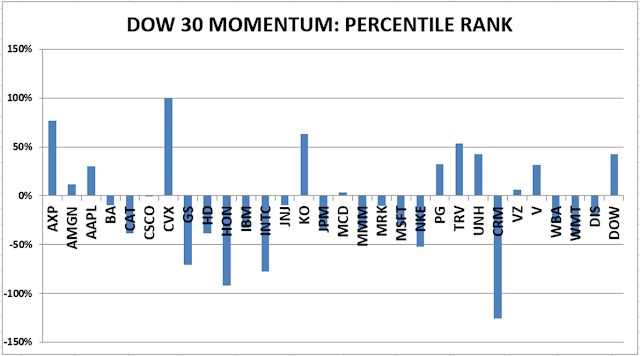

TODAY’S RANKING OF THE DOW 30 STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

Home Depot dropped 9% today.

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals declined to SELL.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from the

Index.

My stock-allocation in the portfolio is about 40% invested in stocks. This is below my “normal” fully invested stock-allocation of 50%.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a conservative

position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.