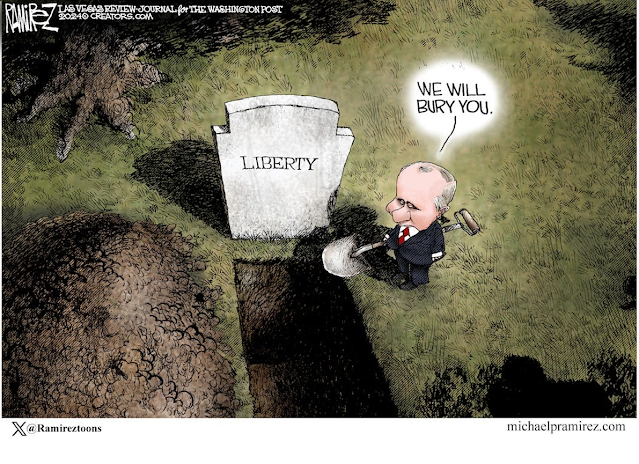

“Buried” — Michael Ramirez, political commentary at...

https://michaelramirez.substack.com/p/michael-ramirez-guest-essay-putin?r=ntzh3&utm_campaign=post&utm_medium=web&triedRedirect=true

My cmt: I remember that Kruschev took off his shoe and pounded it on a table as he screamed “We will bury you” at the United Nations. There were other occasions when he made this statement, but the UN incident made Life magazine. There are apologists who now claim the statement was not translated properly. Perhaps, but I assure you he was not saying “We love the west.” Putin is simply following the old Russian narrative. My opinion: It is impossible that the US will not continue to support Ukraine...unless Trump is elected. Trump’s comments show his lack of understanding of international affairs.

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

“The problem isn't that Johnny can't read. The problem

isn't even that Johnny can't think. The problem is that Johnny doesn't know

what thinking is; he confuses it with feeling.” ―

SUPREME COURT HAD TO HEAR THE TRUMP CASE (WSJ)

“Many observers thought the Supreme Court would decline to consider Donald Trump’s claim that presidential immunity shields him from prosecution for his conduct on Jan. 6, 2021... but the justices had little choice but to take up this question because the lower court’s ruling was so sweeping and dangerous. Mr. Trump claims that his allegedly criminal actions were “official acts” taken as president. The U.S. Circuit Court of Appeals for the District of Columbia held that it didn’t matter if they were—that no president is entitled to immunity from “generally applicable criminal laws.” That decision violates the separation of powers, threatens the independence and vigor of the presidency, and is inconsistent with Supreme Court precedent.” – David B. Rivkin Justice Department and White House Counsel official during the Reagan and George H.W. Bush Administrations. Elizabeth Price Foley, professor of constitutional law at Florida International University. Commentary at...

https://www.wsj.com/articles/why-the-justices-had-to-hear-trumps-case-presidential-immunity-125803c6

FBI ARRESTS “JOURNALIST” (Newsweek via MSN)

“Supporters of Donald Trump's Make America Great Again (MAGA) movement voiced their outrage on social media on Friday after investigative reporter Steve Baker was arrested by the Federal Bureau of Investigation...

...Baker is facing charges of Knowingly Entering or Remaining in any Restricted Building or Grounds Without Lawful Authority, Disorderly and Disruptive Conduct in a Restricted Building or Ground, Disorderly Conduct in a Capitol Building, and Parading, Demonstrating, or Picketing in a Capitol Building.” Story at...

FBI Arresting Reporter Sparks MAGA Outrage (msn.com)

My cmt: “Disorderly Conduct... Parading, Demonstrating, or Picketing” – Doesn’t sound like journalistic activity to me.

ISM MANUFACTURING (ISM)

“The Manufacturing PMI® registered 47.8 percent in February, down 1.3 percentage points from the 49.1 percent recorded in January. The overall economy continued in expansion for the 46th month after one month of contraction in April 2020... the share of sector GDP registering a composite PMI® calculation at or below 45 percent — a good barometer of overall manufacturing weakness — was 1 percent in February, compared to 27 percent in January and 48 percent in December. Among the top six industries by contribution to manufacturing GDP in February, none had a PMI® at or below 45 percent, compared to two in the previous month...” Press release at...

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/february/

CONSTRUCTION SPENDING (MorningStar News)

“Construction spending fell in January as U.S. companies and the government scaled back on projects across the nation amid high interest rates. Spending on construction projects fell 0.2% in January to $2.1 trillion, the Commerce Department reported Friday.

https://www.morningstar.com/news/marketwatch/20240301269/construction-spending-falls-for-the-first-time-since-december-2022

My cmt: This is surprising, considering the trillion-dollar infrastructure spending that should be getting underway. Spending on construction had not declined since 2020.

MARKET REPORT / ANALYSIS

-Friday the S&P 500 rose about 0.8% to 5137.

-VIX dipped about 2% to 13.09.

-The yield on the 10-year Treasury slipped to 4.186%.

MY TRADING POSITIONS:

QLD- Added 2/20/2024

UWM – Added 1/22/2024.

XLK – Technology ETF (holding since the October 2022 lows).

INTC – Added 12/6/2023.

CRM – Added 1/22/2024

Salesforce reported and beat on earnings and revenue. CRM was up 3% on Thursday.

BA – Added 12/6/2023. I plan to hold Boeing for the time

being, although my patience is running out! Technically, there is a lot of

support around the 200 level. If Boeing

drops below 200 it will be time to bail out.

DWCPF - Dow Jones U.S. Completion Total Stock Market

Index. – Added 12/7/2023 when I sold the S&P 500. This is a large position

in my retirement account betting on Small Caps.

TODAY’S COMMENT:

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Now there are 6 bear-signs and 17-Bull. Last week, there were 7 bear-sign and 16 bull-signs.

The most significant BEAR signs have not changed much:

-The S&P 500 is 13.5% above its 200-dMA. Markets are getting stretched. (The Bear indicator is 12% above the 200-day.)

- All the ETFs I track were above their respective 200-dMA, today, 3/1/2024. That’s too bullish, so it’s a bearish indicator. This indicator will be extended for a week.

-Bollinger Bands are overbought. RSI is not, so I tend to ignore this one unless RSI joins the bear party.

On the BULL side:

-MACD of S&P 500 price has flip-flopped recently, but it made a bullish crossover 29 Feb.

-61% of the 15-ETFs that I track have been up over the last 10-days. (45-55% is neutral.)

NEUTRAL indicators include:

-9.6% of all issues traded on the NYSE made new, 52-week highs when the S&P 500 made a new all-time-high, 1 March 2024. (There is no bullish signal for this indicator, but this is a good, higher than average number that reinforces the notion that breadth is healthy with decent participation in the advance.)

-RSI remains in neutral territory.

My stock portfolio positioning has been overly bullish since the October low

in 2022. Markets are stretched enough to indicate that some risk management in

the portfolio may soon be necessary. There

are several triggers that would make me sell leveraged positions: (1) There is

a huge up-day that is statistically significant in my system; (2) the S&P

500 reaches its upper trend-line in the short-term chart from the October 2023

low; (3) Top indicators warn – i.e., both RSI and Bollinger Bands are

overbought; (4) Indicators deteriorate significantly.

LONG-TERM INDICATOR: The Long Term NTSM indicator

remained HOLD: PRICE was positive; VOLUME, SENTIMENT & VIX are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Friday Rundown” of

indicators.)

BOTTOM LINE

I remain cautiously bullish,, but my plan is to take profits in leveraged positions as noted above.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

The DOW added Amazon to the Dow 30. I’ll add it, but it’s a time consuming effort and may take awhile. Walmart split 3 for 1 today and that took some manipulation in the momentum ranking, too.

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals slipped to HOLD. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)

...My current invested

position is about 70% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’m “over invested” now expecting

continuation of bullish market action.

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio using an S&P 500 ETF as I did back in

October.

https://michaelramirez.substack.com/p/michael-ramirez-guest-essay-putin?r=ntzh3&utm_campaign=post&utm_medium=web&triedRedirect=true

My cmt: I remember that Kruschev took off his shoe and pounded it on a table as he screamed “We will bury you” at the United Nations. There were other occasions when he made this statement, but the UN incident made Life magazine. There are apologists who now claim the statement was not translated properly. Perhaps, but I assure you he was not saying “We love the west.” Putin is simply following the old Russian narrative. My opinion: It is impossible that the US will not continue to support Ukraine...unless Trump is elected. Trump’s comments show his lack of understanding of international affairs.

“Many observers thought the Supreme Court would decline to consider Donald Trump’s claim that presidential immunity shields him from prosecution for his conduct on Jan. 6, 2021... but the justices had little choice but to take up this question because the lower court’s ruling was so sweeping and dangerous. Mr. Trump claims that his allegedly criminal actions were “official acts” taken as president. The U.S. Circuit Court of Appeals for the District of Columbia held that it didn’t matter if they were—that no president is entitled to immunity from “generally applicable criminal laws.” That decision violates the separation of powers, threatens the independence and vigor of the presidency, and is inconsistent with Supreme Court precedent.” – David B. Rivkin Justice Department and White House Counsel official during the Reagan and George H.W. Bush Administrations. Elizabeth Price Foley, professor of constitutional law at Florida International University. Commentary at...

https://www.wsj.com/articles/why-the-justices-had-to-hear-trumps-case-presidential-immunity-125803c6

“Supporters of Donald Trump's Make America Great Again (MAGA) movement voiced their outrage on social media on Friday after investigative reporter Steve Baker was arrested by the Federal Bureau of Investigation...

...Baker is facing charges of Knowingly Entering or Remaining in any Restricted Building or Grounds Without Lawful Authority, Disorderly and Disruptive Conduct in a Restricted Building or Ground, Disorderly Conduct in a Capitol Building, and Parading, Demonstrating, or Picketing in a Capitol Building.” Story at...

FBI Arresting Reporter Sparks MAGA Outrage (msn.com)

My cmt: “Disorderly Conduct... Parading, Demonstrating, or Picketing” – Doesn’t sound like journalistic activity to me.

“The Manufacturing PMI® registered 47.8 percent in February, down 1.3 percentage points from the 49.1 percent recorded in January. The overall economy continued in expansion for the 46th month after one month of contraction in April 2020... the share of sector GDP registering a composite PMI® calculation at or below 45 percent — a good barometer of overall manufacturing weakness — was 1 percent in February, compared to 27 percent in January and 48 percent in December. Among the top six industries by contribution to manufacturing GDP in February, none had a PMI® at or below 45 percent, compared to two in the previous month...” Press release at...

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/february/

“Construction spending fell in January as U.S. companies and the government scaled back on projects across the nation amid high interest rates. Spending on construction projects fell 0.2% in January to $2.1 trillion, the Commerce Department reported Friday.

https://www.morningstar.com/news/marketwatch/20240301269/construction-spending-falls-for-the-first-time-since-december-2022

My cmt: This is surprising, considering the trillion-dollar infrastructure spending that should be getting underway. Spending on construction had not declined since 2020.

-Friday the S&P 500 rose about 0.8% to 5137.

-VIX dipped about 2% to 13.09.

-The yield on the 10-year Treasury slipped to 4.186%.

QLD- Added 2/20/2024

UWM – Added 1/22/2024.

XLK – Technology ETF (holding since the October 2022 lows).

INTC – Added 12/6/2023.

Salesforce reported and beat on earnings and revenue. CRM was up 3% on Thursday.

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Now there are 6 bear-signs and 17-Bull. Last week, there were 7 bear-sign and 16 bull-signs.

-The S&P 500 is 13.5% above its 200-dMA. Markets are getting stretched. (The Bear indicator is 12% above the 200-day.)

- All the ETFs I track were above their respective 200-dMA, today, 3/1/2024. That’s too bullish, so it’s a bearish indicator. This indicator will be extended for a week.

-Bollinger Bands are overbought. RSI is not, so I tend to ignore this one unless RSI joins the bear party.

-MACD of S&P 500 price has flip-flopped recently, but it made a bullish crossover 29 Feb.

-61% of the 15-ETFs that I track have been up over the last 10-days. (45-55% is neutral.)

-9.6% of all issues traded on the NYSE made new, 52-week highs when the S&P 500 made a new all-time-high, 1 March 2024. (There is no bullish signal for this indicator, but this is a good, higher than average number that reinforces the notion that breadth is healthy with decent participation in the advance.)

-RSI remains in neutral territory.

I remain cautiously bullish,, but my plan is to take profits in leveraged positions as noted above.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

The DOW added Amazon to the Dow 30. I’ll add it, but it’s a time consuming effort and may take awhile. Walmart split 3 for 1 today and that took some manipulation in the momentum ranking, too.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals slipped to HOLD. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)