In an effort to turn Virginia into California, liberal politicians who previously ran our government sold Virginia out by subjecting Virginia drivers to California vehicle laws. Now, under that pact, Virginians will be forced to adopt the California law that prohibits the sale of gas and diesel-fueled vehicles. I am already at work to prevent this ridiculous edict from being forced on Virginians. California’s out of touch laws have no place in our Commonwealth.” - Governor Glenn Youngkin.

“Today, the S&P 500 Index sports a price-to-earnings ratio of 21 on trailing 12-months’ operating earnings and 18 on analyst estimates of operating earnings over the next 12 months. Relative to the past five years, these levels are about average, leading many investors to the conclusion that stocks, after their decline so far this year, are now fairly valued... if profit margins fall, it will quickly become apparent that earnings were over-inflated and thus price-to-earnings ratios were misleadingly low. As my friend, John Hussman, points out (and small businesses have been suggesting for months now) there is a compelling case to be made that this is precisely the case.” Commentary at...

https://thefelderreport.com/2022/08/17/the-dangerous-assumption-embedded-in-todays-p-e-ratios/

-Monday the S&P 500 fell about 0.7%% to 4031.

-VIX rose about 3% to 26.21.

-The yield on the 10-year Treasury was little changed at 3.090%.

-Drop from Top: 16% as of today. 23.6% max.

-Trading Days since Top: 164-days.

The S&P 500 is 6.4% Below its 200-dMA & closed 0.7% Above its 50-dMA.

-A support point for the rally is 3996, the 50-dMA.

SH, short the S&P 500 ETF.

SDS, 2x short S&P 500 ETF.

I have built these positions to significantly large values, although I am still not net short.

After the big down day Friday (-3.3%), it would not have been a surprise to seen some buying today. That was not to be as the S&P 500 was down. Indicators remain bearish. We might see an up-day Tuesday (futures are up as I write this), but overall, I am expecting the Index to fall and retest the June lows. At that point we may have a better idea of whether there will be an end of the correction.

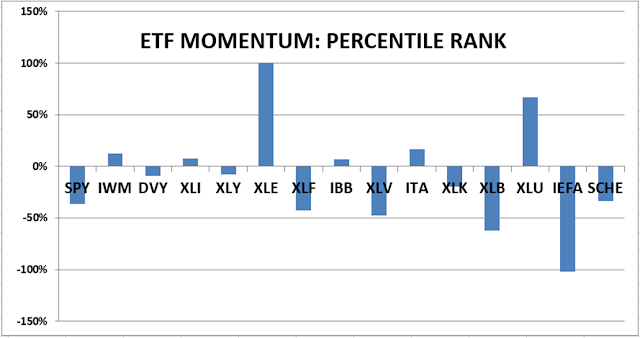

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

BEST DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

Here’s the revised DOW 30 and its momentum analysis. The top ranked stock receives 100%. The rest are then ranked based on their momentum relative to the leading stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals remained SELL.