“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“U.S. Federal Reserve chair Jerome Powell said Wednesday that the Fed would wait for more data on the economy's direction before changing interest rates, and characterized recent market volatility as a logical processing of the Trump administration's dramatic shifts in tariff policy... "I do think we'll be moving away from those goals [2% inflation], probably for the balance of this year. Or at least not making any progress," due to the impact of tariffs that have proved larger, at least as announced, than even the most severe scenarios penciled into initial Fed planning estimates...” Story at...

https://www.reuters.com/markets/us/fed-chair-powell-deliver-fresh-economic-view-tariffs-inject-uncertainty-2025-04-16/

“U.S. retail sales rose in March, as consumers flocked to buy goods ahead of the Trump administration's latest tariffs going into effect. According to the U.S. Census Bureau, retail sales increased by 1.4 percent on a monthly basis in March, up from February's 0.2 percent increase...” Story at...

https://www.newsweek.com/march-retail-sales-donald-trump-tariffs-2060407

“US factory output rose at a modest pace [0.3%] in March, a month ahead of President Donald Trump’s announcement of more sweeping tariffs that pose at least a short-term risk for manufacturers... Overall industrial production fell for the first time in four months.” Story at...

https://www.detroitnews.com/story/business/2025/04/16/us-factory-output-increases-at-modest-pace-ahead-of-tariffs/83119590007/

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 0.5 million barrels from the previous week. At 442.9 million barrels, U.S. crude oil inventories are about 6% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

-Wednesday the S&P 500 declined about 2.2% to 5275.

-VIX rose about 8% to 30.12.

-The yield on the 10-year Treasury declined to 4.311% (compared to about this time prior market day).

NONE

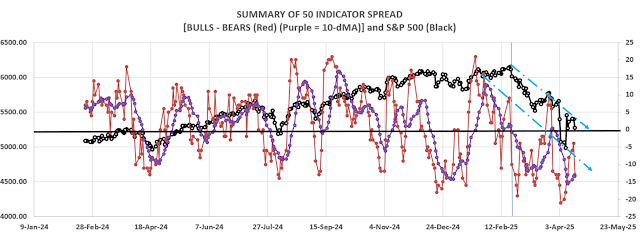

Today, of the 50-Indicators I track, 18 gave Bear-signs and 5 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

The daily, bull-bear spread of 50-indicators fell to a bearish at -13 (13 more Bear indicators than Bull indicators) - the 10-dMA of the spread reversed down – a bearish sign.

I am neutral, leaning bearish, in a wait-and-see mode.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

Only IEFA has positive momentum; IEFA is #1; ITA is #2; XLU is #3.

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained HOLD. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.