“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

“...Preservation of Capital is still #1... Judging from

price action, we are witnessing a turn away from US assets.” – Goldman Sachs,

Tony Pasquariello note, 14 April.

“In years where Berkshire has been a net seller, we’ve

seen below-average years follow. With the firm a net seller of $134 billion in

2024, we can assume 2025 could be below average, too.” From...

Warren Buffett’s Warning Is Now Playing Out in the Stock Market

RECESSION WILL HAPPEN (The Independent)

“The chief economist at Apollo Global Management, Torsten Slok, appeared on CNBC Monday, saying that, ‘It’s all conditioned on tariffs staying in place at these levels, and if they stay at these levels, we will absolutely have a recession in 2025.’” Story at...

Recession ‘absolutely’ will happen if Trump’s tariffs remain, top financial expert says

RICHMOND FED MANUFACTURING (Richmond Fed)

“Fifth District manufacturing activity slowed further in April, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite manufacturing index fell to −13 in April from −4 in March. Of its three component indexes, shipments and new orders fell notably to −17 and −15, respectively, and employment fell slightly to −5 from −1... The average growth rate of prices paid increased notably. The average growth rate of prices received increased somewhat. Firms expected heightened growth in prices paid and prices received over the next 12 months.” Report at...

https://www.richmondfed.org/region_communities/regional_data_analysis/surveys/manufacturing

“Markets are soaring on Tuesday after Bloomberg reported

that Treasury Secretary Scott Bessent told investors he expects the tariff

standoff with China to de-escalate as the current situation is not

sustainable. Speaking at a closed-door investor summit hosted by

JPMorgan Chase in Washington, Bessent said that negotiations haven't started

but a deal is possible.” Story at...

Markets Soar As Treasury Secretary Reportedly Says Tariff Standoff With China Is Unsustainable And Set To De-Escalate

MARKET REPORT / ANALYSIS

-Tuesday the S&P 500 rose about 2.5% to 5288.

-VIX dropped about 10% to 30.56.

-The yield on the 10-year Treasury declined to 4.401% (compared to about this time prior market day).

MY TRADING POSITIONS:

NONE

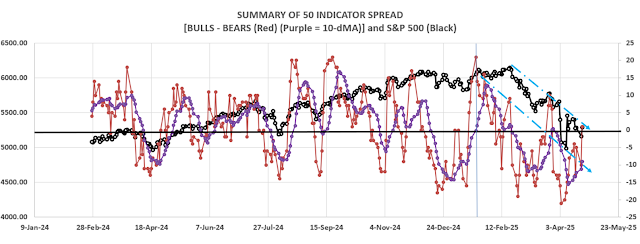

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators I track, 10 gave Bear-signs and 11 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

The S&P 500 bounced up to its upper, descending trendline. The daily chart (at left) showed profit taking in the afternoon. That sort of chart always looks suspicious. Did traders drive the price up in the morning only to sell late in the day? I don’t know – it did recover into the close so I shouldn’t be so paranoid. The Index is still below the upper trendline.

Until the Index breaks decisively higher, I am still on

hold. Paul Schatz, President Heritage Capital, has a good view on the

markets. I linked to his blog yesterday

where he wrote, “Unless the Fed dramatically pivots, this bottom will evolve

over the next 4-7 weeks with high volatility and lots of ups and downs.

Absolutely do not be surprised if the April lows are breached in May.”

The daily, bull-bear spread of 50-indicators declined,

and improved to Neutral at +1 (1 more Bull indicator than Bear indicators) -

the 10-dMA of the spread continued higher – another bullish sign, but it has

flipped a few times during this pullback.

Overall though, indicators continue to improve.

The “Death Cross” remains on the S&P 500 – the 50-day

moving average has dropped below its 200-dMA. Markets are already in bad shape

so the “Death Cross” may not be important.

BOTTOM LINE

I am neutral, leaning bearish, in a wait-and-see mode. I expect a retest of the prior low.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

Only IEFA has positive momentum; IEFA is #1; XLU is #2; ITA is #3.

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

TUESDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals improved to BUY. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

My current invested position

is about 30% stocks, including stock mutual funds and ETFs. 50% invested in

stocks is a normal position. (75% is my max stock allocation when I am

confident that markets will continue higher; 30% in stocks is my Bear market

position.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.

Warren Buffett’s Warning Is Now Playing Out in the Stock Market

“The chief economist at Apollo Global Management, Torsten Slok, appeared on CNBC Monday, saying that, ‘It’s all conditioned on tariffs staying in place at these levels, and if they stay at these levels, we will absolutely have a recession in 2025.’” Story at...

Recession ‘absolutely’ will happen if Trump’s tariffs remain, top financial expert says

“Fifth District manufacturing activity slowed further in April, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite manufacturing index fell to −13 in April from −4 in March. Of its three component indexes, shipments and new orders fell notably to −17 and −15, respectively, and employment fell slightly to −5 from −1... The average growth rate of prices paid increased notably. The average growth rate of prices received increased somewhat. Firms expected heightened growth in prices paid and prices received over the next 12 months.” Report at...

https://www.richmondfed.org/region_communities/regional_data_analysis/surveys/manufacturing

Markets Soar As Treasury Secretary Reportedly Says Tariff Standoff With China Is Unsustainable And Set To De-Escalate

-Tuesday the S&P 500 rose about 2.5% to 5288.

-VIX dropped about 10% to 30.56.

-The yield on the 10-year Treasury declined to 4.401% (compared to about this time prior market day).

NONE

Today, of the 50-Indicators I track, 10 gave Bear-signs and 11 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

The S&P 500 bounced up to its upper, descending trendline. The daily chart (at left) showed profit taking in the afternoon. That sort of chart always looks suspicious. Did traders drive the price up in the morning only to sell late in the day? I don’t know – it did recover into the close so I shouldn’t be so paranoid. The Index is still below the upper trendline.

I am neutral, leaning bearish, in a wait-and-see mode. I expect a retest of the prior low.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

Only IEFA has positive momentum; IEFA is #1; XLU is #2; ITA is #3.

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals improved to BUY. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.