“Last year, the Supreme Court limited the government's capacity to restrict pollution in small streams that spend the majority of the year dry. In a 5 to 4 vote in May of 2023, the Supreme Court limited the reach of the Clean Water Act, effectively curtailing federal protection for about 4.9 million miles of streams that flow only when it rains, per reports by the New York Times.”

New study uncovers value lost after Supreme Court strips regional waterways' environmental protection: 'These streams convey a substantial amount of water' (msn.com)

My cmt: This is just another misleading report designed to undermine the Supreme Court. The Supreme Court is merely interpreting a poorly written law, The Clean Water Act. The law isn’t clear whether these small-stream, partially dry waters are covered. “The 1972 amendments to the Clean Water Act established federal jurisdiction over “navigable waters” (per the EPA). A dry stream isn’t a navigable water. An honest reading of the law would suggest that Congress never intended for seasonally dry streams to be covered. If this is really a problem, Congress could clarify the law.

“For many years, several coastal cities have been living with outdated sewage systems — and with climate change poised to trigger more extreme precipitation, these systems are at particular risk for flooding.” Story at...

Scientists sound alarm over issue plaguing older US cities: 'Making ... a difficult problem even more challenging' (msn.com)

While the media attempts to panic us with more climate change half-truths, I need to point out that, so far, there has been no increase in rain due to climate change. (ref., “Unsettled: What Climate Science Tells Us, What It Doesn't, and Why It Matters” by Steven Koonin, Phd). Rain is lumpier, with higher intensity in some areas, but overall, total rain has not increased. While the Weather Channel anchors state frequently that warmer temperatures allow the air to hold more moisture and will cause more rain, they miss the fact that rain is caused by condensation as warm, moist air is cooled. The cooler air that causes the rain is now also warmer (climate change), so not as much moisture is wrung out of a warm air mass. In other words, a warmer climate doesn’t necessarily result in more rain.

Climate change is real. The Earth has warmed 1 degree centigrade over the last 100-years, but the panic and fear-mongering from the media is unwarranted.

...FYI: “The Cool Down” is a media channel that aims to be “America’s first mainstream climate brand.” Too bad they have joined the climate change, fear-mongers.

“The backbone of America’s economy remains solid, despite a slowing job market, elevated interest rates and still-high inflation. Sales at US retailers unexpectedly surged in July, the Commerce Department said Thursday, rising by a solid 1% from the prior month...” Story at...

https://www.cnn.com/2024/08/15/economy/retail-sales-july/index.html

“The Labor Department said initial claims for state unemployment benefits dropped to a seasonally adjusted 227,000 for the week ended Aug. 10, missing economists’ predictions of 235,000...” Story at...

https://nypost.com/2024/08/15/business/us-weekly-job-claims-fall-boosting-case-for-fed-to-cut-rates/

“The New York Fed's Empire State business-conditions index, a gauge of manufacturing activity in the state, stayed in contraction territory for the ninth straight month in August. The general business-conditions index picked up 1.9 points - to negative 4.7 from negative 6.6 in July.

...The Philadelphia Fed manufacturing index slowed to a reading of negative 7 in August from 13.9 in the prior month....Any reading below zero indicates deteriorating conditions.” Story at...

https://www.morningstar.com/news/marketwatch/20240815270/empire-state-philly-fed-factory-gauges-show-weak-manufacturing-conditions

“US industrial output declined in July by the most since the start of the year on a pullback in factory production that included a Hurricane Beryl-related decrease in Gulf Coast refinery activity.” Story at...

https://finance.yahoo.com/news/us-industrial-production-declines-most-133004045.html

-Thursday the S&P 500 rose about 1.6% to 5543.

-VIX fell about 6% to 15.23.

-The yield on the 10-year Treasury rose to 3.919% (compared to this time, prior trading day).

XLK – Holding since the October 2022 lows.

XLK – added more 7/26. This reestablishes the position I had before this recent weakness.

UWM – added 7/15.

QLD – added 7/24.

The Bull/Bear Spread count moved strongly to the bull side at 2 Bear-signs and 16-Bull. (The rest are neutral. It is normal to have a lot of neutral indicators since many of those are top or bottom indicators that will signal only at extremes.)

The Bull/Bear, 50-Indicator spread (Bull Indicators minus Bear Indicators) jumped from +5 to +14 (14 more Bull indicators than Bear indicators). The 10-dMA is rising, confirming the buy signal from 5 days ago.

Indicators jumped to the bullish side and markets agreed with a hugely bullish day. “Looking good, Billy Ray! Feeling good, Louis!”

I’m bullish. What’s not to like.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

For more details, see NTSM Page at…

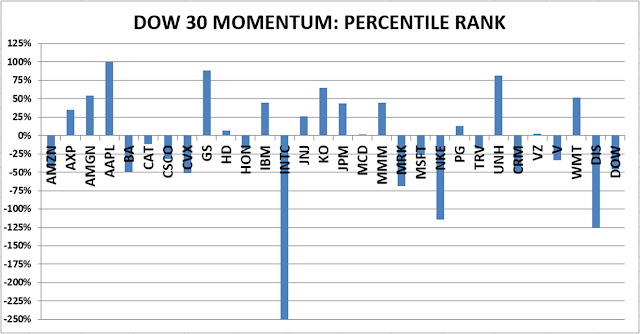

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals improved to HOLD. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)