“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

"I'm sorry, but I just can't stand it anymore...This massive, outrageous, pork-filled Congressional spending bill is a disgusting abomination. Shame on those who voted for it: you know you did wrong” ... "It will massively increase the already gigantic budget deficit to $2.5 trillion (!!!) and burden America citizens with crushingly unsustainable debt," ... "Congress is making America bankrupt." – Elon Musk on the “Big Beautiful Bill.”

“...this is how nuts this is, this bill actually cuts funding to people who really need it, health care in rural hospitals to give a tax break to gun silencers. Let that sink in for a minute," she suggested. "How many Americans are out there protesting and saying, 'I want gun silencers to get a tax break? That's some of the stuff that's buried in this abomination and as time goes on, more and more of those little nuggets are going to become public it's going to be more and more difficult for [Republican Senate Majority Leader John] Thune to find 51 votes." Story at...

'Let that sink in': Ex-senator singles out 'nuts' inclusion in big budget bill

"Private sector employment increased by 37,000 jobs in May and annual pay was up 4.5 percent year-over-year, according to the May ADP® National Employment Report produced by ADP Research in collaboration with the Stanford Digital Economy Lab ("Stanford Lab")..."After a strong start to the year, hiring is losing momentum," said Dr. Nela Richardson, chief economist, ADP. "Pay growth, however, was little changed in May, holding at robust levels for both job-stayers and job-changers." Press release at...

https://www.prnewswire.com/news-releases/adp-national-employment-report-private-sector-employment-increased-by-37-000-jobs-in-may-annual-pay-was-up-4-5-302473143.html

“Economic activity in the services sector contracted in May, the first time since June 2024, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®...This is the index's first month out of expansion territory since May 2020... "May's PMI® level is not indicative of a severe contraction, but rather uncertainty that is being expressed broadly among ISM Services Business Survey panelists.” Press release at...

https://www.prnewswire.com/news-releases/services-pmi-at-49-9-may-2025-services-ism-report-on-business-302472478.html

“U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.3 million barrels from the previous week. At 436.1 million barrels, U.S. crude oil inventories are about 7% below the five year average for this time of year.” Report at...

https://ir.eia.gov/wpsr/wpsrsummary.pdf

“In its deepening face-off with the Trump administration, Beijing’s trade negotiator has given a preview of Xi Jinping’s chief objective for this trade war: It won’t be like last time. In Geneva in mid-May, Vice Premier He Lifeng extracted a 90-day trade truce from a Trump team that had until then declined to pause a tariff blitz on China the way it had for other countries. The deal calmed the nerves of investors and markets around the world.

Now, after both sides have complained that the other wasn’t upholding the terms of the deal, that trade truce is teetering, once again jolting global investors and businesses.” Story at...

https://www.wsj.com/world/china/trade-negotiator-he-lifeng-hardball-1f27e4c3?mod=djem10point

“U.S. economic growth is likely to hit the brakes this year, with GDP dramatically slowing due to the impact of the Trump administration's tariffs and uncertainty around its economic policies, the Organization for Economic Cooperation and Development, or OECD, said Tuesday.

GDP growth is forecast to slide to 1.6% in 2025 and 1.5% next year, a sharp reduction from the 2.8% growth recorded last year, according to the OECD, an international organization of 38 member countries that focuses on promoting economic growth.” Story at...

OECD forecasts a sharp economic slowdown in the U.S., citing tariffs

-Wednesday the S&P 500 was little changed at 5971

-VIX declined about 0.5% to 17.61.

-The yield on the 10-year Treasury declined to 4.357% (compared to about this time prior market day).

None

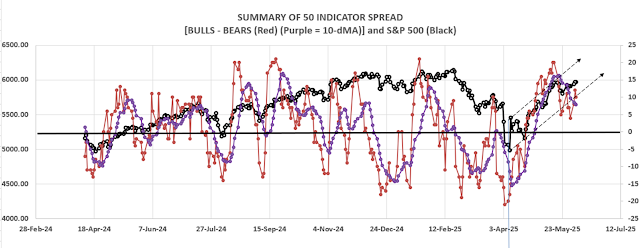

Today, of the 50-Indicators I track, 6 gave Bear-signs and 16 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

The daily, bull-bear spread of 50-indicators declined but remained a very Bullish +10 (10 more Bull indicators than Bear indicators). I consider +5 to -5 the neutral zone. The 10-dMA of the spread continued down – a bearish sign.

I am neutral, but leaning bullish longer-term. I’ve been saying that a trip to the lower trendline is underway. That’s not as clear now. The number of indicators is bullish, but the trend is slipping down so we have unresolved cross-currents.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained HOLD. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.