“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

“They [referring to Biden’s OP ED in the Washington Post]

decided the time has come to eliminate the Supreme Court as we know it... In his op-ed, the president says he

wants term limits to his own justices. Never mind what the Constitution says.

Never mind the advice and consent role of the Senate. President Biden and his

leftist allies don't like the current composition of the court, so they want to

shred the Constitution to change it. He wants what he calls an ethics code, but

that already exists. What the president is actually proposing is a stealth

process for people other than the justices to decide cases. Again, the

Constitution be damned.” – Mitch McConnell, (R) Senator from KY.

“For decades we disagreed with [Supreme] Court rulings

when progressives held sway, but we never called the Court illegitimate. But

now that the left has lost the Court as a backup legislature for its policy

goals, the institution is supposedly broken. Tell us again who is the threat to

democratic institutions?” – WSJ Editorial Board.

IRAN UNDERMINING TRUMP CANDIDACY (CNN via msn.com)

“Iran is using covert social media activity and related

influence operations in an effort to undercut the candidacy of former President

Donald Trump, a US intelligence official said Monday in an updated assessment

of threats to the November election...because Iranian leaders want to avoid an

outcome they perceive would increase tensions with the United States,” the

Office of the Director of National Intelligence (ODNI) said in a statement... In the 2020 election campaign, Iran “carried

out a multi-pronged covert influence campaign intended to undercut former

President Trump’s reelection prospects,” according to a declassified US intelligence report.”

Story at...

Iran

using covert influence campaign to undermine Trump candidacy, US intelligence

says (msn.com)

INFLUENCER VISITS THE WEST BANK – ALMOST DIDN’T MAKE IT

OUT ALIVE (Fox News vis msn.com)

"It was like one after another, massive love and

support for Hamas...I was specifically looking for younger people thinking, OK,

someone here is not going to support Hamas. And they all do," he

continued. "It really ranged from sympathy to actual love and admiration

for Hamas…. I thought I would find at least some people who were not diehard

Hamas supporters, and I couldn’t find one." - Zach Sage

Fox, Comedian and social media influencer. Story at...

Influencer

went to the West Bank to see if Palestinians support Hamas – he almost didn’t

make it out alive (msn.com)

CONSUMER CONFIDENCE (Conference Board)

“Confidence increased in July, but not enough to break

free of the narrow range that has prevailed over the past two years,”

said Dana M. Peterson, Chief Economist at The Conference Board. “Even

though consumers remain relatively positive about the labor market, they still

appear to be concerned about elevated prices and interest rates, and

uncertainty about the future; things that may not improve until next year... The proportion of consumers predicting

a forthcoming recession ticked up in July but remains well below the

2023 peak. Consumers’ assessments of their Family’s Financial Situation—both

currently and over the next six months—was less positive. Indeed, assessments

of familial finances have deteriorated continuously since the beginning of

2024.’” Press release at...

https://www.conference-board.org/topics/consumer-confidence

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 declined about 0.5% to 5436.

-VIX rose about 6% to 17.65.

-The yield on the 10-year Treasury declined to 4.140%

(compared to this time, prior trading day).

MY TRADING POSITIONS:

XLK – Holding since the October 2022 lows.

XLK – added more 7/26. This reestablishes the position I

had before this recent weakness.

UWM – added 7/15.

QLD – added 7/24.

DWCPF - Dow Jones U.S. Completion Total Stock Market

(TSM) Index, a broad market index made up of stocks of U.S. companies not

included in the S&P 500 Index. – Added 7/29/2024

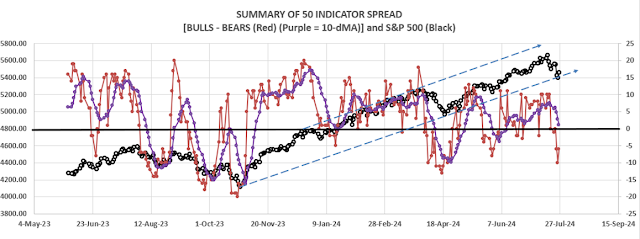

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

The Bull/Bear Spread count deteriorated to 15 Bear-signs

and 6-Bull. (The rest are neutral. It is normal to have a lot of neutral

indicators since many of those are top or bottom indicators that will signal

only at extremes.)

The Bull/Bear, 50-Indicator spread (Bull Indicators minus

Bear Indicators) declined from -7 to -9 (9 more Bear indicators than Bull

indicators).

TODAY’S COMMENT:

The S&P 500 dropped below its 50-dMA for most of the

day; improved after 1pm; but then dipped again in the final minutes of trading

to close below its 50-dMA. That’s not a good sign.

Microsoft beat on earnings and revenue, but cloud

services disappointed and the beats may not have beaten the whisper

numbers. MSFT fell about 6% in after-hours

trading as of 4:30 pm. That is not a good sign either. Worse...

There were signs of deteriorating Breadth today – the 10-dMA

of the % of issues advancing on the NYSE dipped below 50% today. That’s shows that over the last 2 weeks, less

than half of the issues on the NYSE have gone up. Speaking of bad signs...

The 10-dMA of the 50-indicator spread (purple line in the

chart above) slipped to -2. I said that

when that stat starts moving up, I’ll add to stocks. On further consideration,

I decided to add to stocks Monday.

I may have gotten too far ahead of my indicators. Someday

I’ll learn to follow my own indicators! (Trade what you see – not what you think.)

The good news is that the S&P 500 remains above it lower trendline.

LONG-TERM INDICATOR: The Long Term NTSM indicator remained

SELL: PRICE, VOLUME, & VIX were bearish; SENTIMENT is neutral.

This always raises a question, should I sell? That

depends mostly on whether I am predicting a big correction or a more normal

pullback. Breadth going into this decline was good, so I do not expect a big

correction. Therefore, I won’t sell.

(The Long-Term Indicator is not a good top-indicator. It

can signal BUY at a top.)

(The important major BUY in this indicator was on 21

October 2022, 7-days after the bear-market bottom. For my NTSM overall signal,

I suggested that a short-term buying opportunity occurred on 27 September

(based on improved market internals on the retest), although without market

follow-thru, I was unwilling to call a buy; however, I did close shorts and

increased stock holdings. I issued a Buy-Signal on 4 October, 6-days before the

final bottom, based on stronger market action that confirmed the market internals

signal. The NTSM sell-signal was issued 21 December, 9 sessions before the high

of this recent bear market, based on the bearish “Summary of 50” indicator.

BOTTOM LINE

I need to turn Bearish on the market, because that’s what

the indicators are suggesting. Now it’s

up to the Fed. I suspect if they hint at

a rate cute in September, markets will be positive. Otherwise, the pullback

will be back.

I may be a seller if the Fed doesn't help us out.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals declined to SELL. (My basket of Market

Internals is a decent trend-following analysis of current market action, but

should not be used alone for short term trading. They are most useful when they

diverge from the Index.)

...My current invested

position is about 70% stocks, including stock mutual funds and ETFs. I’m

usually about 50% invested in stocks when markets are stretched; my current

stock position is slightly above the norm. (75% is my max stock allocation when

I am strongly bullish.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see a definitive bottom, I add a

lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did

back in October 2022 and 2023.