“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“...If the Republicans were serious, why not begin by cutting 3% off every line in the budget, no exceptions, other than interest on the debt? If the Republicans were serious about addressing entitlements, why not start with Medicare, an $850 billion program that exclusively benefits the elderly, the wealthiest cohort of society?

If the Republicans were serious, why not address the single largest federal expenditure, Social Security, which clocks in over $1 trillion? Means test the benefits, and silence the naysayers who complain that they “paid in” by allowing them to collect until they get back as much as they contributed. These kinds of measures may be bold and ambitious, but they are necessary. It isn’t serious merely to rearrange the deck chairs on our fiscal Titanic.” - Kenneth A. Margolis, WSJ Letters.

“Sales of new single-family homes dropped 13.7% in May compared with April... That sales total was 6.3% lower than May 2024...” Story at...

https://www.cnbc.com/2025/06/25/may-2025-new-home-sales.html

“U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 5.8 million barrels from the previous week. At 415.1 million barrels, U.S. crude oil inventories are about 11% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

-Wednesday the S&P 500 was unchanged at 6092.

-VIX declined about 4% to 16.76.

-The yield on the 10-year Treasury declined to 4.291% (compared to about this time prior market day).

SPY – added 6/5/2025

Today, of the 50-Indicators I track, 10 gave Bear-signs and 12 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

The daily, bull-bear spread of 50-indicators declined to Neutral at +2 (2 more Bull indicators than Bear indicators). I consider +5 to -5 the neutral zone. The 10-dMA of the spread continued down – a bearish sign.

I am cautiously Bullish.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

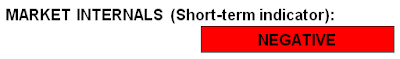

My basket of Market Internals declined to SELL. (My basket of Market

Internals is a decent trend-following analysis that is most useful when it

diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.