“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

BIDEN INSISTED HE DIDN’T SIGN EXECUTIVE ORDER JUST WEEKS AFTER DOING SO (NY Post)

“President Biden had no clue whether or not he signed a critical executive order during a conversation last year with Republican House Speaker Mike Johnson, who admitted he left the meeting fearing the nation is in “serious trouble.” An addled Biden insisted to the Louisiana lawmaker that he never issued the order to freeze new liquid natural gas export permits — even though he signed off on it less than a month earlier. Johnson told the Free Press’ Bari Weiss he didn’t believe Biden was lying, but was left to believe the then-81-year-old leader “genuinely didn’t know what he had signed.” Story at...

Biden insisted he didn’t sign executive order just weeks after doing so, Speaker Johnson reveals

My cmt: Disturbing, but not surprising.

“Trump’s order asserts that the children of noncitizens [born in the U.S.] are not subject to the jurisdiction of the United States...It goes on to bar federal agencies from recognizing the citizenship of people in those categories. It takes effect 30 days from Tuesday, on Feb. 19.” Story at...

https://apnews.com/article/birthright-citizenship-trump-executive-order-immigrants-fc7dd75ba1fb0a10f56b2a85b92dbe53

My cmt:

Section 1 of the 14th Amendment states: “All persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside.” I see no wiggle room in the language. The President does not have the authority to make his own rules. Any real conservative would follow the constitution. King Trump has forgotten the oath of office he took just a few days ago.

“Initial claims for state unemployment benefits increased 6,000 to a seasonally adjusted 223,000 for the week ended Jan. 18. Economists polled by Reuters had forecast 220,000 claims for the latest week. Claims were lifted by the wildfire in Los Angeles, with unadjusted applications increasing in California, but falling in the majority of states.” Story at...

https://www.reuters.com/markets/us/us-weekly-jobless-claims-increase-marginally-2025-01-23/

“U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.0 million barrels from the previous week. At 411.7 million barrels, U.S. crude oil inventories are about 6% below the five-year average for this time of year.” Story at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

“The risk of the stock market is forming a bubble that will soon burst is higher — especially because the rich and famous don’t think so. I’m referring to attendees at the World Economic Forum...By almost any objective measure, the risk of a bubble bursting is perhaps higher now than at any time in decades. But because no major asset bubble has burst in recent years, recency bias leads the global elite — just like the rest of us — to underestimate the risks of such an event...

The rich and famous don’t fear a stock market bubble. That’s why you should.

“Calamos Investments is targeting two of the most popular ETF themes with a new fund that offers 100% downside protection on bitcoin investing... [It] builds on the Chicago area firm's suite of exchange-traded funds that offer 100% downside protection on the S&P 500 Index, the Russell 2000 Index, and the Nasdaq Composite Index.” Story at...

https://finance.yahoo.com/news/calamos-unveils-cant-lose-bitcoin-225042366.html

My cmt: These funds cap upside potential at around 10%, but when Wall Street decides markets can’t go down, it is time to be afraid, very afraid.

-Thursday the S&P 500 rose about 0.5% to 6119.

-VIX declined about 0.5% to 15.02.

-The yield on the 10-year Treasury rose (compared to about this time, prior trading day) to 4.646%.

XLK – Holding since the October 2022 lows. Added more 9/20.

SPY – added 12/20. (IRA acct.)

QLD – added 12/20. (IRA acct.)

NVDA – added 1/6/2025

Today, of the 50-Indicators I track, 5 gave Bear-signs and 18 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators minus Bear Indicators, red curve in the chart above) declined to +13 (13 more Bull indicators than Bear indicators).

The Table in the above piece, “The Rich and Famous Don’t Fear a Bubble,” notes how stocks are overvalued. Valuation is not a good way to time the market. I heard Dennis Gartman (Gartman letter, former CNBC contributor) on a local radio show this morning and he said he has been out of the market for a year due to high valuations. This just demonstrates the difficulty in using valuation for timing the market. There are now fewer stocks and more investors chasing them – less supply and more demand means that valuation-indicators are likely to be higher than past historical extremes. I’ll be watching my 50-indicators (plus a dozen or so others not in the system) to warn me of market dislocations. Valuation indicators are not in my system.

I am bullish.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

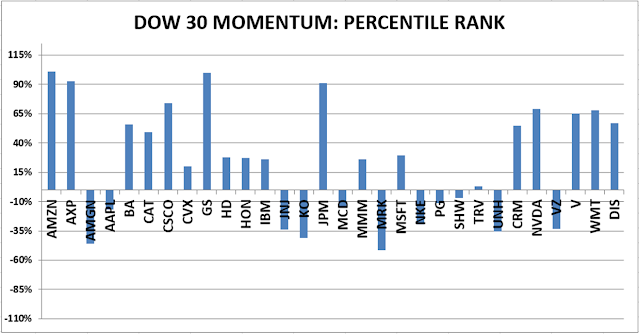

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals improved to BUY. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.