“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“Orders for durable goods increased in March after a surge in orders for aircraft, the Commerce Department said today. Durable goods orders rose 3.2% to $276.4 billion, the department said in a monthly report. That snapped a streak of two monthly declines, including a fall of 1.2% in February. Excluding transportation, orders advanced 0.3%.

“U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 5.1 million barrels from the previous week. At 460.9 million barrels, U.S. crude oil inventories are about 1% below the five-year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

-Wednesday the S&P 500 fell about 0.4% to 4056.

-VIX rose about 0.4% to 18.84. (Options traders don’t seem worried.)

-The yield on the 10-year Treasury rose to 3.450%.

-Drop from Top: 15.4% as of today. 25.4% max (on a closing basis).

-Trading Days since Top: 328-days.

The S&P 500 is 2.4% ABOVE its 200-dMA and 0.6% ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area.

I am not trading as much as in the past. You may wish to use the momentum charts and/or the Monday 40-day gain charts for trading the Dow stocks and ETFs.

XLK – Technology ETF.

XLE – Energy Sector ETF. It hasn’t been doing much recently, but Russia is cutting production and that should help the sector. We have a good dividend in the meantime.

KRE – Regional Banking ETF. This is a small position for me.

SHY – Short term bonds. 30-day yield is 4%. (Trailing 1-year yield is 1.6%.) I’ll hold this, but if the market retests the lows, I’ll sell it and buy stocks.)

Repeating from yesterday: Today, there is still a Bollinger Squeeze. Investopedia says, “When Bollinger Bands® are far apart, volatility is high. When they are close together, it is low. A Squeeze is triggered when volatility reaches a six-month low and is identified when Bollinger Bands® reach a six-month minimum distance apart.”

https://www.investopedia.com/terms/r/rsi.asp

A squeeze precedes a big breakout either up or down. Bollinger said to use RSI and a couple of other indicators I don’t follow to determine the direction of the breakout. RSI is 43 and is closer to oversold than overbought. Bollinger Bands are also close to “oversold” so it looks like the break out should be up.

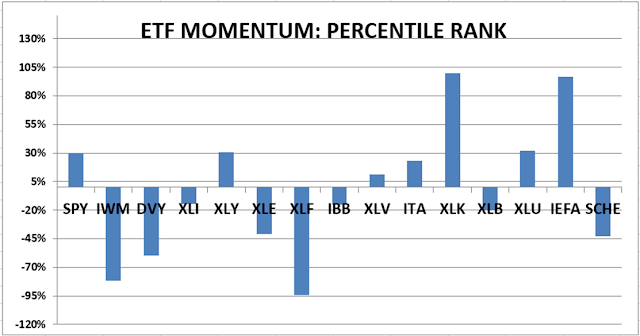

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW 30 momentum ranking follows:

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained SELL. (Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)