“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“For decades we disagreed with [Supreme] Court rulings

when progressives held sway, but we never called the Court illegitimate. But

now that the left has lost the Court as a backup legislature for its policy

goals, the institution is supposedly broken. Tell us again who is the threat to

democratic institutions?” – WSJ Editorial Board.

SMALL BUSINESS OPTIMISM (NFIB)

“NFIB’s Small Business Optimism Index declined 0.8 points in October to 91.3, which is the 10th consecutive month below the 49-year average of 98. Thirty-three percent of owners reported that inflation was their single most important problem in operating their business, three points higher than September’s reading and four points lower than July’s highest reading since the fourth quarter of 1979. ‘Owners continue to show a dismal view about future sales growth and business conditions, but are still looking to hire new workers,’ said NFIB Chief Economist Bill Dunkelberg. ‘Inflation, supply chain disruptions, and labor shortages continue to limit the ability of many small businesses to meet the demand for their products and services.’” Press release at...

https://www.nfib.com/surveys/small-business-economic-trends/

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 rose about 0.6% to 3828.

-VIX went the wrong way and rose about 5% to 25.54.

-The yield on the 10-year Treasury dipped to 4.134%.

PULLBACK DATA:

-Drop from Top: 20.2% as of today. 25.4% max (on a closing basis).

-Trading Days since Top: 214-days.

The S&P 500 is 6.4% Below its 200-dMA & 0.9% ABOVE its 50-dMA. (It’s good to see the Index above its 50-day.)

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area and I am fully invested with a higher percentage of stocks than normal.

MY TRADING POSITIONS:

XLI – Industrial ETF

QLD – 2x Nas 100

DDM – 2x Dow 30

XLK – Technology ETF

CVX – (I may hold this as a long-term position. I already

owned a small position in CVX.)

TODAY’S COMMENT:

Election day rally continues. The mid-term, Presidential cycle suggests a significant rally at least though the end of the year.

Today, the daily sum of 20 Indicators slipped from +9 to

+8 (a positive number is bullish; negatives are bearish); the 10-day smoothed

sum that smooths the daily fluctuations slipped from +110 to +101. (The trend

direction is more important than the actual number for the 10-day value.) These

numbers sometimes change after I post the blog based on data that comes in

late. Most of these 20 indicators are short-term so they tend to bounce

around a lot.

LONG-TERM INDICATOR: The Long

Term NTSM indicator remained HOLD: VOLUME, SENTIMENT & VIX are neutral;

PRICE is bullish.

Bottom line: I’m a still a Bull. I haven’t seen many

signs that would change my mind. I think the bottom was 3577 on 12 October.

I’m now invested with about 75% of the portfolio invested

in stocks. (As a retiree, 50% invested in stocks is my “normal” portfolio.) 75%

stocks is uber-bullish and that’s as far as I’ll go.

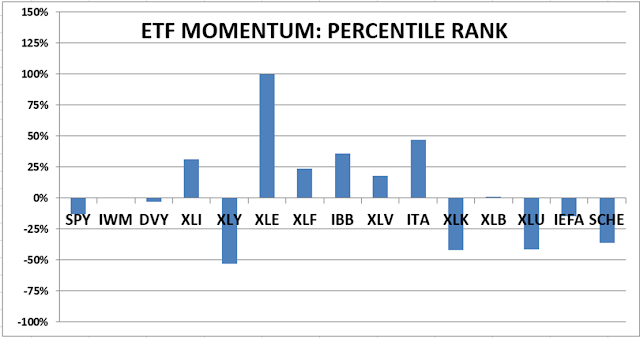

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

BEST DOW STOCKS - TODAY’S MOMENTUM

RANKING OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals slipped to HOLD.

(Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks. I’ll cut back on stocks if we see serious

bear signs. It may be time to take profits...we’ll see.

I trade about 15-20% of the

total portfolio using the momentum-based analysis I provide here. If I can see

a definitive bottom, I’ll add a lot more stocks to the portfolio using an

S&P 500 ETF.

“NFIB’s Small Business Optimism Index declined 0.8 points in October to 91.3, which is the 10th consecutive month below the 49-year average of 98. Thirty-three percent of owners reported that inflation was their single most important problem in operating their business, three points higher than September’s reading and four points lower than July’s highest reading since the fourth quarter of 1979. ‘Owners continue to show a dismal view about future sales growth and business conditions, but are still looking to hire new workers,’ said NFIB Chief Economist Bill Dunkelberg. ‘Inflation, supply chain disruptions, and labor shortages continue to limit the ability of many small businesses to meet the demand for their products and services.’” Press release at...

https://www.nfib.com/surveys/small-business-economic-trends/

-Tuesday the S&P 500 rose about 0.6% to 3828.

-VIX went the wrong way and rose about 5% to 25.54.

-The yield on the 10-year Treasury dipped to 4.134%.

-Drop from Top: 20.2% as of today. 25.4% max (on a closing basis).

-Trading Days since Top: 214-days.

The S&P 500 is 6.4% Below its 200-dMA & 0.9% ABOVE its 50-dMA. (It’s good to see the Index above its 50-day.)

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area and I am fully invested with a higher percentage of stocks than normal.

XLI – Industrial ETF

QLD – 2x Nas 100

DDM – 2x Dow 30

XLK – Technology ETF

Election day rally continues. The mid-term, Presidential cycle suggests a significant rally at least though the end of the year.

BEST ETFs - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW 30 momentum ranking follows:

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals slipped to HOLD.

(Market Internals are a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)