“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Faced with a combination of record speculative extremes

and deteriorating speculative conditions, investors may want to remember that

the best time to panic is before everyone else does.” – John Hussman, Phd.

GDP (Advisor Perspectives)

“The Second Estimate for Q4 GDP, to one decimal, came in

at 7.0%.” Commentary at...

JOBLESS CLAIMS (Yahoo Finance)

“New weekly jobless claims dipped last week, returning to

a downward trend following a brief spike higher... Initial jobless claims, week ended Feb. 24: 232,000

vs. 235,000 expected...” Story at...

NEW HOME SALES (Reuters)

“Sales of new U.S. single-family homes fell slightly more

than expected in January, likely as rising mortgage rates and higher prices

sidelined some first-time buyers from the market. New home sales fell 4.5%...”

Story at...

https://www.reuters.com/business/us-new-home-sales-fall-january-prices-march-higher-2022-02-24/

EIA CRUDE OIL INVENTORIES (EIA)

“U.S. commercial crude oil inventories (excluding those

in the Strategic Petroleum Reserve) increased by 4.5 million barrels from the

previous week. At 416.0 million barrels, U.S. crude oil inventories are about

9% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 jumped up about 1.5% to 4289. (It

was down 2.5% in the pre-market/morning.)

-VIX dipped about 3% to 29.98.

-The yield on the 10-year Treasury rose to 1.971%.

Pullback Data:

Days since top: 36 (Avg= 30 days top to bottom for

corrections <10%; 60 days top to bottom for larger, non-crash pullbacks)

Drop from Top: Now 10.6% at closing. (Avg.= 13% for

non-crash pullbacks)

The S&P 500 is 3.8% BELOW its 200-dMA & 6% BELOW

its 50-dMA.

Max Retracement from bottom: 56% 2 Feb.

The slope of the 200-dMA is up, but just barely.

Time for a bounce. As we noted yesterday, “the market is overstretched

to the downside and Bollinger Bands and RSI are both oversold – a bullish sign

suggesting at least a bounce.” Markets don’t go down forever, so this looks like

a bounce. I certainly haven’t seen anything that would suggest that the markets

have bottomed. No capitulation yet.

While markets jumped higher today, only 11 of the 30 Dow

stocks were up. That’s hardly a broad based rally needed to break the back of

the correction.

The daily sum of 20 Indicators improved from -5 to -4 (a

positive number is bullish; negatives are bearish); the 10-day smoothed sum

that smooths the daily fluctuations dropped from -37 to -47 (The trend

direction is more important than the actual number for the 10-day value.) These

numbers sometimes change after I post the blog based on data that comes in

late. Most of these indicators are short-term so they tend to bounce around a

lot.

The Long Term NTSM indicator

ensemble remained to SELL. Volume & VIX are bearish; Price & Sentiment

are Neutral.

Until we see some more bullish signs, I remain bearish.

TRADING POSITIONS:

XLE; Purchased Wednesday, 26 January. I sold XLE today.

It has not performed well since it peaked 2 weeks ago. It under performed the

markets today and I didn’t want to lose on the trade.

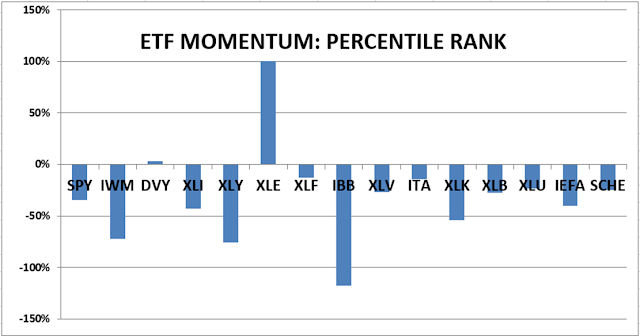

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs

(Ranked Daily)

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

BEST DOW STOCKS - TODAY’S MOMENTUM

RANKING OF THE DOW 30 STOCKS (Ranked Daily)

Here’s the revised DOW 30 and

its momentum analysis. The top ranked stock receives 100%. The rest are then

ranked based on their momentum relative to the leading stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS

(NYSE DATA)

My basket of Market Internals remained SELL.

Market Internals are a decent

trend-following analysis of current market action, but should not be used alone

for short term trading. They are usually right, but they are often late. They are most useful when they diverge from

the Index.

My stock-allocation in the

portfolio is now about 35% invested in stocks. This is below my “normal” fully invested

stock-allocation of 50%.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

You may wish to have a higher

or lower % invested in stocks depending on your risk tolerance. 50% is a

conservative position that I consider fully invested for most retirees.

As a general rule, some

suggest that the % of portfolio invested in the stock market should be one’s

age subtracted from 100. So, a

30-year-old person would have 70% of the portfolio in stocks, stock mutual

funds and/or stock ETFs. That’s ok, but

for older investors, I usually don’t recommend keeping less than 50% invested

in stocks (as a fully invested position) since most people need some growth in

the portfolio to keep up with inflation.