Political commentary by Michael Ramirez at...

https://michaelramirez.substack.com/p/michael-ramirez-trumps-return-1-16

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far more money has been lost by investors in preparing for

corrections, or anticipating corrections, than has been lost in the corrections

themselves.” - Peter Lynch, former manager of Fidelity’s Magellan®

fund.

PHILLY FED (Advisor Perspectives)

“The latest Philadelphia Fed manufacturing index jumped to its highest level since April 2021 as manufacturing activity increased overall. In January, the index rose to 44.3 from -10.9 in December, the largest monthly increase since June 2020. The latest reading was much higher than the forecast of -5.0... Retail sales excluding automobiles, gasoline, building materials and food services surged 0.7% last month after an unrevised 0.4% gain in November. These so-called core retail sales correspond most closely with the consumer spending component of gross domestic product” Commentary at...

https://www.advisorp\erspectives.com/dshort/updates/2025/01/16/philly-fed-manufacturing-index-activity-jumps-to-highest-level-since-april-2024

RETAIL SALES (Reuters)

“Retail sales rose 0.4% last month after an upwardly revised 0.8% gain in November...” Story at...

https://www.reuters.com/markets/us/us-retail-sales-rise-solidly-december-2025-01-16/

JOBLESS CLAIMS (Reuters)

“Initial claims for state unemployment benefits rose 14,000 to a seasonally adjusted 217,000 for the week ended Jan. 11, the Labor Department said on Thursday. Economists polled by Reuters had forecast 210,000 claims for the latest week.” Story at...

https://www.reuters.com/markets/us/us-weekly-jobless-claims-increase-labor-market-conditions-still-healthy-2025-01-16/

MARKET REPORT / ANALYSIS AS OF 1PM FRIDAY

-Thursday the S&P 500 declined about 0.2% to 5937.

-VIX rose about 3% to 16.60.

-The yield on the 10-year Treasury declined (compared to about this time, prior trading day) to 4.619%.

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows. Added more 9/20.

SSO – added 12/20. (IRA acct.)

SPY – added 12/20. (IRA acct.)

QLD – added 12/20. (IRA acct.)

NVDA – added 1/6/2025

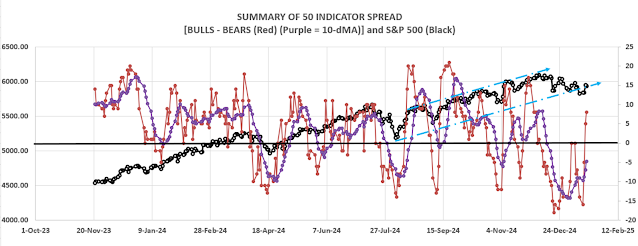

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 7 gave Bear-signs and 15 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators minus Bear Indicators, red curve in the chart above) improved to +8 (8 more Bull indicators than Bear indicators).

TODAY’S COMMENT

The S&P 500 was down some today – not much of a surprise given the big rebound over the last 2 days.

The daily, bull-bear spread of +8 is Bullish. The 10-dMA

of the spread is also moving higher, another bull-sign.

This is the first time

since November that the Bull/Bear Spread has gone from Bearish to Bullish so

there is good confirmation that the bottom is in for a while. Breadth has

improved and almost all of the breadth indicators are now bullish. Late-day

action is bullish so the Pros must agree

that the bottom is in.

The S&P 500 remains

below its 50-dMA. I don’t think this means much, but according to the old Wall

Street adage, support becomes resistance so some investors will be watching to

see if the Index can close above the 50-day.

I see no reason why it won’t.

BOTTOM LINE

I am bullish.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

THURSDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained BUY. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

...My current invested

position is about 75% stocks, including stock mutual funds and ETFs. 50%

invested in stocks is a normal position. (75% is my max stock allocation when I

am confident that markets will continue higher; 30% in stocks is my Bear market

position.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.

https://michaelramirez.substack.com/p/michael-ramirez-trumps-return-1-16

“The latest Philadelphia Fed manufacturing index jumped to its highest level since April 2021 as manufacturing activity increased overall. In January, the index rose to 44.3 from -10.9 in December, the largest monthly increase since June 2020. The latest reading was much higher than the forecast of -5.0... Retail sales excluding automobiles, gasoline, building materials and food services surged 0.7% last month after an unrevised 0.4% gain in November. These so-called core retail sales correspond most closely with the consumer spending component of gross domestic product” Commentary at...

https://www.advisorp\erspectives.com/dshort/updates/2025/01/16/philly-fed-manufacturing-index-activity-jumps-to-highest-level-since-april-2024

“Retail sales rose 0.4% last month after an upwardly revised 0.8% gain in November...” Story at...

https://www.reuters.com/markets/us/us-retail-sales-rise-solidly-december-2025-01-16/

“Initial claims for state unemployment benefits rose 14,000 to a seasonally adjusted 217,000 for the week ended Jan. 11, the Labor Department said on Thursday. Economists polled by Reuters had forecast 210,000 claims for the latest week.” Story at...

https://www.reuters.com/markets/us/us-weekly-jobless-claims-increase-labor-market-conditions-still-healthy-2025-01-16/

-Thursday the S&P 500 declined about 0.2% to 5937.

-VIX rose about 3% to 16.60.

-The yield on the 10-year Treasury declined (compared to about this time, prior trading day) to 4.619%.

XLK – Holding since the October 2022 lows. Added more 9/20.

SPY – added 12/20. (IRA acct.)

QLD – added 12/20. (IRA acct.)

NVDA – added 1/6/2025

Today, of the 50-Indicators I track, 7 gave Bear-signs and 15 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

The daily Bull/Bear, 50-Indicator spread (Bull Indicators minus Bear Indicators, red curve in the chart above) improved to +8 (8 more Bull indicators than Bear indicators).

The S&P 500 was down some today – not much of a surprise given the big rebound over the last 2 days.

I am bullish.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained BUY. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.