“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

https://michaelpramirez.com/index.html

“Consumer confidence declined again in November, most likely prompted by the recent rise in gas prices,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The Present Situation Index moderated further and continues to suggest the economy has lost momentum as the year winds down. Consumers’ expectations regarding the short-term outlook remained gloomy. Indeed, the Expectations Index is below a reading of 80, which suggests the likelihood of a recession remains elevated.” Press release at...

https://www.conference-board.org/topics/consumer-confidence

-Tuesday the S&P 500 slipped about 0.2% to 3958.

-VIX dipped about 1% to 20. 50.

-The yield on the 10-year Treasury dipped to 3.734%.

-Drop from Top: 17.5% as of today. 25.4% max (on a closing basis).

-Trading Days since Top: 228-days.

The S&P 500 is 2.3% Below its 200-dMA & 4.3% above its 50-dMA. (The last rally failed at the 200-dMA so I am watching this now.)

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area and I am fully invested with a higher percentage of stocks than normal.

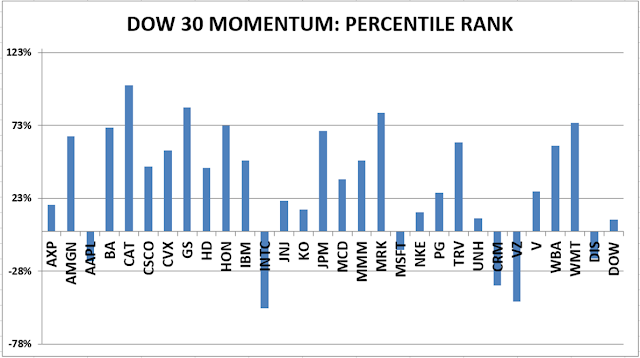

XLI – Industrial ETF (XLI still looks good to me. Nearly 10% of XLI is in Boeing and Caterpillar and they are both strong performers in the DOW momentum analysis.)

QLD – 2x Nas 100

DDM – 2x Dow 30. I may sell DDM and replace it with SSO (2x S&P 500), but for now, the DOW 30 is still doing better than the S&P 500.

XLK – Technology ETF

It is not surprising to see some profit taking. I’d still like to see the Nasdaq perform better so we could feel more confident that the lows are definitely behind us. While I doubt that a return to the October lows will happen this year, there is always the concern that we could see selling pick up next year, especially if there are recession signs.

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

XLE has taken the top position in the ETF momentum index. I own CVX so I already have good exposure to energy.

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained HOLD.

(Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)