“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

...Lawyers in the Missouri v. Biden case took sworn depositions from many federal officials involved in the censorship efforts, including Anthony Fauci. During the hours-long deposition, Fauci showed a striking inability to answer basic questions about his pandemic management, replying “I don’t recall” over 170 times. Legal discovery unearthed email exchanges between the government and social media companies showing an administration willing to threaten the use of its regulatory power to harm social media companies that did not comply with censorship demands...

...Censorship is the death of science and inevitably leads to the death of people. America should be a bulwark against it, but it was not during the pandemic. Though the tide is turning with the Missouri v. Biden case, we must reform our scientific institutions so what happened during the pandemic never happens again.” - Dr. Jay Bhattacharya, Professor of Medicine at Stanford University and a research associate at the National Bureau of Economics Research

American Pandemic ‘Samizdat’ | RealClearPolitics

Judge is right to rebuke Biden's anti-oil obsession (msn.com)

SHOCKING CANDOR ON FUEL STANDARDS (WSJ)

“For decades, bureaucrats in Washington have argued that fuel-economy mandates pay for themselves... But unlike in previous rulemakings, the costs are now so comically high that regulators can no longer pretend that mandating greater fuel economy for passenger cars is good for society... But the proposed rule says this White House’s not-so-secret password: climate change. What about it? Without a hint of sarcasm, page 5-39 of the department’s accompanying environmental assessment estimates that in 2060 the proposal would reduce average global temperatures by 0.000%... Chinese Communist Party officials must be reading our wonderful environmental assessments for comic relief as they ramp up coal production.” - Michael Buschbacher, partner at the law firm Boyden Gray PLLC and served in the Justice Department’s Environment Division (2020-21), and James Conde, counsel at Boyden Gray PLLC. Commentary at...

https://www.wsj.com/articles/transportation-department-fuel-standards-car-ev-electric-vehicle-auto-industry-climate-change-388d6dd0

My cmt: If Global Temperatures will not be affected by the above rule that essentially does away with gasoline powered vehicles, what is the point?

https://www.regulations.gov/document/NHTSA-2023-0022-0004

The comments I read were all form letters from Environmental Whackos who stated that “We urge NHTSA to finalize the strongest rule possible...”

...This proposed rule remains open for comment. Comments are requested on or before October 16, 2023.

“While the pieces are coming together nicely for a bottom and Q4 rally as I have been writing about, it is never easy nor fun to live through. Declines shakes investors’ faith and they don’t reengage until the best opportunity has been exhausted. Next week I will be keenly watching for sectors that are beginning to shape up for a rally. Right now, it’s hard to see.” – Paul Schatz, President Heritage Capital.

https://investfortomorrow.com/blog/pullback-accelerates/

-Monday the S&P 500 rose about 0.4% to 4337.

-VIX fell about 2% to 16.9.

-The yield on the 10-year Treasury rose to 4.537%, a continuing worry for the stock market.

-Drop from Top: 9.6%. 25.4% max (on a closing basis).

-Trading Days since Top: 433-days.

The S&P 500 is 3.4% ABOVE its 200-dMA and 3% BELOW its 50-dMA.

*I won’t call the correction over until the S&P 500 makes a new-high; however, evidence suggests the bottom was in the 3600 area and we called a buy on 4 October 2022.

XLK – Technology ETF (holding since the October 2022 lows).

XLY - Consumer Discretionary ETF. (Holding since the October 2022 lows - I bought more XLY Monday, 8/21.)

I took profits and then reestablished positions as follows:

SPY – I bought a large position in the S&P 500 Friday, 8/14, in my 401k (it has limited choices).

XLE – Added Tuesday, 8/22.

SSO – 2x S&P 500 ETF. Added 8/24.

CSCO – added 9/5.

On 1 September, there were 22 Bull-indicators and Zero Bear-indicators. As a result, I went “all-in” again on the following Monday. The S&P 500 was 4497. The S&P 500 has dropped about 4% since then while indicators have shifted significantly to the bear side. Friday, the summary of indicators on Friday was a bearish 15-bear and 4-bull. I remain more than fully invested since several of the bull indicators are calling for a bottom. As I’ve noted frequently, calling short-term stock movement is a losing proposition that is partly or even mostly luck, but I’ll hope for luck. Today’s late-day, market action was bullish: Utilities were sold; Cyclical industrials were bought; Consumer Discretionary stocks outpaced the S&P 500 – all are bullish signs suggesting a possible end of market weakness. These are just daily moves, but I’ll keep hoping for the luck factor.

TODAY’S RANKING OF 15 ETFs (Ranked Daily)

ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

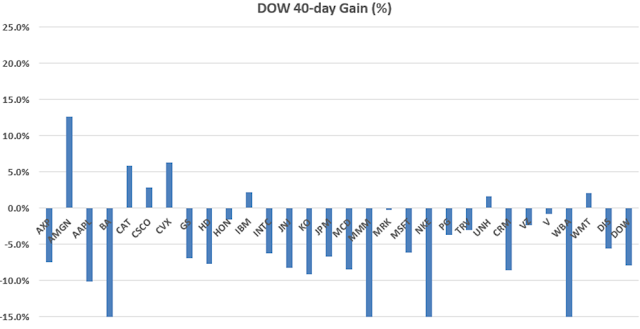

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

DOW 30 momentum ranking follows:

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals remained SELL. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)