Payroll Report ... Factory Orders ... Durable Orders ... Momentum Trading DOW Stocks & ETFs … Stock Market Analysis ...

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

“Yet again, President Biden took precisely the wrong

position when he bashed Israel for taking out Hamas’ leader, Ismail Haniyeh. Asked

if asked if Haniyeh’s assassination ruined the chances for a cease-fire

agreement in Gaza, the prez said, “It doesn’t help.” Is he for real? Would any

normal American have said taking out Osama bin Laden after 9/11 was

inflammatory and jeopardized peace with al Qaeda?” – NY Post. Story at...

Biden’s

latest idiotic Israel bash is exactly why Iran wants Kamala Harris to beat

Trump (msn.com)

My cmt: Interesting comment by the NY Post. Biden did oppose taking out Osama bin Laden,

but Obama ignored his advce.

PAYROLL REPORT (CNN)

“The US economy added just 114,000 jobs in July, the Bureau of Labor

Statistics reported Friday. That’s significantly worse than predicted, and

underscores recent fears that the job market is slowing too quickly and could

trigger a recession.” Story at...

https://www.cnn.com/business/live-news/us-jobs-report-july-markets/index.html

FACTORY ORDERS (Nasdaq.com via RTT News)

“New orders for U.S. manufactured goods saw a steep drop

in the month of June, according to a report released by the Commerce Department

on Friday.

The report said factory orders plunged by 3.3 percent in

June after falling by 0.5 percent in May.” Story at...

https://www.nasdaq.com/articles/us-factory-orders-plunge-more-expected-june

DURABLE GOODS (Census.gov)

“The final Durable Orders report came in at down 6.6%: “New

orders for manufactured durable goods in June, down following four consecutive

monthly increases, decreased $18.6 billion or 6.6 percent to $264.5 billion,

the U.S. Census Bureau announced today.” Pres release at...

https://www.census.gov/manufacturing/m3/adv/current/index.html

MARKET REPORT / ANALYSIS

-Friday the S&P 500 fell about 1.8% to 5347.

-VIX rose about 26% to 23.39.

-The yield on the 10-year Treasury declined to 3.799%

(compared to this time, prior trading day). The good news of falling rates is

offset by the worry that rates are falling due to fears the economy is

slipping.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows.

XLK – added more 7/26. This reestablishes the position I

had before this recent weakness.

UWM – added 7/15.

QLD – added 7/24.

DWCPF - Dow Jones U.S. Completion Total Stock Market

(TSM) Index, a broad market index made up of stocks of U.S. companies not

included in the S&P 500 Index. – Added 7/29/2024

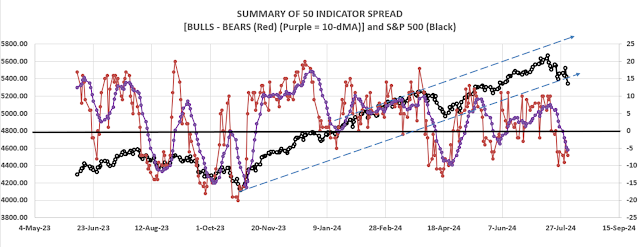

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread count slipped a bit to 15 Bear-signs

and 8-Bull. (The rest are neutral. It is normal to have a lot of neutral

indicators since many of those are top or bottom indicators that will signal

only at extremes.)

The Bull/Bear, 50-Indicator spread (Bull Indicators minus

Bear Indicators) dropped from -6 to -7 (7 more Bear indicators than Bull

indicators).

TODAY’S COMMENT:

Big sell-off Friday with new warnings from indicators and

some positive notes too.

Friday there was a Hindenburg Omen signal. Investopedia

says, “The Hindenburg Omen is a technical

indicator that was designed to signal the increased probability of

a stock market

crash. It compares the percentage of new 52-week highs and new 52-week lows in

stock prices to a predetermined reference percentage that is supposed to

predict the increasing likelihood of a market crash...

The Hindenburg Omen looks for a statistical deviation from the premise that

under normal conditions, some stocks are either making new 52-week highs or new

52-week lows. It would be abnormal if both were occurring at the same time.”

From Investopedia at...

https://www.investopedia.com/terms/h/hindenburgomen.asp

As we’ve noted before, the Omen sends a lot of false

warnings. Along those lines, neither the long-term or short-term Fosback Hi/Low

Logic indicators are bearish. Those

indicators also look at the number of new-highs and new-lows in a somewhat

similar style of analysis as the Hindenburg Omen.

As noted previously, I have been using the 10-dMA of the

50-indicator spread (purple line in the chart above) as a buy-signal. When the

10-dMA is moving higher, it is time to buy. It is still falling, so no

buy-signal yet.

On a more positive note:

Friday, was another statistically significant day, this

time a down-day. That just means that the price-volume move exceeded my

statistical parameters. Statistics show that a statistically-significant, down-day

is followed by an up-day about 60% of the time.

Breadth still looks good.

Even after the selloff today, more than half of all issues on the NYSE

have been up over the last 10-days. Longer time frames look good too.

The 7-Day VIX Rate of Change (ROC) jumped up 29% today. (At

one point, it was up 45%.) As noted by Tom McClellan of McClellan Financial

Publications, "...any reading above around +20% is a pretty good sign of

an oversold bottom for stock prices, one that is worthy of a bounce...”

Bollinger Bands were oversold today. RSI was very close to oversold. Let’s say “close

enough.” These two indicators are

suggesting a bottom.

In addition, there was buying late in the day Friday. If investors

were uniformly negative selling would have carried into the close, so this is

encouraging.

All in all, there are enough encouraging signs to suggest

that if selling does continue it is not likely to fall too much farther.

As of Friday’s close, the S&P 500 has dropped 5.7%

from its all-time high on 16 July. It is now 6.8% above its 200-dMA. It is less

than 1% above its 100-dMA and that is another support level. Looking at the

chart, today’s close is a decent support level going back to May.

Indicators are suggesting a bottom, but signals are not as

strong as we might like. Still, based on indicators, further declines from here

are not likely to exceed 4%.

The average decline of less than 10% takes about 30-days

from top to bottom. This pullback is

17-days as of Friday so we may have more to go before the bottom. It is not a

slam dunk, however; in 2020 there was a 10% correction that was only 14-days

long, top to bottom.

LONG-TERM INDICATOR: The Long Term NTSM indicator declined

to SELL: VOLUME & VIX are bearish; PRICE & SENTIMENT are neutral.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market

internals signal. The NTSM sell-signal was issued 21 December, 9 sessions

before the high of this recent bear market, based on the bearish “Summary of 50”

indicator.

BOTTOM LINE

I’m waiting to get a buy signal to add more stocks to the

portfolio. I suspect the correction is not over even though there were some

hopeful signs. Volume picked up today

and we’d like to see volume falling to make a meaningful bottom. (I am

wishy-washy here because small corrections give small signals and calling a

bottom on a small pullback is mostly guesswork and/or witchcraft.)

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals improved but remained HOLD. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 70% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks when markets are stretched; my current

stock position is above the norm. (75% is my max stock allocation when I am

strongly bullish.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did

back in October 2022 and 2023.