“Initial unemployment claims posted an unexpected

increase last week in a potential trouble sign for the wobbling U.S. economy. First-time

filings for unemployment insurance totaled a seasonally adjusted 241,000 for

the week ended April 26, up 18,000 from the prior period and higher than the

Dow Jones estimate for 225,000...” Story at...

https://www.cnbc.com/2025/05/01/weekly-jobless-claims-surge-to-241000.html

-Thursday the S&P 500 rose about 0.6% to 5604.

-VIX slipped about 0.4% to 24.6.

-The yield on the 10-year Treasury rose to 4.212%

(compared to about this time prior market day).

XLK-added 4/28

SPY-added 4/28

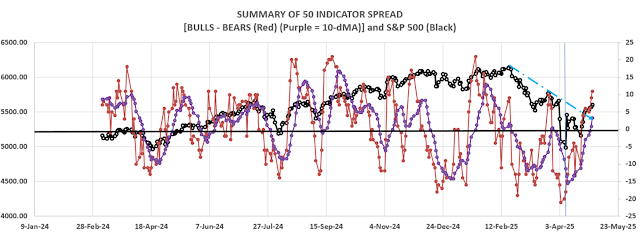

Today, of the 50-Indicators

I track, 6 gave Bear-signs and 17 were Bullish. The rest are neutral. (It is normal

to have a lot of neutral indicators since many of the indicators are top or

bottom indicators that will signal only at extremes.)

TODAY’S COMMENT

The daily, bull-bear spread of 50-indicators improved to +11 (11 more Bull-indicators than Bear-indicators) a Bullish indication (I consider 5 neutral) - the 10-dMA of the spread continued higher – also a bullish sign. Indicators continue to improve and are now clearly to the bull side.

.

I am bullish, though perhaps warily. I added XLK and SPY

Monday.