“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“In the wake of former President Donald Trump’s resounding defeat of Vice President Kamala Harris—in which he improved his 2020 margins in nearly every key demographic—Democrats are facing a reckoning about what went wrong, and many are openly pointing the finger at President Joe Biden... David Axelrod, former President Barack Obama’s strategist, told Time magazine, “the story might have been different if” Biden “made a timely decision to step aside" From...

https://www.forbes.com/sites/saradorn/2024/11/07/legacy-in-tatters-reeling-democrats-blame-biden-for-harris-loss/

My cmt: Ok, blame it on Biden, but what about the press and other Democrats who aided the cover-up of Biden’s senility? Remember he hid in the basement (figuratively) in 2020 to get elected.

“The experience that I am having is one in which it is clear that regardless of someone’s gender, [voters] want to know that their president has a plan to lower costs, that their president has a plan to secure America in the context of our position around the world.” – VP Kamala Harris.

My cmt: Excuse me. What were those plans? In her ads she campaigned on protecting a woman’s right to abortion, “I’m-not-Trump” and not much else.

MAYBE IT WAS HARRIS’ POLICIES:

Harris opposes right-to-work without joining a union; proposed a bill with Bernie Saunders to abolish private health insurance; co-sponsored the Green New Deal; proposed guaranteed payments to those making less than 100,000 per year; proposed taxpayers pay for college education; sued Exxon-Mobil over global warming (she doesn’t drive a car or heat her house?); supported sweeping changes to the “extreme” Supreme Court; stated she will support abolishing the filibuster in the Senate and more.

The self-described "government transparency

website" scored Harris as the "most liberal compared to all senators" in

2019, outranking Sens. Bernie Sanders and Elizabeth Warren at the time. (After

Harris became the defacto Presidential candidate, the website removed the

rating.)

OR HER IN ABILITY TO THINK ON HER FEET...

The most effective anti-Harris ad run by the Trump campaign? On The View, she was asked,

"If anything, would you have done something differently than President Biden during the past four years?"... Harris responded, "there is not a thing that comes to mind."

OR MAYBE THE NY TIMES HAD IT RIGHT IN 2019

“The organizational unsteadiness of Ms. Harris’s campaign reflects a longtime personal trait, according to allies: she is a candidate who seeks input from a stable of advisers, but her personal political convictions can be unclear...To some Democrats who know Ms. Harris, her struggles indicate larger limitations. ‘You can’t run the country if you can’t run your campaign...” – NY Times, November 2019.

For all the “We’ve got to stop Trump” talk by the Democrats,

they didn’t choose a candidate who could do it. Had they run Senator Joe

Manchin (or another moderate Democrat) the story today would be about the Democrat

2 to 1 landslide victory and the end of Trump. The Democrats did a great disservice

to the country by sticking with identity politics and a far left candidate

Harris opposes right-to-work without joining a union; proposed a bill with Bernie Saunders to abolish private health insurance; co-sponsored the Green New Deal; proposed guaranteed payments to those making less than 100,000 per year; proposed taxpayers pay for college education; sued Exxon-Mobil over global warming (she doesn’t drive a car or heat her house?); supported sweeping changes to the “extreme” Supreme Court; stated she will support abolishing the filibuster in the Senate and more.

The most effective anti-Harris ad run by the Trump campaign? On The View, she was asked,

"If anything, would you have done something differently than President Biden during the past four years?"... Harris responded, "there is not a thing that comes to mind."

“The organizational unsteadiness of Ms. Harris’s campaign reflects a longtime personal trait, according to allies: she is a candidate who seeks input from a stable of advisers, but her personal political convictions can be unclear...To some Democrats who know Ms. Harris, her struggles indicate larger limitations. ‘You can’t run the country if you can’t run your campaign...” – NY Times, November 2019.

THE SHOCKING TRUTH

So far, Trump has received 2 million fewer votes in 2024 than he received in 2020 - this is not a Trump victory, it is a Democratic failure.

JOBLESS CLAIMS (RTTnews)

“The Labor Department said initial jobless claims crept up to 221,000, an increase of 3,000 from the previous week's revised level of 218,000...‘Initial claims for unemployment insurance benefits remain low as the biggest issue for the job market isn't firing but weaker hiring,’ said Ryan Sweet, Chief US Economist at Oxford Economics.' Story at...

https://www.rttnews.com/3488872/u-s-weekly-jobless-claims-rebound-modestly-from-five-month-low.aspx

MARKET REPORT / ANALYSIS

-Thursday the S&P 500 rose about 0.7% to 5973.

-VIX dropped about 7% to 15.20.

-The yield on the 10-year Treasury declined (compared to about this time, prior trading day) to 4.326%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 10/16.

SPY – added 9/19 & more 10/16

QLD – added 11/5.

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 4 gave Bear-signs and 19 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators minus Bear Indicators, red curve in the chart above) improved to +15 (15 more Bull indicators than Bear indicators).<<Typo here previously.

TODAY’S COMMENT:

Yesterday and today, (Thursday) the S&P 500 made new all-time highs. 16.7% and 9.8% (respectively) of all issues on the NYSE made new 52-week, new-highs on those days. Those are good numbers that demonstrate a broad advance with healthy breadth.

Today’s Bull-Bear spread of +15 is very bullish. The

10-dMA of the 50-Indicator Spread (purple line in the chart above) is bullish

too since it is moving higher. (I follow the 10-dMA for trading buy-signals and

as an indicator for sell signals.)

Indicators made a huge improvement over the past few days

and that’s a bullish sign. As noted previously, the S&P 500 tends to bottom

when the Daily indicator spread bottoms. Clearly, the mild pullback is over.

Now, the most significant Bear signal is Bollinger Bands

that are now overbought. RSI is not overbought so I’m not worried about the Bollinger

Band signal since RSI is not confirming the signal. We also note that the

S&P 500 has a lot of room to run to its upper trend line.

“Looking good, Billy Ray! Feeling good, Louis!”

BOTTOM LINE

I’m bullish on the markets.

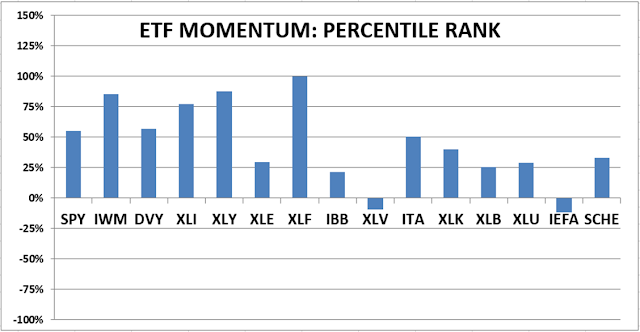

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained BUY. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

...My current invested

position is about 65% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks when markets are stretched. (75% is my max

stock allocation when I am confident that markets will continue higher.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see bullish signs, I add a lot more

stocks to the portfolio, usually by using an S&P 500 ETF as I did back in

October 2022 and 2023.

“The Labor Department said initial jobless claims crept up to 221,000, an increase of 3,000 from the previous week's revised level of 218,000...‘Initial claims for unemployment insurance benefits remain low as the biggest issue for the job market isn't firing but weaker hiring,’ said Ryan Sweet, Chief US Economist at Oxford Economics.' Story at...

https://www.rttnews.com/3488872/u-s-weekly-jobless-claims-rebound-modestly-from-five-month-low.aspx

-Thursday the S&P 500 rose about 0.7% to 5973.

-VIX dropped about 7% to 15.20.

-The yield on the 10-year Treasury declined (compared to about this time, prior trading day) to 4.326%.

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 10/16.

SPY – added 9/19 & more 10/16

QLD – added 11/5.

Today, of the 50-Indicators I track, 4 gave Bear-signs and 19 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators minus Bear Indicators, red curve in the chart above) improved to +15 (15 more Bull indicators than Bear indicators).<<Typo here previously.

Yesterday and today, (Thursday) the S&P 500 made new all-time highs. 16.7% and 9.8% (respectively) of all issues on the NYSE made new 52-week, new-highs on those days. Those are good numbers that demonstrate a broad advance with healthy breadth.

I’m bullish on the markets.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained BUY. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)