... Momentum Trading DOW Stocks & ETFs … Stock Market Analysis ...

“Trade what you see; not what you think.” – The Old Fool,

Richard McCranie, trader extraordinaire.

“Far

more money has been lost by investors in preparing for corrections, or

anticipating corrections, than has been lost in the corrections themselves.” -

Peter Lynch, former manager of Fidelity’s Magellan® fund.

“...Preservation of Capital is still #1... Judging from

price action, we are witnessing a turn away from US assets.” – Goldman Sachs,

Tony Pasquariello note, 14 April.

NEGOTIATIONS? WHAT NEGOTIATIONS? (RBC Ukraine)

“Beijing denied that it is nearing an agreement to

resolve the trade war with the US and set a tough condition for the US, the

Financial Times reports. China urged the US to "completely cancel all

unilateral tariff measures" if it wishes to continue trade negotiations.

Beijing also stated that "currently no economic and trade negotiations

between China and the United States." Story at...

Negotiations

at risk. China sets tough condition for US

MARKET REPORT / ANALYSIS

-Friday the S&P 500 rose about 0.8% to 5525.

-VIX dropped about 7% to 24.84.

-The yield on the 10-year Treasury declined to 4.255%

(compared to about this time prior market day).

MY TRADING POSITIONS:

NONE

CURRENT SUMMARY OF APPROXIMATELY 50 INDICATORS:

Today, of the 50-Indicators

I track, 8 gave Bear-signs and 14 were Bullish. The rest are neutral. (It is

normal to have a lot of neutral indicators since many of the indicators are top

or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

The daily, bull-bear spread of 50-indicators improved +6

(6 more Bull indicator than Bear indicators) a Neutral indication - the 10-dMA

of the spread continued higher – a bullish sign, but it has flipped a few times

during this pullback. Overall, though,

indicators continue to improve and there were other significant bull signs.

The 50-indicator Spread finally moved into Bullish

territory. My Long-Term indicator (a smaller

basket of sensitive indicators) gave a BUY- signal today. I also noticed that

there was a Zweig Breadth Thrust yesterday.

That is a rare BUY-signal based on a 10-day period of rapid, breadth

improvement. I got fooled because the Breadth-thrust occurred in only 9-days

and my calculations didn’t pick it up. (That may take some programming to fix.)

I can also look back to the 90% up-volume day the day after the bottom as a

buying signal, although it hadn’t been preceded by two 90% down-volume days. We

also saw the S&P 500 break above the upper trendline and remain there for

consecutive days.

The technicals support buying at this point. If we had gotten

a retest I might have been able to call the bottom. The problem has been that

this decline has been driven mostly by Trump’s Tariff antics - difficult to

assess and nearly impossible to predict. In his Time magazine interviews, Trump

said he would consider it a “total victory” if tariffs are as high as 50% a

year from now. Markets moved higher on that news? That’s a bullish sign too,

but it reminds us that even though we have technical Buy-signals, markets could

still go south in a hurry.

Markets could still retest the prior low, but the

buy-signals suggest that it is unlikely to fall below the prior low unless

there are legitimate recession fears.

BOTTOM LINE

I am bullish, though perhaps warily. Time to buy some

stocks.

ETF - MOMENTUM ANALYSIS:

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking

follows:

The top ranked ETF receives

100%. The rest are then ranked based on their momentum relative to the leading

ETF.

*For additional background on

the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

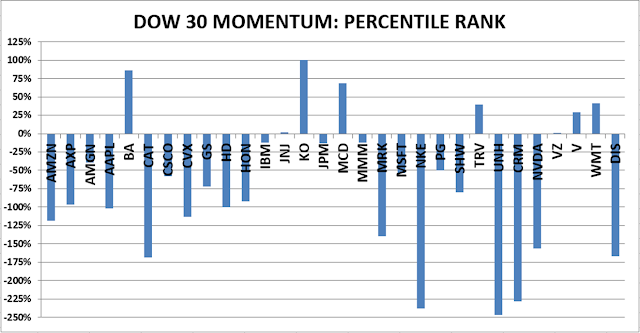

DOW STOCKS - TODAY’S MOMENTUM RANKING

OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives

100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM

Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

FRIDAY MARKET INTERNALS (NYSE

DATA)

My basket of Market Internals remained HOLD. (My basket of Market

Internals is a decent trend-following analysis that is most useful when it

diverges from the Index.)

I plan to move to 50%

invested Monday. My current invested position is about 30% stocks,

including stock mutual funds and ETFs. 50% invested in stocks is a normal

position. (75% is my max stock allocation when I am confident that markets will

continue higher; 30% in stocks is my Bear market position.)

I trade about 15-20% of the total portfolio using the

momentum-based analysis I provide here. When I see bullish signs, I add a lot more

stocks to the portfolio, usually by using an S&P 500 ETF as I did back in

October 2022 and 2023.