“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

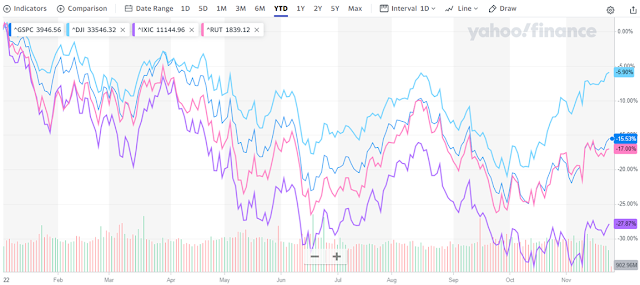

This is the year-to-date chart showing the DOW (DJI), S&P 500 (GSPC), Russell 2000 (RUT) and the NASDAQ (IXIC). NASDAQ is on the bottom; DOW is on the top.

-Friday the S&P 500 slipped 1pt to 4026.

-VIX rose about 0.7% to 20. 50.

-The yield on the 10-year Treasury dipped to 3.688%.

-Drop from Top: 16.1% as of today. 25.4% max (on a closing basis).

-Trading Days since Top: 226-days.

The S&P 500 is 0.8% Below its 200-dMA & 6.2% above its 50-dMA. (The last rally failed at the 200-dMA so I am watching this now.)

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area and I am fully invested with a higher percentage of stocks than normal.

XLI – Industrial ETF (XLI still looks good to me. Nearly 10% of XLI is in Boeing and Caterpillar and they are both strong performers in the DOW momentum analysis.)

QLD – 2x Nas 100

DDM – 2x Dow 30. I may sell DDM and replace it with SSO (2x S&P 500), but for now, the DOW 30 is still doing better than the S&P 500.

XLK – Technology ETF

I mentioned a high daily sum of indicators Wednesday. My list of 20 Indicators was 21. That’s Bullish indicators minus Bearish and one might think that a sum larger than 20 would be impossible. It would be, but there are a couple of indicators that get weighted at +2 or -2 in the summation list, depending on whether they are bullish or bearish, so a number greater than 20 is possible. I’ve never had a sum larger than 20...until Wednesday.

-The 10-dMA percentage of issues advancing on the NYSE (Breadth) is above 50%.

-Smoothed Buying Pressure minus Selling Pressure is rising.

-13 & 21 Oct were Bullish Outside Reversal Days with no Bearish Outside Reversal days since then.

-MACD of S&P 500 price made a bullish crossover 13 Oct.

-MACD of the percentage of issues advancing on the NYSE (breadth) made a bullish crossover 26 Oct.

-Short-term new-high/new-low data.

-Long-term new-high/new-low data.

-Slope of the 40-dMA of New-highs is rising.

-On average, the size of up-moves has been larger than the size of down-moves over the last month.

-VIX indicator.

-10 and 11 Nov were high up-volume days at 87% and 77%. That’s close enough to back-to-back 80% up-volume days, so I’ll call this one bullish. There have not been any more extreme volume signals since then.

-Cyclical Industrials (XLI-ETF) are outpacing the S&P 500.

-The 5-10-20 Timer System is BUY; the 5-dEMA and 10-dEMA are both above the 20-dEMA. (The 5-day is above the 10-day so short-term momentum is bullish.)

-McClellan Oscillator.

-59% of the 15-ETFs that I track have been up over the last 10-days.

-Bollinger Bands.

-RSI

-There have been 10 up-days over the last 20 sessions – neutral.

-There have been 5 up-days over the last 10 sessions – neutral.

-The graph of the 100-day Count (the 100-day sum of up-days) is flat.

-The Smart Money (late-day action) is mixed.

-The short-term, 10-day, Fosback Hi-Low Logic Index.

-The longer-term, 50-dEMA, Fosback Hi-Low Logic Index is neutral.

-Issues advancing on the NYSE (Breadth) compared to the S&P 500 is neutral.

-Overbought/Oversold Index (Advance/Decline Ratio).

-There was a Follow-through Day 10 November, but 1 is not enough to give a signal.

-There have been 2 Statistically-Significant days (big moves in price-volume) in the last 15-days.

-Sentiment.

-The Calm-before-the-Storm/Panic Indicator flashed a panic-buying signal 10 November - expired.

-The S&P 500 is 0.8% below its 200-dMA. (Bull indicator is 12% below the 200-day, although this is based on “normal” pullbacks.)

-There was an Inverse Zweig Breadth Collapse (negative Breadth Thrust) 21 June. That’s a rare, very-bearish sign, but it was a long time ago - expired.

-There was a Hindenburg Omen signal 8 April – expired.

-2.8% of all issues traded on the NYSE made new, 52-week highs when the S&P 500 made a new all-time-high, 3 January 2022. (There is no bullish signal for this indicator.) This indicated that the advance was too narrow and a correction was likely to be >10%. It proved correct, but is now Expired

-The 52-week, New-high/new-low ratio improved by 3.5 standard deviations. More simply, the spread between new-highs and new-lows improved by 716 on 14 October. That’s a solid bottom sign at a retest. – Expired.

-S&P 500 is outperforming the Utilities (XLU), but the spread is falling sharply so call it neutral.

-My Money Trend indicator is falling.

-The 50-dMA percentage of issues advancing on the NYSE (Breadth) is below 50%.

-The 100-dMA percentage of issues advancing on the NYSE (Breadth) is below 50%

-The 50-dMA percentage of issues advancing on the NYSE (Breadth) has been below 50%, for 3 days in a row below 50% giving me a “correction-now” signal. – Tell me something I didn’t know.

-The smoothed advancing volume on the NYSE is falling.

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

XLE has taken the top position in the ETF momentum index. I own CVX so I already have good exposure to energy.

DOW 30 momentum ranking follows:

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals slipped to HOLD.

(Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’ll cut back on stocks if we see serious

bear signs.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals slipped to HOLD.

(Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)