BIDEN BOWS OUT

“I believe it is in the best interest of my party and the country for me to stand down and to focus solely on fulfilling my duties as president for the remainder of my term.” – President Joe Biden.

“Democracy is dead in the Democratic Party... If he [President Biden] had any decency at all he would leave the White House this week and never come back.” – Sean Hannity, Fox talking head...

...My cmt: Talk about hypocrisy - who is he kidding? Democracy died in the Republican party in 2020 when Trump claimed he won the Presidency; put forth a set of phony Trump-supporting, Electoral College members; attempted to overthrow the election by having VP Pence recognize those illegal Electoral College votes; and lied about the “stolen election” for years.

“In an essay published by The New York Times, [‘West Wing’ creator Aaron] Sorkin drew parallels between real-world events and his acclaimed TV series... Describing a plotline in which Bartlet [played by Martin Sheen in the series] chose to run for re-election despite being diagnosed with a serious illness...

‘...What if Bartlet’s opponent had been a dangerous imbecile with an observable psychiatric disorder who related to his supporters on a fourth-grade level and treated the law as something for suckers and poor people?...and was a hero to white supremacists? We’d have had Bartlet drop out of the race and endorse whoever had the best chance of beating the guy....”

...Sorkin then proposed that the Democrats nominate former Republican presidential nominee Mitt Romney, in an attempt to unify the US public and fend off a Trump victory.”

The West Wing creator Aaron Sorkin pens essay telling Democrats to nominate Mitt Romney for president (msn.com)

My cmt: Zero % chance of Romney being the Democratic nominee even though Romney could win handily. Nearly Zero chance that anyone but Harris will be the nominee. Sorkin has already disavowed his weekend Times piece.

“A Russian plot to kill one of Europe’s most prominent defense-industry executives signals a significant escalation in Moscow’s covert efforts to sabotage Western weapons production and weaken support for Ukraine, Western officials said. Earlier this year, the U.S. warned Germany that Moscow had set in motion a plan targeting Armin Papperger, CEO of Rheinmetall, U.S. and German officials said. The German manufacturer of tanks, armored vehicles and ammunition has been integral to Western efforts to support Ukraine as it fights to fend off invading Russian forces... A German Interior Ministry...said Moscow was waging a campaign of threats, cyberattacks, disinformation, sabotage and at least one act of terrorism in Germany to weaken Berlin’s support for Kyiv.” Story at...

https://www.wsj.com/world/europe/u-s-germany-foil-russian-plot-to-kill-defense-executive-9cc497f3

“...now he [Mark Spitznagel, founder and chief Investment officer of Universa Investments] sees a major selloff approaching with stocks potentially losing more than half of their value. Yet predicting even approximately when the market will crash is a lot harder than hedging a portfolio against it—many would say impossible. In the same way that so many fund managers and strategists always sound optimistic, scary talk sounds like a shrewd marketing exercise for someone insuring against tail risk. ‘I think we’re on the way to something really, really bad—but of course I’d say that,’ joked Spitznagel in an interview this week... High public indebtedness and valuations make a Washington-led rescue harder to pull off. He sees today’s benign slowdown in inflation overshooting and says the U.S. economy could enter a recession by the end of the year.”

https://www.wsj.com/finance/investing/greatest-bubble-nearing-its-peak-says-black-swan-manager-6f531740

-Monday the S&P 500 rose about 1.1% to 5564.

-VIX fell about 10% to 14.91.

-The yield on the 10-year Treasury rose to 4.254% (compared to this time, prior trading day).

XLK – Holding since the October 2022 lows.

UWM – added 7/15.

The Bull/Bear Spread (Bull Indicators minus Bear Indicators) slipped but are still Neutral at 13 Bear-signs and 12-Bull. (The rest are neutral. It is normal to have a lot of neutral indicators since many of those are top or bottom indicators that will signal only at extremes.)

The above “Greatest Bubble” article predicts a crash “approaching” and Mark Spitznagel predicts a recession by the end of the year. Given that markets anticipate the economy by roughly 6-months, we should be worried now if one agrees that a crash is coming. While markets are now in a weak period, it seems highly unlikely that a major decline is starting - breadth remains in good shape.

(The Long-Term Indicator is not a good top-indicator. It can signal BUY at a top.)

I am still Neutral to Bearish on the market; the pullback we have been experiencing is probably not over yet.

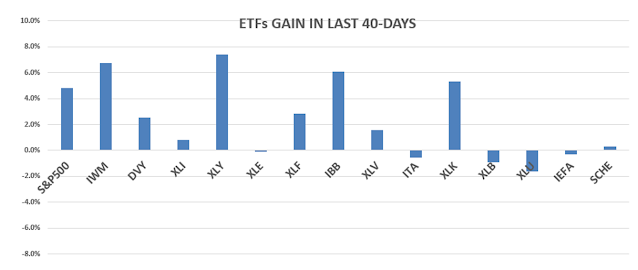

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals improved to BUY. (My basket of Market Internals is a decent trend-following analysis of current market action, but should not be used alone for short term trading. They are most useful when they diverge from the Index.)