The stock market is all about earnings, or more specifically, earnings growth. If earnings are growing, stock prices are usually rising. Rising earnings go hand in hand with rising revenues. Companies need to bring in more dollars each quarter to improve the earnings. If revenues are falling, companies can make up for that by reducing costs or increasing productivity, but cost reduction can only go so far. Here’s what Contrary Investor had to say about Revenues (Contrary Investor.com):

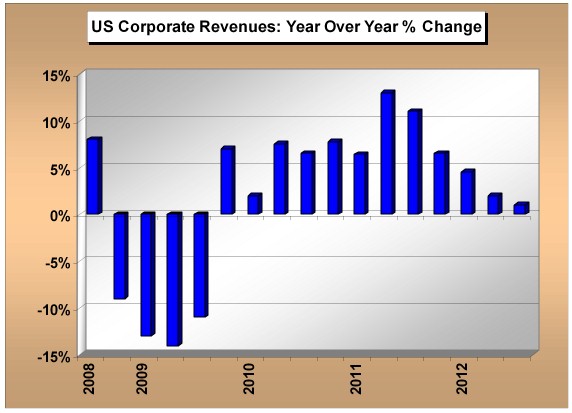

“3Q saw the smallest year

over year gain in US corporate revenues since 2009. Moreover, the ongoing trend

in slowing year over year revenue growth is unmistakable over the last five

quarters.”

“Looking beyond the US

Fiscal Cliff issues specifically, it’s clear that global economic slowing is

negatively impacting US goods exports, one of the two key legs of the economic

stool in the current recovery. Additionally, the ability of the US Federal

government to continue to take on debt is more of a question mark than has been

the case in recent years. Both of these issues have direct bearing on the

forward character of US corporate earnings. Is this what is really causing

angst among the equity investment community as of late as opposed to the

already more than well-known Fiscal Cliff issues?…Now is the time to look over

the Cliff and assess the forward rhythm and tenor of the global economy, as

well as how that rhythm will either positively or negatively impact the US

corporate revenue and earnings growth outlook for the next two to three quarters.” From Contrary Investor.com at…

http://www.contraryinvestor.com/mo.htm

ATA TRUCK TONNAGE

The ATA Truck tonnage

Index, as reported by the American Trucking Association, rebounded from a 3.8% drop

in October to post a seasonally adjusted 3.7% gain in November. That’s the first positive month since July. ATA said, “Year-to-date,

compared with the same period last year, tonnage was up 2.8%.” From their

website: “Trucking serves as a barometer of the U.S.

economy, representing 67% of tonnage carried by all modes of domestic freight

transportation…” My cmt: I think

this data supports a slightly growing economy, though one-month’s increase (remember

August thru October were down) may not indicate we are out of the woods yet. From ATA at…

RETAIL SALES DOWN

(coloradoan.com)

“Holiday retail sales this year were the

weakest since 2008, when the nation was in a deep recession. In 2012, the

shopping season was disrupted by bad weather and consumers’ rising uncertainty

about the economy… In the end, even steep last-minute discounts weren’t enough

to get people into stores, said Marshal Cohen, chief research analyst at the

market research firm NPD Inc.” Full

story at…http://www.coloradoan.com/viewart/20121225/BUSINESS/312260006/Holiday-Retail-sales-weakest-since-2008

SENTIMENT

As of Monday’s close, sentiment is 66%-bulls

so now it’s official: 2 out of every 3 investors are betting the markets will

rise. (My sentiment indicator tracks the assets invested in selected bull and

bear mutual funds in the Guggenheim Investment Family, formerly Rydex

Funds.) This is negative for the

markets. Too much bullish sentiment is

not a good thing. Furthermore, sentiment

usually peaks after the stock market has topped as investors move in to

buy-the-dip. Could sentiment be

right? Is now the time to be more

optimistic than at any other time since last May? - Maybe, but not likely.

MARKET RECAP

Wednesday

the S&P 500 was down 0.5% to 1420 (rounded). VIX rose 9% to 19.48.

NTSM

The NTSM analysis remained HOLD Wednesday. Sentiment is the only negative indicator.

MY INVESTED POSITION

Based on the SELL signal, 7 November 2012, I

moved out of the stock market at 1377 on the S&P 500. Because of the negativity I have noted from

Hussman and others, I am currently invested in a range of near 15% invested in

stocks.