GREEN ELECTRICITY COSTS A BUNDLE (WSJ - Excerpt)

“The claim that green energy is cheaper relies on bogus math that measures the cost of electricity only when the sun is shining and the wind is blowing. Modern societies need around-the-clock power, requiring backup, often powered by fossil fuels. That means we’re paying for two power systems: renewables and backup. Moreover, as fossil fuels are used less, those power sources need to earn their capital costs back in fewer hours, leading to even more expensive power... Take Germany, where electricity costs 30 cents a kilowatt-hour—more than twice the U.S. cost and more than three times the Chinese price. Germany has installed so much solar and wind that, on sunny and windy days, renewable energy satisfies close to 70% of Germany’s needs... Last month, with cloudy skies and nearly no wind, Germany faced the highest power prices since the energy crisis caused by Russia’s invasion of Ukraine in 2022, with wholesale prices reaching a staggering $1 a kilowatt-hour. [About 10x the cost in the US] ... If solar and wind really were less expensive, the world’s poorer countries would easily leapfrog from today’s energy poverty to energy abundance.” - Bjorn Lomborg, President of the Copenhagen Consensus, visiting fellow at Stanford University’s Hoover Institution. Commentary at...

https://www.wsj.com/opinion/green-electricity-costs-a-bundle-wind-solar-data-analysis-power-prices-259344f4

My cmt: My nephew works for a large utility company. He said that renewable energy has complicated his job. He balances energy supplies and when the sun and wind aren’t cooperating, he has to make sure that power is transferred to where it is needed. He described an accident when a car took out a power pole. The number of people without power numbered in the thousands. It would have been a lot less except that renewable energy means that energy balancing is much more difficult on a cloudy day.

JOBLESS CLAIMS (AP News)

“The number of Americans applying for unemployment checks dropped last week to the lowest level since March, suggesting that suggest most U.S. workers continue to enjoy unusually high job security. Jobless claims dropped by 9,000 to 211,000 last week, the Labor Department reported Thursday.” Story at...

https://apnews.com/article/employment-layoffs-labor-united-states-economy-ae4832c3e937f5789a3de71cce98202f

MARKET REPORT / ANALYSIS AS OF 1PM FRIDAY

-Thursday the S&P 500 declined about 0.2% to 5869.

-VIX rose about 3% to 17.93.

-The yield on the 10-year Treasury declined (compared to about this time, prior trading day) to 4.563%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 12/20. (IRA acct.)

SPY – added 12/20. (IRA acct.)

QLD – added 12/20. (IRA acct.)

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 17 gave Bear-signs and 7 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators

minus Bear Indicators, red curve in the chart above) improved to -10 (10 more Bear

indicators than Bull indicators).

TODAY’S COMMENT

The bull-bear indicator spread improved today and the bullish divergence between the indicators and the S&P 500 value remains. This is indicated by green arrows on the above chart. The 10-dMA of the indicator spread turned up today and that’s another buy signal.

BOTTOM LINE

Even though the S&P 500 declined today, indicators suggest (again) the weakness is ending.

ETF - MOMENTUM ANALYSIS:

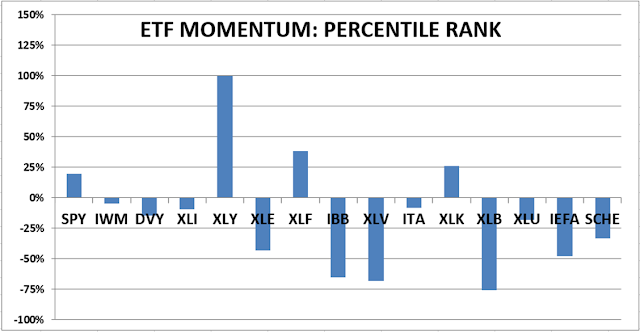

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained HOLD. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

...My current invested

position is about 70% stocks, including stock mutual funds and ETFs. 50%

invested in stocks is a normal position. (75% is my max stock allocation when I

am confident that markets will continue higher; 30% in stocks is my Bear market

position.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see bullish signs, I add a lot more

stocks to the portfolio, usually by using an S&P 500 ETF as I did back in

October 2022 and 2023.

“The claim that green energy is cheaper relies on bogus math that measures the cost of electricity only when the sun is shining and the wind is blowing. Modern societies need around-the-clock power, requiring backup, often powered by fossil fuels. That means we’re paying for two power systems: renewables and backup. Moreover, as fossil fuels are used less, those power sources need to earn their capital costs back in fewer hours, leading to even more expensive power... Take Germany, where electricity costs 30 cents a kilowatt-hour—more than twice the U.S. cost and more than three times the Chinese price. Germany has installed so much solar and wind that, on sunny and windy days, renewable energy satisfies close to 70% of Germany’s needs... Last month, with cloudy skies and nearly no wind, Germany faced the highest power prices since the energy crisis caused by Russia’s invasion of Ukraine in 2022, with wholesale prices reaching a staggering $1 a kilowatt-hour. [About 10x the cost in the US] ... If solar and wind really were less expensive, the world’s poorer countries would easily leapfrog from today’s energy poverty to energy abundance.” - Bjorn Lomborg, President of the Copenhagen Consensus, visiting fellow at Stanford University’s Hoover Institution. Commentary at...

https://www.wsj.com/opinion/green-electricity-costs-a-bundle-wind-solar-data-analysis-power-prices-259344f4

My cmt: My nephew works for a large utility company. He said that renewable energy has complicated his job. He balances energy supplies and when the sun and wind aren’t cooperating, he has to make sure that power is transferred to where it is needed. He described an accident when a car took out a power pole. The number of people without power numbered in the thousands. It would have been a lot less except that renewable energy means that energy balancing is much more difficult on a cloudy day.

“The number of Americans applying for unemployment checks dropped last week to the lowest level since March, suggesting that suggest most U.S. workers continue to enjoy unusually high job security. Jobless claims dropped by 9,000 to 211,000 last week, the Labor Department reported Thursday.” Story at...

https://apnews.com/article/employment-layoffs-labor-united-states-economy-ae4832c3e937f5789a3de71cce98202f

-Thursday the S&P 500 declined about 0.2% to 5869.

-VIX rose about 3% to 17.93.

-The yield on the 10-year Treasury declined (compared to about this time, prior trading day) to 4.563%.

XLK – Holding since the October 2022 lows. Added more 9/20.

SPY – added 12/20. (IRA acct.)

QLD – added 12/20. (IRA acct.)

Today, of the 50-Indicators I track, 17 gave Bear-signs and 7 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

The bull-bear indicator spread improved today and the bullish divergence between the indicators and the S&P 500 value remains. This is indicated by green arrows on the above chart. The 10-dMA of the indicator spread turned up today and that’s another buy signal.

Even though the S&P 500 declined today, indicators suggest (again) the weakness is ending.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained HOLD. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)