“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“Life changed for Spaniards at noon on Monday. With the sun at its peak, the country’s largely solar-powered electrical grid shut down. Mere days before, Spain’s government had announced that its grid had for the first time run entirely on renewable power, with new records set almost daily for solar. Breathless declarations of victory flowed, in service of the government’s promise to phase out reliable nuclear power plants with many years of remaining service life... The grid collapse was the result of a series of brazen missteps by lawmakers. They disregarded warnings grounded in laws of physics. One could say that Spain flew too close to the sun, leaving its electrical grid exposed to imbalances that became impossible to stabilize.

Events will inevitably test any electrical system’s limits. A rational system should be designed to handle such events. Spain’s system was engineered politically, not rationally. It’s the latest lesson in how not to make energy policy. Will anyone learn from it?” - Messrs. Calzada and Fernández Ordóñez, senior fellows at the University of the Hesperides’ Peter Huber Center. WSJ at...

https://www.wsj.com/opinion/how-the-lights-went-out-in-spain-solar-power-electric-grid-0096bbc7?mod=columnists_trendingnow_article_pos2

“The Institute of Supply Management (ISM) Non-Manufacturing Purchasing Managers’ Index (PMI) reported an unexpected rise in the non-manufacturing sector, indicating an expansion in the economy...The actual PMI figure of 51.6 outperformed the forecasted figure of 50.2. This indicates a more robust expansion in the non-manufacturing sector than analysts had predicted.” Story at...

https://www.investing.com/news/economic-indicators/us-nonmanufacturing-sector-shows-unexpected-strength-ism-pmi-rises-to-516-93CH-4022308

-Tuesday the S&P 500 declined about 0.8% to 5607.

-VIX rose about 5% to 24.76.

-The yield on the 10-year Treasury declined to 4.298% (compared to about this time prior market day).

XLK-added 4/28

SPY-added 4/28

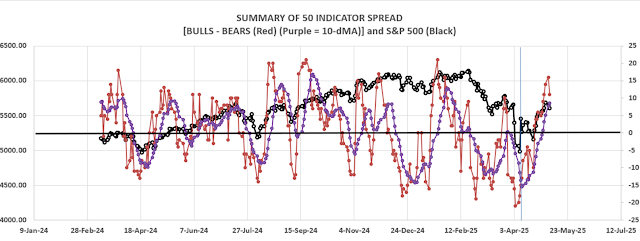

Today, of the 50-Indicators I track, 5 gave Bear-signs and 16 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

The daily, bull-bear spread of 50-indicators declined to +11 (11 more Bull indicators than Bear indicators) a Bullish indication (I consider 5 neutral) - the 10-dMA of the spread continued higher – also a bullish sign.

I am bullish, though perhaps warily. The markets may trade sideways for a while or drift down.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

The top ranked ETF receives 100%. The rest are then ranked based on their momentum relative to the leading ETF.

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals declined to HOLD. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.