“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

Don't like the Supreme Court's recent opinions? Chief Justice John Roberts has thoughts

My cmt: The Court didn’t rule on Birthright Citizenship – just that federal judges can’t block government policies for the entire country when a case is local.

“...this week's third GDP estimate was worse than expected and the previous two estimates. The third estimate showed real GDP dropped at an annualized rate of 0.5% compared to a 0.2% expected drop and the 0.3% drop reported in the initial advance estimate on April 30... Consumer spending, which is crucial for GDP growth, cooled in the first quarter. It rose 0.5% compared to 4% in the last quarter of 2024... Real spending has weakened, dropping 0.3% in May from April, according to a BEA report out Friday morning. All told, spending growth has been largely flat since late last year.” Story at...

3 signs the economy is in worse shape than we thought

“While below initial expectations, this is still the highest level of tariffs the U.S. has had in nearly nine decades and, if maintained, will have substantial impact on the U.S. and global economies...we continue to expect interest rates higher for longer. As of this writing, we see the Federal Reserve cutting rates only once in 2025, with a year-end fed funds-rate target range of 4.00% to 4.25%. We believe that Fed Chairman Jerome Powell will likely take a conservative approach to easing policy to safeguard against fears of runaway inflation.

Top economist sends sobering tariff, interest rate forecast

“Texas factory activity was largely unchanged in June, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, held steady at 1.3, with the near-zero reading indicating a second month of flat output... Expectations for manufacturing activity six months from now remained positive.” Report at...

https://www.dallasfed.org/research/surveys/tmos/2025/2506

-Monday the S&P 500 rose about 0.5% to 6205.

-VIX rose about 3% to 16.73. (The Options Crowd was concerned about something.)

-The yield on the 10-year Treasury declined to 4.232% (compared to about this time prior market day).

SPY – added 6/5/2025 & 6/27/2025

XLK – added 6/27/2025

Today, of the 50-Indicators I track, 3 gave Bear-signs and 21 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

The daily, bull-bear spread of 50-indicators increased to a very bullish +18 from +15 last trading day (18 more Bull indicators than Bear indicators). I consider +5 to -5 the neutral zone. The 10-dMA curve of the spread turned higher – a bullish sign. Indicators don’t get much better than this. Wooo-wooo!

- “Looking good, Billy Ray! Feeling good, Louis!”

- “This is not the recession you are looking for. You can go about your business. Move along.”

- “A toast to my big brother George, the richest man in town.”

I am cautiously Bullish. Cautiously, because of tariffs and their impact on inflation.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

DOW STOCKS - TODAY’S MOMENTUM RANKING OF THE DOW 30 STOCKS (Ranked Daily)

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

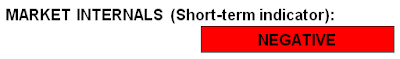

MONDAY MARKET INTERNALS (NYSE DATA)

My basket of Market Internals remained BUY. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.