“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

The above picture proves the Moon landings were fake? The people who believe that are the same folks who believe Trump won the 2020 election, the CIA killed JFK and the Twin Towers were brought down by the US Government. (FYI, the photo was taken during astronaut training at Kennedy Space Center – not the moon.) Oh yeah, here’s another one... Coronavirus was fake. My nurse-daughter heard that one from patients (“I can’t be dying; Covid is fake.”) at her hospital early in the pandemic.

“By refusing repeated chances to answer simple questions about a May 3 incident at Quantico Marine Corps base, the Biden administration has essentially confirmed one of America’s worst — and most politically consequential — nightmares related to the ongoing border crisis. Two illegal immigrants just attempted a terror attack on US soil.” Story at...

Are Biden officials covering up an attempted terror attack by illegal immigrants? (msn.com)

“Repealing Section 230 [it sunsets 31 December 2025] without a plan to replace it is a bipartisan idea—and a terribly reckless one.

The law in question is Section 230 of the 1996 Communications Decency Act. The statute provides that the person who creates content online is legally responsible for it and that websites aren’t liable for efforts to moderate their platforms to make them more welcoming, useful or interesting... Recent history suggests Congress won’t meet its self-imposed deadline. It’s best to judge this latest exercise in brinkmanship for what it is: A reckless ploy to repeal Section 230 without a plan to replace it.” Story at...

https://www.wsj.com/articles/buy-this-legislation-or-well-kill-the-internet-9184202b

My cmt: Blaming “Big Tech” is popular, but if platforms are responsible for the posts of nut-case, whakos the internet will be profoundly different and probably not for the better. Is the phone company liable if someone is harassed on the telephone?

“U.S. economic activity continued to expand from early April to mid-May, according to the Federal Reserve's Beige Book, although conditions varied across industries and districts... Several Districts reported that wage growth was at pre-pandemic historical averages or was normalizing toward those rates... The report also said prices increased at a modest pace over the reporting period and are expected to continue to grow at a modest pace in the near term.” Story at...

https://www.rttnews.com/3450960/fed-s-beige-book-says-u-s-economy-continued-to-expand-prices-rose-modestly.aspx

-Wednesday the S&P 500 declined about 0.8% to 5267.

-VIX rose about 11% to 14.28 so the Options players are worried.

-The yield on the 10-year Treasury rose to 4.736%.

UWM – Added 5/2/2024

QLD – Added 4/29/2024

SSO – Added 4/29/2024.

XLE – Added 4/24/2024

XLK – Technology ETF (holding since the October 2022 lows). I don’t want to pay taxes on this gain, so I am holding this position.

“The Dow Jones U.S. Completion Total Stock Market Index, also known as the DWCPF, is a widely used financial index that provides a comprehensive measure of the US equity market. The DWCPF includes all US stocks that are not included in the Dow Jones US Total Stock Market Index, which comprises large-cap and mid-cap companies. As a result, the DWCPF provides a complete picture of the US stock market, including small-cap and micro-cap companies, which are often overlooked by other indexes.” From...

https://fi.money/blog/posts/what-is-dow-jones-u-s-completion-total-stock-market-index-dwcpf

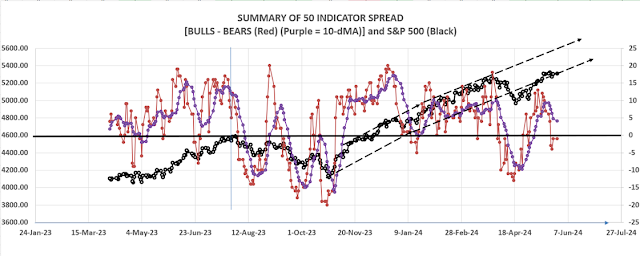

The Bull/Bear Spread (Bull Indicators minus Bear Indicators) continued its trend toward bearish. Today there were 14 Bear-signs and 9-Bull. (The rest are neutral. It is normal to have a lot of neutral indicators since many of those are top or bottom indicators that will signal only at extremes.) The 10-dMA of spread (purple line in the chart below) was down again today.

Indicators are now bearish, but not extremely so. The S&P 500 is 1.7% above it 50-dMA. That is normally the lower trend line so I am not making moves in the portfolio yet. So far, weakness is perfectly normal. I’ll need to look at the leveraged positions tomorrow; I don’t like to take losses in those trades.

“Salesforce (CRM) shares are sinking after Wednesday's market close as the cloud computing company reported mixed first-quarter earnings results. Salesforce posted $9.13 billion in revenue ($9.15 billion expected) and gains of $2.44 per share ($2.38 per share expected). The downward stock pressure is heavily attributed to Salesforce's miss on second-quarter forecasts.” From...

https://finance.yahoo.com/video/salesforce-stock-sinking-q2-earnings-202330512.html

(The Long-Term Indicator is not a good top-indicator. It can signal BUY at a top.)

I remain cautiously bullish.

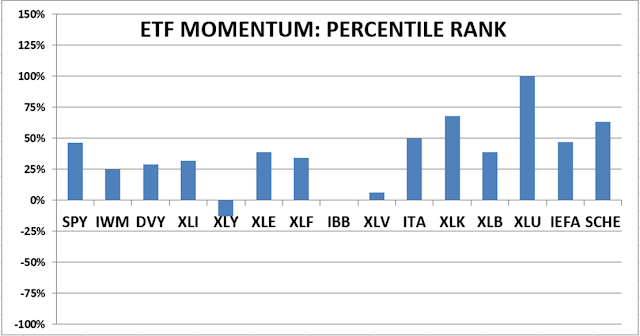

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained Bearish. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)