“Trade what you see; not what you think.” – The Old Fool, Richard McCranie, trader extraordinaire.

“The market has absorbed the early blows of President Trump’s tariffs, making up all its lost ground. Yet that rekindles a Wall Street worry from earlier this year: By the typical measures, stocks look very pricey right now... The most common applications of this metric compare stock prices with a company’s past 12 months of corporate earnings, analysts’ expectations for its next 12 months of earnings or so-called cyclically adjusted earnings: the average annual earnings of the past 10 years, adjusted for inflation...

...Just because stocks look expensive by these measures doesn’t mean they are about to plunge. In periods such as the Roaring ’20s and the 1990s tech bubble, frothy markets defied gravity for years.” Story at...

https://www.wsj.com/finance/stocks/stock-valuations-investors-76d1daa6

“U.S. stocks had been outperforming the rest of the world for years — until a slew of tariffs and trade policies spooked investors and caused global markets to plunge in March. Now, some foreign investors are rethinking their exposure to U.S. markets. That’s according to economic expert Rebecca Patterson, who previously served as Bridgewater’s chief investment strategist, on an episode of CNBC’s Fast Money.” Story at...

Foreign investors losing faith in the US

-Wednesday the S&P 500 declined about 1.6% to 5845.

-VIX rose about 15% to 20.87.

-The yield on the 10-year Treasury rose to 4.597% (compared to about this time prior market day).

XLK-sold 5/21

SPY-sold 5/28

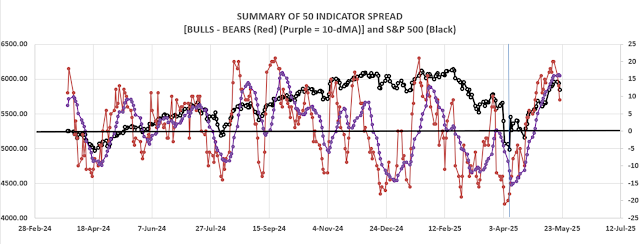

Today, of the 50-Indicators I track, 6 gave Bear-signs and 15 were Bullish. The rest are neutral. (It is normal to have a lot of neutral indicators since many of the indicators are top or bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

“Stocks sold off on Wednesday, pressured by a sharp spike higher in Treasury yields as traders grew worried that a new U.S. budget bill would put even more stress on the country’s already large deficit.” - CNBC

My cmt: Could be. It’s always difficult to pin market moves directly on news.

I am neutral. Let’s see where the indicators go.

TODAY’S RANKING OF 15 ETFs (Ranked Daily) ETF ranking follows:

*For additional background on the ETF ranking system see NTSM Page at…

http://navigatethestockmarket.blogspot.com/p/exchange-traded-funds-etf-ranking.html

The top ranked Stock receives 100%. The rest are then ranked based on their momentum relative to the leading Stock.

For more details, see NTSM Page at…

https://navigatethestockmarket.blogspot.com/p/a-system-for-trading-dow-30-stocks-my_8.html

My basket of Market Internals remained HOLD. (My basket of Market Internals is a decent trend-following analysis that is most useful when it diverges from the Index.)

I trade about 15-20% of the total portfolio using the momentum-based analysis I provide here. When I see bullish signs, I add a lot more stocks to the portfolio, usually by using an S&P 500 ETF as I did back in October 2022 and 2023.