“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

https://notrickszone.com/2023/03/28/body-blow-to-activists-whopping-82-of-berlins-voters-refused-to-support-2030-climate-neutrality/

"The March Manufacturing PMI® registered 46.3 percent, 1.4 percentage points lower than the 47.7 percent recorded in February. Regarding the overall economy, this figure indicates a fourth month of contraction after a 30-month period of expansion. The Manufacturing PMI® is at its lowest level since May 2020, when it registered 43.5 percent.” Press release at...

https://www.prnewswire.com/news-releases/manufacturing-pmi-at-46-3-march-2023-manufacturing-ism-report-on-business-301787309.html

“U.S. construction spending dipped in February as investment in single-family homebuilding maintained its downward trend amid higher mortgage costs. The Commerce Department said on Monday that construction spending slipped 0.1% in February after increasing 0.4% in January.” Story at...

https://finance.yahoo.com/news/us-construction-spending-slips-february-143000626.html

-Monday the S&P 500 rose about 0.4% to 4124.

-VIX slipped about 0.8% to 18.55.

-The yield on the 10-year Treasury slipped to 3.421%.

-Drop from Top: 14% as of today. 25.4% max (on a closing basis).

-Trading Days since Top: 313-days.

The S&P 500 is 4.8% ABOVE its 200-dMA and 2.5% ABOVE its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area.

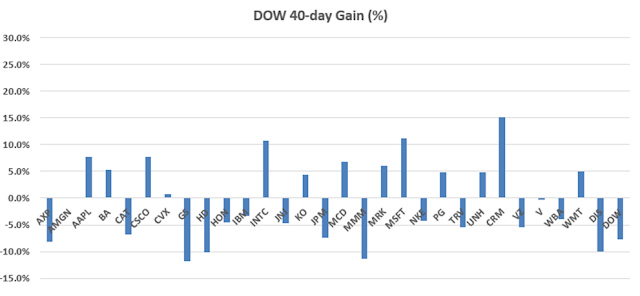

I am not trading as much as in the past. You may wish to use the momentum charts and/or the Monday 40-day gain charts for trading the Dow stocks and ETFs.

QLD – 2xNasdaq 100

SSO – 2x S&P 500

XLK – Technology ETF.

XLE – Energy Sector ETF. It hasn’t been doing much recently, but Russia is cutting production and that should help the sector. We have a good dividend in the meantime.

BA – (Boeing) I am late on this one, but we’ll see. They have more work than they can handle and are hiring. They should do well going forward. Boeing reports earnings 4/26/2023.

XLY - Consumer Discretionary ETF.

KRE – Regional Banking ETF. This is a small position for me. I have no cash left.

Bollinger Bands are overbought again today and there have been 8 up-days in the last 10-days. That suggests some weakness, but I don’t see any other top indicators so I doubt that we’re looking at a real pullback. Markets don’t go up in a straight line so a down-day or two is overdue.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals slipped to HOLD. (Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)